NEPSE Shows Signs of Recovery, Market Turns Green Ahead of Tihar

Author

NEPSE TRADING

The Nepal Stock Exchange (NEPSE) witnessed a mild recovery on Sunday as the benchmark index climbed by 16.67 points, closing at 2,503.85 points. After a week of continuous decline, the market showed a positive reversal, although the trading volume decreased compared to the previous session.

According to NEPSE, the total turnover stood at Rs. 2.79 billion, down from Rs. 3.27 billion recorded on Thursday. Out of all traded companies, 163 gained, 78 declined, and 8 remained unchanged.

The Banking Index increased by 11.64 points to 1,349.36, while the Development Bank Index fell by 11.64 points to 5,258.87. The Finance Index rose by 11.16 points to 2,172.86, and the Hotels & Tourism Index climbed 42.96 points to 5,973.13. The Hydropower Index surged by 22.03 points to 3,269.78, showing renewed investor interest in the energy sector.

The Investment Index added 0.76 points, the Life Insurance Index gained 40.63 points, while the Non-Life Insurance Index declined by 36.12 points. Similarly, the Manufacturing Index gained 63.95 points, Microfinance Index rose by 22.22 points, Mutual Fund Index by 0.02 points, Trading Index by 33.28 points, and Others Index by 26.05 points.

Aatmanirbhar Laghubitta Bittiya Sanstha was the top gainer of the day, surging by 10% to close at Rs. 6,710 per share. Himalayan Power Partner jumped 9.89% to Rs. 511, followed by Bhagawati Hydropower Development Company, which gained 9.88%. Asian Hydropower rose 7.80%, and Abhiyan Laghubitta advanced 6.01%.

On the losing side, Himalayan 80–20 Fund declined the most by 6.10%, followed by Kalika Laghubitta (-3.94%), Prabhu Select Fund (-3.76%), Nepal Micro Insurance (-3.70%), and Muktinath Bikas Bank (-3.42%).

Technical Analysis: Market at a Critical Support Zone

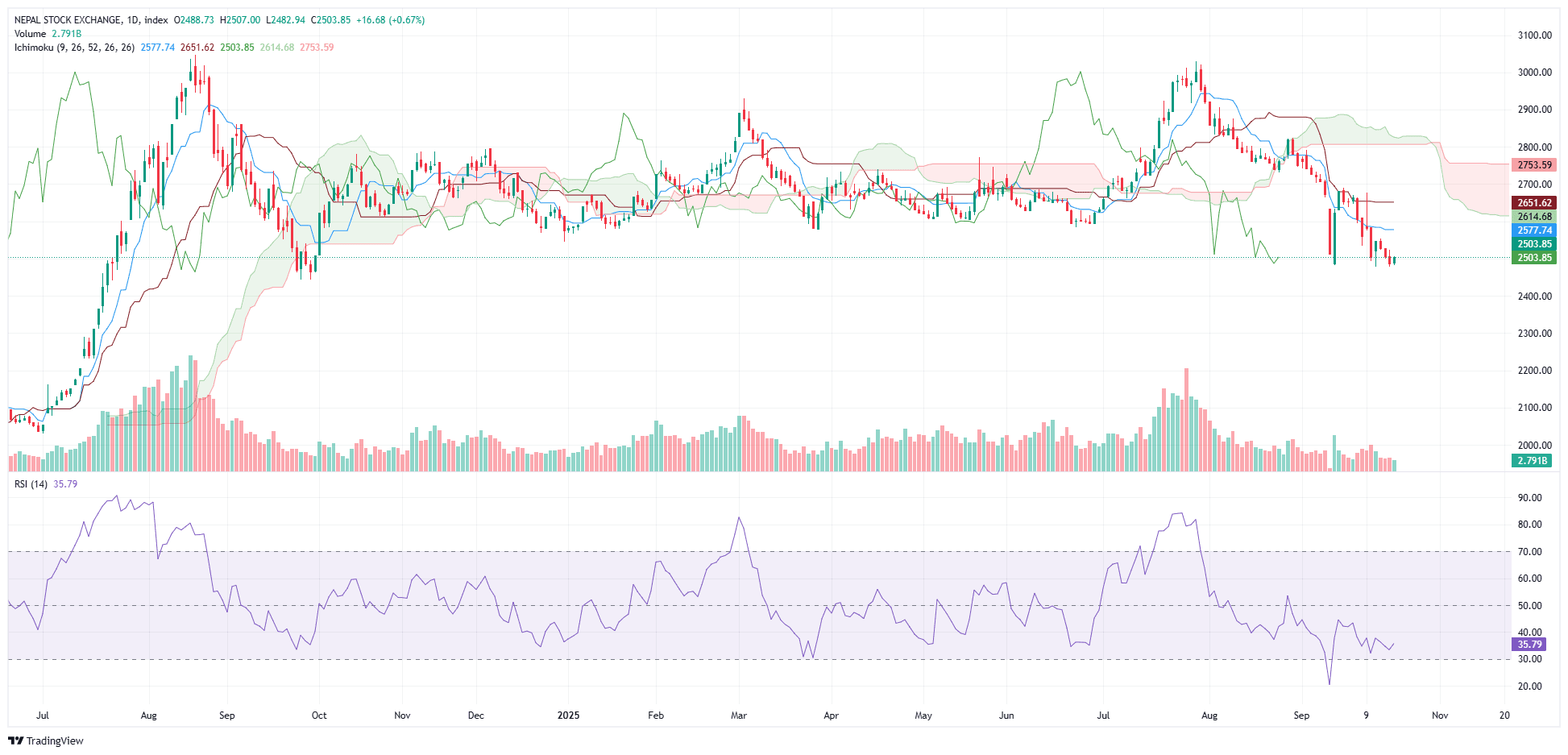

According to market analyst Ajit Khanal, the NEPSE index is currently standing at a strong support zone, where a Tweezers Bottom candlestick pattern has formed — although not a perfect bullish engulfing, it indicates a potential reversal signal.

The RSI (Relative Strength Index) is hovering around 35, suggesting a mild bullish divergence. This implies that the market might be emerging from the oversold zone, signaling potential recovery in the days ahead.

Among the top 10 brokers, 7 recorded more buying than selling, reflecting balanced participation from both retail and institutional investors.

After a week of decline, the market has finally closed on a positive note, showing early signs of reversal just before the Tihar festival.

Wishing all investors a Happy and Prosperous Tihar!