Nepal’s Economy Shows Stability in First Four Months of FY 2082/83

Author

NEPSE TRADING

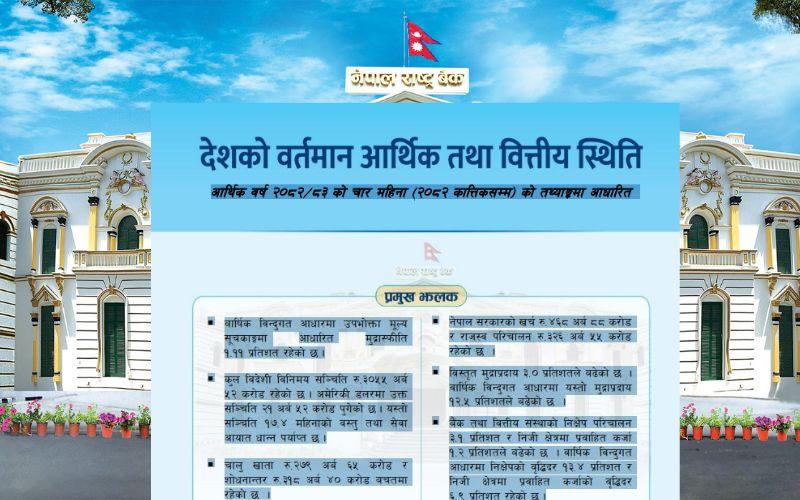

Kathmandu — Key economic and financial indicators of Nepal remained largely stable and positive during the first four months of the current fiscal year 2082/83 (up to mid-November), according to data released by Nepal Rastra Bank (NRB). Low inflation, strong foreign exchange reserves, and improved external sector balances have supported overall macroeconomic stability, although credit growth remains weak.

Inflation Remains Low

Based on the annual point-to-point consumer price index, inflation stood at 1.11 percent, indicating a subdued price environment. Analysts say stable food and non-food prices have helped keep inflation under control, easing pressure on household purchasing power and providing short-term relief to consumers.

Foreign Exchange Reserves Strengthen

Nepal’s total foreign exchange reserves reached Rs. 3,055.52 billion, equivalent to USD 21.52 billion. According to NRB, the reserves are sufficient to finance 17.4 months of imports of goods and services, reflecting a strong external buffer and improved balance-of-payments resilience.

Current Account and Balance of Payments in Surplus

During the review period, the current account recorded a surplus of Rs. 279.65 billion, while the balance of payments surplus stood at Rs. 318.40 billion. The surplus was largely supported by rising remittance inflows and controlled import growth, helping stabilize the external sector.

Remittance Inflows Surge

Remittance inflows continued to be a major support for the economy. In Nepali rupees, remittances increased by 31.4 percent, while in US dollar terms they rose by 25.3 percent. By mid-November, remittance inflows reached Rs. 133.82 billion, highlighting continued reliance on overseas employment as a key source of foreign income.

Trade Activity Picks Up

Trade activity showed mixed but improving trends. Exports increased sharply by 77.5 percent, while imports rose by 18.7 percent during the first four months of the fiscal year. The faster growth in exports has helped narrow external imbalances, although Nepal’s trade deficit remains structurally large.

Government Spending and Revenue

Government finances reflected moderate activity. Total government expenditure reached Rs. 468.88 billion, while revenue collection stood at Rs. 326.55 billion. Although expenditure exceeded revenue, analysts note that revenue performance has shown improvement compared to previous periods, even as capital spending remains relatively slow.

Money Supply, Deposits, and Credit Growth

Broad money supply expanded by 3.0 percent during the four-month period, while on an annual basis it increased by 12.5 percent.

Bank deposits grew by 3.1 percent, but private sector credit increased by only 1.2 percent, indicating weak loan demand. On a year-on-year basis, deposit growth stood at 13.4 percent, while credit growth was limited to 6.9 percent, underscoring cautious borrowing behavior by businesses and households.

Interest Rates Remain Low

Liquidity conditions remained comfortable. The weighted average interbank rate stood at 2.75 percent, while the 91-day Treasury bill rate averaged 2.37 percent.

Similarly, the weighted average deposit rate of commercial banks remained low at 3.74 percent, reflecting excess liquidity in the banking system.

Overall Assessment

The first four months of FY 2082/83 present a picture of macroeconomic stability with subdued domestic demand. While low inflation, strong foreign reserves, and healthy external balances are positive signs, slow credit expansion and modest private-sector investment remain concerns for sustaining economic growth.

Economists argue that without a revival in private investment and lending, liquidity alone may not translate into faster economic momentum, despite the currently favorable financial indicators.