Profit of Commercial Banks Declines Slightly; 10 Banks See Drops, Nabil Bank Leads the Pack

Author

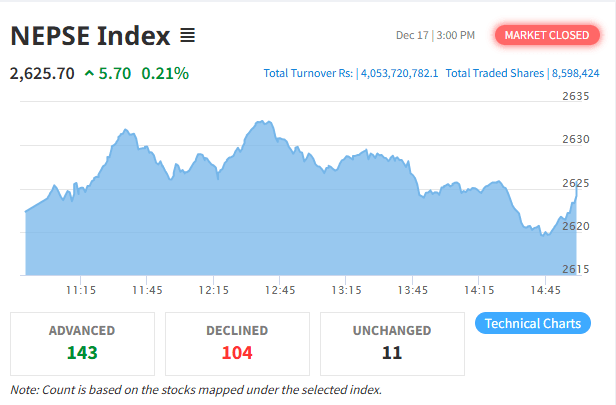

NEPSE TRADING

As of the end of Baisakh 2082, Nepal’s 20 commercial banks have collectively earned a net profit of NPR 47.79 billion. This marks a 1.7% decline compared to the same period last fiscal year when total net profit stood at NPR 48.60 billion.

Banks with Profit Growth

Out of 20 banks, 10 recorded profit growth. Key performers include:

Nabil Bank: Profit surged by an impressive 186.4%, reaching NPR 5.60 billion

Global IME Bank: Jumped 79.7% to NPR 5.35 billion

Nepal Investment Mega Bank: Rose 21.8% to NPR 5.02 billion

Everest Bank: Increased by 3.6% to NPR 3.90 billion

NMB Bank, Laxmi Sunrise Bank, Sanima Bank, Siddhartha Bank, and others also saw modest growth

Note: The earlier claim of Nepal Bank’s 457% profit growth appears to be inaccurate based on the table; it actually shows a decline of 39.8%.

Banks with Profit Decline

The remaining 10 banks experienced a fall in profits. Notable declines include:

NIC Asia Bank: Down 77.9%, profit dropped to NPR 478.7 million from NPR 2.16 billion

Himalayan Bank: Fell 69.3%, limited to NPR 683.4 million

Kumari Bank: Decreased 66.3%, down to NPR 481.9 million

Other significant drops:

Agriculture Development Bank: Down 35.7%

Rastriya Banijya Bank: Down 30.9%

Citizen Bank, Prabhu Bank, Prime Commercial, Standard Chartered, Nepal SBI Bank also posted losses.

Top 5 Most Profitable Banks

Bank | Net Profit (in NPR billion) |

|---|---|

Nabil Bank | 5.60 |

Global IME Bank | 5.35 |

Nepal Investment Mega Bank | 5.02 |

Everest Bank | 3.90 |

Nepal Bank | 3.28 |

Banks with Profit Above NPR 2 Billion

NMB, Prime Commercial, Standard Chartered, Laxmi Sunrise, Siddhartha, Prabhu

Profit Between NPR 1B–2B

Sanima, Rastriya Banijya, ADBL, Nepal SBI, Machhapuchhre, Citizen Bank

Below NPR 1 Billion

Himalayan, Kumari, NIC Asia

While a few banks, especially Nabil, Global IME, and NIMB, posted strong gains, half of the commercial banks saw profit shrink. The overall decline in aggregate profit signals tightening margins and competitive or regulatory pressures in Nepal’s banking sector.