ECB Keeps Interest Rates Unchanged, Hints at Possible Future Cuts

Author

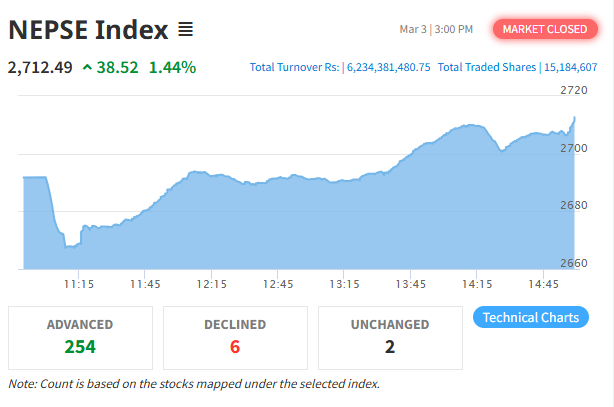

NEPSE TRADING

The European Central Bank (ECB) has decided to keep its key interest rates unchanged amid global trade disputes and geopolitical tensions that have created an uncertain economic outlook. Following its meeting on Thursday, the ECB announced that its main deposit rate will remain steady at 2 percent.

After a year-long cycle of rate cuts, the ECB has maintained this rate since July. Inflation currently hovers near the bank’s target of 2 percent. According to officials, the eurozone has managed to weather the impact of U.S. President Donald Trump’s tariff increases on foreign imports better than expected.

Jose Luis Escrivá, head of Spain’s central bank and member of the ECB’s Governing Council, said, “The current level of interest rates is appropriate.” Senior ECB officials gathered in Florence, Italy, for their regular off-site meeting, with attention now turning to President Christine Lagarde’s upcoming press conference and potential signals about future rate direction.

Meanwhile, the U.S. Federal Reserve has resumed rate cuts, citing concerns over a weakening labor market. The Fed reduced its benchmark rate by 0.25 percentage points during its second consecutive meeting this week.

Despite ongoing challenges, the eurozone economy has performed better than many expected. The ECB raised its growth forecast during its September meeting, signaling modest recovery. However, political turmoil in France, rising borrowing costs, and slower wage growth have fueled debates over whether further rate cuts will be necessary.

Analysts at UniCredit and Capital Economics believe additional reductions could be on the horizon. Lithuanian Governing Council member Gediminas Simkus also stated, “From a risk management perspective, a rate cut in the next meeting would be a prudent move.”

According to Andrew Kenningham, Senior Economist at Capital Economics, the ECB may implement further cuts by 2026. “The eurozone economy is weakening, the labor market is loosening, and there’s little reason to fear a resurgence in inflation,” he said.