Over Half of Listed Hydropower Companies Have Book Value Below Rs. 100

Author

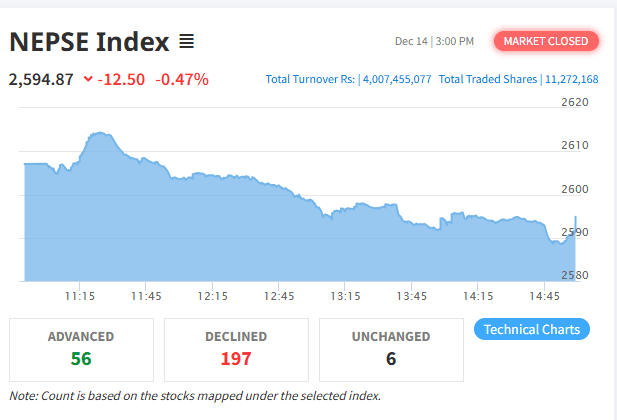

NEPSE trading

The latest third-quarter financial disclosures have revealed alarming signs of financial stress in Nepal’s hydropower sector. Among the 89 hydropower companies listed on the Nepal Stock Exchange (NEPSE), 31 companies have reported negative earnings per share (EPS) — accounting for 34% of all listed hydropower firms.

Sahas Urja Limited (SAHAS) recorded the highest EPS at Rs. 29.41 per share, showcasing strong earnings performance. On the other end of the spectrum, Mandakini Hydropower (MCHL) posted the worst result, with negative EPS of Rs. 45.03, indicating significant losses and poor financial health.

From a book value standpoint, the numbers are equally worrying. Butwal Power Company Limited (BPCL) leads with the highest book value of Rs. 207.60, suggesting solid asset strength. However, Divyajyoti Hydropower (DHPL) has sunk to a critically low book value of just Rs. 4.53, pointing to a near wipeout of shareholder equity.

What’s even more concerning is that 48 out of 89 listed hydropower companies have a book value under Rs. 100. That’s 54% of the sector, indicating that more than half of the companies in the market are in questionable financial condition when it comes to their asset base.