Nepal Rastra Bank to Withdraw NPR 40 Billion Liquidity

Author

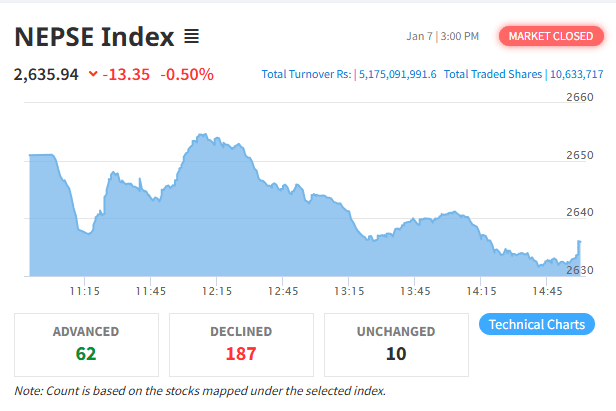

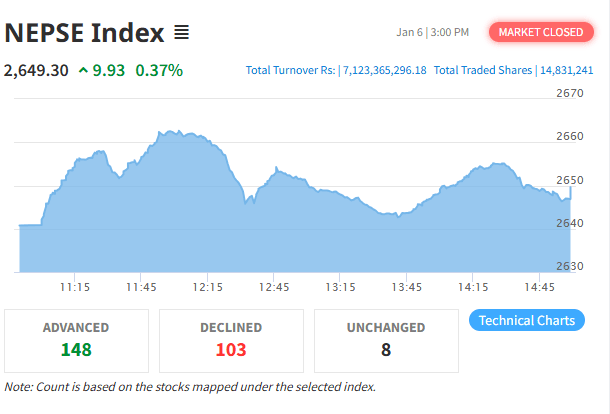

NEPSE trading

Nepal Rastra Bank (NRB) has decided to withdraw an additional NPR 40 billion from the banking system due to excess liquidity. The central bank, which regularly manages liquidity through the Standing Deposit Facility (SDF), has taken this step on Wednesday using a deposit collection instrument.

Key Points:

Liquidity Management Initiative: Just a day earlier, on Tuesday, NRB raised NPR 174.55 billion under the SDF. On Wednesday, it plans to auction NPR 40 billion for a 21-day period.

Auction Process: Banks can participate in the online auction until 3 PM. The principal and interest payment will be due on Ashwin 2. The interest rate will be determined through the auction process.

Application Process: Banks can bid in increments of at least NPR 100 million and up to NPR 500 million.

Secured Collateral Instrument: The deposit collection instrument can be used as collateral with other banks and financial institutions, except NRB, as per the central bank's guidelines.

Purpose of Liquidity Management: NRB has adopted this liquidity management measure through its deposit instrument to manage market interest rates amid a situation of excess liquidity in the financial market.

Role of Standing Deposit Facility (SDF): Since the beginning of the current fiscal year, NRB has raised NPR 5.106 trillion through 18 operations under the SDF, with NPR 174 billion yet to be returned to the banks. Banks receive a 3% interest rate under the SDF.

Conclusion: This step by NRB aims to manage liquidity and maintain balance in the financial system. Banks can use this opportunity to manage their financial liquidity in cooperation with the central bank. This process can play a crucial role in stabilizing market interest rates and strengthening the banking system.