Investor Groups Demand Separate ISIN Numbers for Promoter and Ordinary Shares

Author

NEPSE TRADING

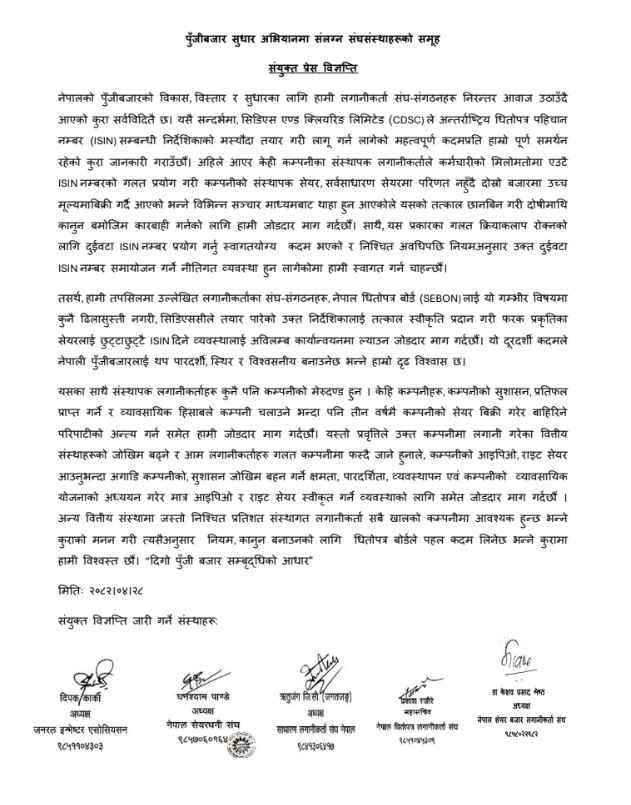

Five investor organizations have called for the implementation of separate International Securities Identification Numbers (ISIN) for promoter shares and ordinary shares. The joint demand was made by Dr. Keshav Prasad Shrestha, President of Nepal Share Market Investors Association; Prakash Rajoure, General Secretary of Nepal Securities Investors Association; Ritu Jung GC, President of General Investors Association Nepal; Ghanshyam Pandey, President of Nepal Shareholders Association; and Deepak Karki, President of General Investor Association, through a joint press statement.

In their statement, the organizations urged the Nepal Securities Board to immediately approve the draft guidelines on ISIN numbers prepared by CDS and Clearing Limited (CDSC). They alleged that some promoter shareholders, in collusion with employees, have been misusing a single ISIN number to sell promoter shares in the secondary market at high prices without converting them into ordinary shares, and demanded an immediate investigation into the matter.

According to the investors, implementing two separate ISIN numbers would be a forward-looking step that would enhance transparency, stability, and credibility in Nepal’s capital market. They welcomed the planned policy provision to merge the two ISIN numbers after a certain period in accordance with regulations.

The statement also called for ending the practice of promoter shareholders exiting by selling their shares within just three years. They warned that such behavior increases risks for financial institutions and can lead ordinary investors into investing in weak companies. The groups demanded that IPOs and rights shares should only be approved after assessing a company’s corporate governance, risk-bearing capacity, transparency, management, and business plans. In addition, they called for mandatory allocation of a certain percentage of shares to institutional investors in all types of companies, similar to the provision in other financial institutions.