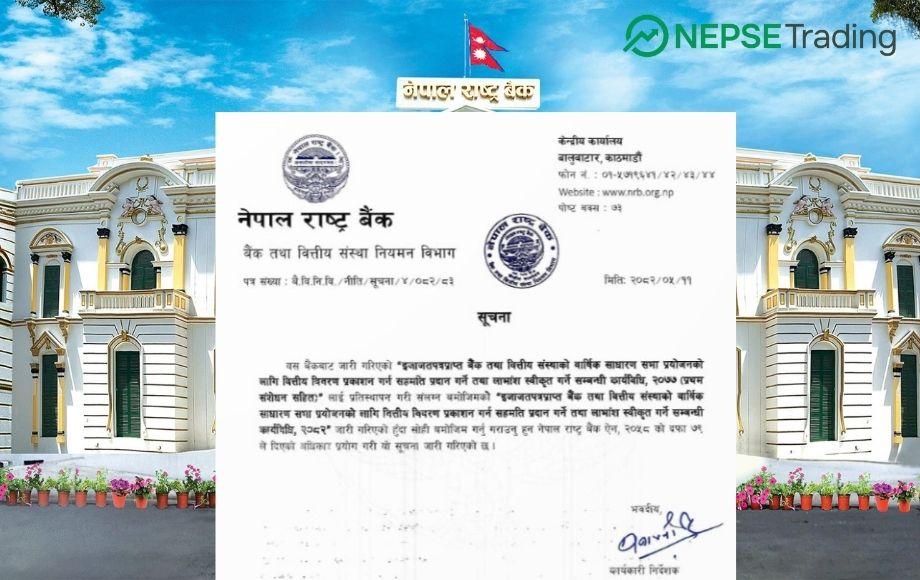

NRB Issues New Procedure on Financial Statements and Dividend Approval

Author

NEPSE TRADING

Nepal Rastra Bank (NRB) has issued the “Procedure for Approval of Financial Statement Publication and Dividend Distribution, 2082”, replacing the previous procedure of 2077 (including first amendment). The new guidelines apply to commercial banks, development banks, finance companies, and microfinance institutions.

According to NRB, the procedure aims to enhance financial transparency, strengthen risk management, and align Nepal’s banking system with international accounting standards (IFRS).

Provisions on Financial Statement Publication

Banks and financial institutions (BFIs) must submit their annual accounts to the NRB’s supervision department for preliminary review before board approval and signatures.

The department may recommend corrections, and only after the final audit report will permission be granted to publish financial statements.

If the loan loss provision under NFRS (Nepal Financial Reporting Standards) is less than NRB’s directive, the shortfall must be transferred to the regulatory reserve fund.

Capitalized interest during grace periods must also be allocated to the reserve fund.

Compliance with Expected Credit Loss Guideline (NFRS-9) and Guidance Note on Interest Recognition 2025 must be clearly disclosed in financial statement notes.

Institutions issuing debentures or other debt instruments must show compliance with contributions to the Capital Redemption Reserve Fund.

Employee liability assessments must use realistic assumptions based on past data as per NFRS.

Provisions on Dividend Approval

Dividend approval is now strictly linked to Capital Adequacy Ratio (CAR) requirements.

Commercial banks and national-level development banks must comply with CAR 2015, infrastructure development banks with CAR 2018, while other development banks and finance companies must follow CAR 2008 standards.

For national-level exceptions:

Development banks and finance companies must maintain at least 6.5% core capital and 11% total capital.

Microfinance institutions must maintain a minimum 0.5% core capital buffer and 1% total capital buffer.

In cases of mergers or acquisitions, any capital shortfall must be recorded in the Capital Reserve Fund and cannot be used for cash dividends.

Cash dividends will not be permitted from goodwill generated during mergers unless the equivalent loss is recognized in the profit and loss account.

For debentures and irredeemable preference shares, only bonus shares can be distributed from the adjustment reserve after payment obligations.

NRB’s Rationale

NRB stated that some banks and financial institutions still lack robust risk assessment, risk mitigation, internal control systems, and governance structures. Therefore, stricter procedures have been introduced.

The new rules aim to:

Ensure proper liquidity management,

Reduce systemic risk exposure,

Strengthen the regulatory reserve system, and

Link dividend distribution directly to capital adequacy compliance.

NRB expects the new provisions to improve the resilience of BFIs against future risks and promote stronger financial discipline.