Surge in Nepal’s Stock Market: How Far Will It Go? Time to Buy or Sell?

Author

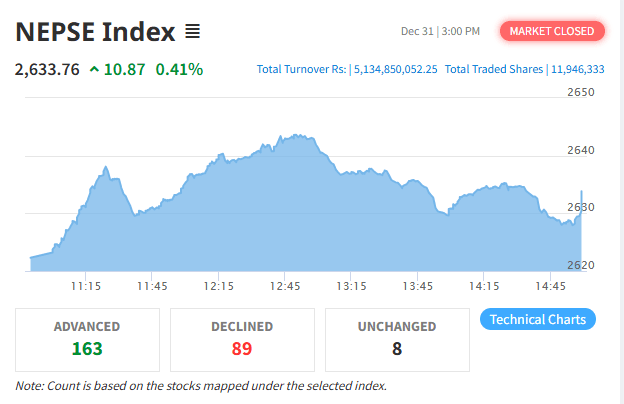

Nepse trading

The Nepal Stock Exchange (NEPSE) index made a significant leap on Sunday, the first trading day of the week. The index surged by 75.24 points to close at 2,890.28, nearing the psychological level of 2,900. This marks a 2.67% increase. Today’s trading saw a turnover exceeding NPR 14.25 billion, reflecting strong enthusiasm and active participation from investors in the stock market.

In Sunday’s session, over 29.1 million shares of 302 companies were traded. Half a dozen companies hit the positive circuit breaker (10% increase) mark. Except for the mutual fund group, all sub-indices of the market showed gains. The manufacturing sector, particularly cement companies, recorded the highest growth, significantly contributing to the rally. Nepal Reinsurance Company led the turnover with NPR 975.3 million, followed by Himalayan Reinsurance and Sindhu Bikas Bank in second and third places, respectively. The high trading volumes of these companies indicate active involvement of large investors.

According to market analysts, the standout feature of this surge is the growing investor interest in fundamentally strong companies. Insurance companies, which had been dormant for a long time, also showed excitement today. For instance, Nepal Reinsurance and Himalayan Reinsurance not only recorded high turnovers but also gained investor confidence. Similarly, cement companies saw increased trading, strengthening the manufacturing sector. Positive signals were also observed in other sectors such as banking, hydropower, and finance companies.

Last Thursday, the NEPSE index breached the key support level of 2,780 and the psychological resistance of 2,800, adding fresh momentum to the market. Analysts suggest that the index could now reach 3,000, potentially offering a selling opportunity. While a minor correction might follow, some predict the market could enter a "super bull" phase. Previously, only small-cap stocks were rising, but now large-cap companies, especially banks, are witnessing gains, signaling a stronger market foundation.

Daily turnover has now exceeded NPR 14 billion. Investors believe that if the average daily turnover surpasses NPR 15 billion, it will further bolster the market. Sunday’s high turnover has reinforced this possibility.

Several factors have played a crucial role in driving Nepal’s stock market upward. First, the second quarterly review of the Nepal Rastra Bank’s monetary policy has boosted market sentiment by reducing the provisioning rate for good loans, making it easier for banks to extend margin loans against shares. Second, the exit of Governor Mahaprasad Adhikari has been viewed positively by investors, as his policies were not considered market-friendly. Third, expectations of a new stock exchange and the introduction of derivative products have attracted more investors. Fourth, banks offering low-interest margin loans have encouraged large investors to increase their market exposure. Fifth, excess liquidity in the banking system and low interest rates on fixed deposits have prompted institutional investors like mutual funds and insurance companies to shift focus to the stock market. Sixth, signs of economic recovery have raised expectations of improved corporate profits and dividend capacities. These factors have collectively increased demand and reduced supply, pushing the NEPSE index higher.

Additionally, expectations of rising corporate profits and enhanced dividend potential have excited investors. After a prolonged decline, stock prices had become undervalued, creating a favorable buying opportunity, as per analysts. Investors focusing on companies with strong financials and good dividend prospects are likely to face lower risks. Such a strategy can help mitigate market volatility.

Technical Analysis

The NEPSE index’s technical chart currently shows a strong bullish trend. Closing at 2,890.28 with a 75.24-point (2.67%) gain, supported by a high volume of NPR 14.25 billion, confirms the strength of this momentum. The chart’s ascending green trendline connects higher highs and higher lows, signaling bullish momentum. The index has already crossed the major support of 2,780 and the psychological resistance of 2,800, accelerating its upward trajectory. Analysts estimate it could easily reach 3,023. However, some caution that immediate resistance lies around 2,900–2,920, which could pose a challenge before hitting 3,000. Candlestick patterns reflect strong buying-selling pressure, and volume supports the continuation of the bullish trend. Technical indicators suggest further upside potential, though experts advise caution.

Broker Analysis

Looking at today’s market, large brokers appear heavily engaged in buying. Among the top 10 brokers by turnover, seven showed relatively higher buying activity, while three leaned toward selling. Broker No. 58, the highest performer, recorded NPR 1.65 billion in transactions, buying NPR 944.9 million worth of shares and selling NPR 706.6 million. Broker No. 49, ranking second, traded NPR 1.05 billion worth of shares but sold more than it bought—NPR 460 million in purchases versus NPR 590 million in sales. Broker No. 42, with over NPR 1 billion in turnover, ranked third, buying NPR 532.4 million and selling NPR 518.9 million. Similarly, Broker No. 34 traded NPR 970 million, with NPR 519 million in buys and NPR 452 million in sales. Broker No. 45 bought NPR 527.2 million and sold NPR 413.6 million. Other brokers, including Nos. 55, 56, 28, 48, and 33, also showed higher buying than selling.

Broker Activity by Stock

Examining broker activity by stock, Broker No. 55 accounted for 33% of the total buying in Nepal Reinsurance. Broker No. 72 dominated Sindhu Bikas Bank, taking up 63.5% of the total buys. In Nyaadi Group Power, Broker No. 44 handled nearly 38% of the buying and 48.5% of the selling, suggesting matched trades. Meanwhile, Broker No. 49 sold about 61% of Machhapuchhre Bank’s shares. Broker No. 6 offloaded 39% of Ghorahi Cement, and Broker No. 55 sold 72% of NLG Insurance shares.