Nepal Rastra Bank Takes Action Against Kumari Bank and Prime Commercial Bank

Author

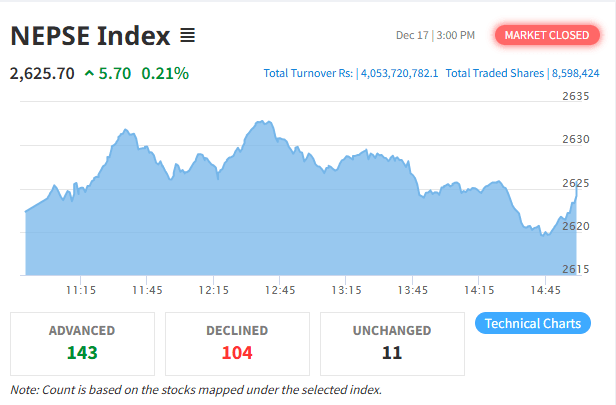

NEPSE trading

Kathmandu: Nepal Rastra Bank (NRB) has taken action against two commercial banks—Kumari Bank Limited and Prime Commercial Bank Limited—for violating regulatory provisions during the first quarter of the current fiscal year.

According to NRB, Kumari Bank failed to comply with the central bank’s directives by engaging in banking transactions with individuals and entities listed on the blacklist. As per the unified directive issued by NRB, individuals, firms, companies, or organizations on the blacklist are prohibited from conducting any banking transactions except for depositing money into their own accounts until they are officially removed from the list.

Since Kumari Bank violated this provision, the bank has been warned under Section 100(1)(a) of the Nepal Rastra Bank Act, 2058 (2002).

Similarly, Prime Commercial Bank was found to have failed to properly classify certain loans based on overdue periods as required by NRB’s unified directive. The inspection revealed that some loans were not classified correctly, loss provisions were not maintained as per the loan default period, and the bank did not calculate risk weights in line with the Capital Adequacy Framework, 2015 issued by NRB.

As a result, the Chief Executive Officer of Prime Commercial Bank has been warned under Section 100(2)(a) of the Nepal Rastra Bank Act, 2058 (2002).

Nepal Rastra Bank has reminded all banks and financial institutions to strictly adhere to regulatory requirements and has warned that stricter actions will be taken in the future against any institution found violating its directives.