By Trading view

6 Essential Finance Rules Everyone Should Master by Age 30

Financial literacy is one of the most empowering tools a person can possess, especially as you navigate adulthood. While school may teach you math and science, it often skips over critical money management strategies. That’s why these six simple but powerful finance rules can make all the difference. If you’re in your 20s or early 30s, now is the perfect time to take control of your financial future using these practical guidelines.

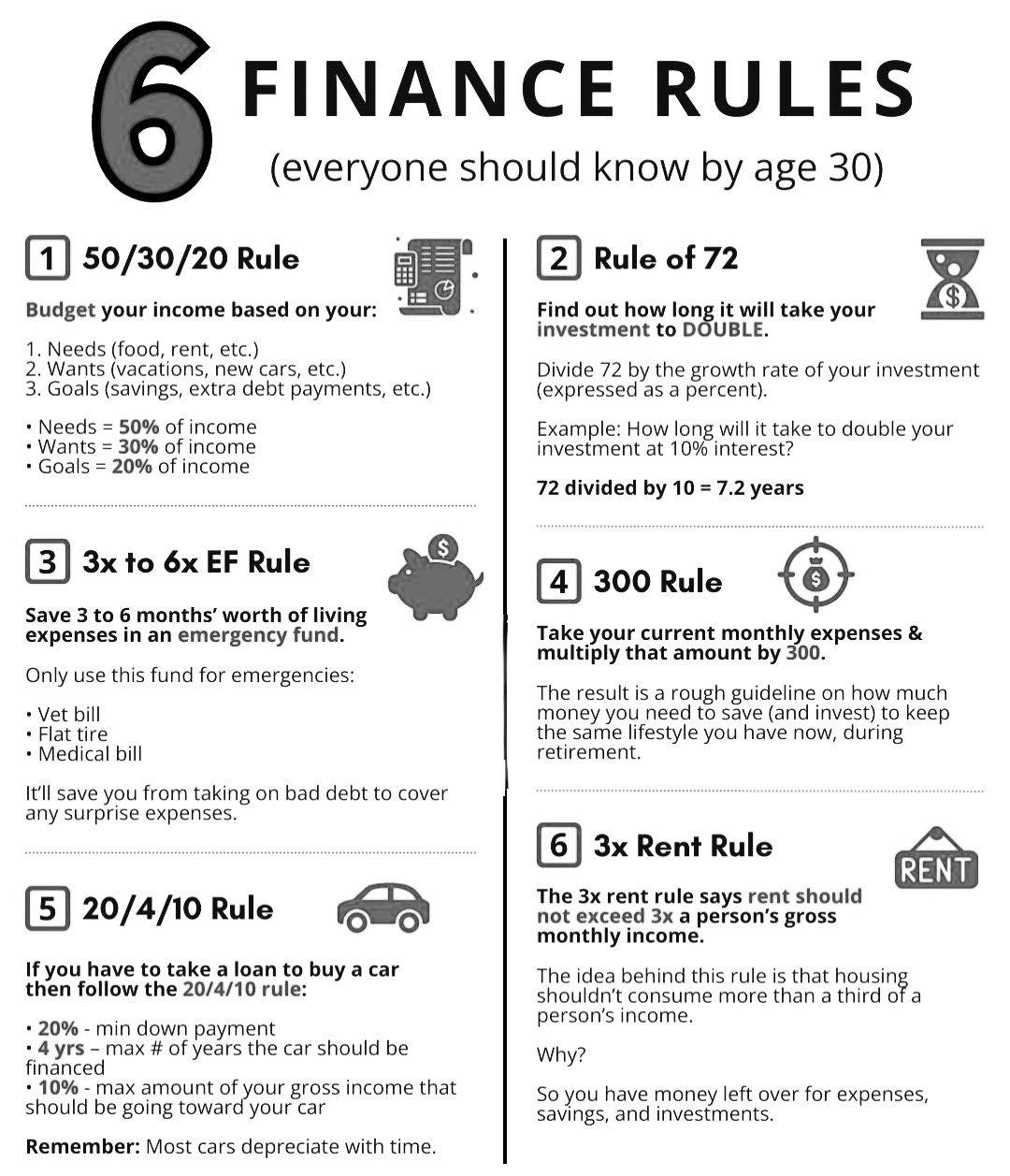

1. The 50/30/20 Rule – Budgeting Made Simple

The 50/30/20 rule is one of the easiest and most effective ways to manage your income. Here’s how it works:

50% of your income should go toward needs—essentials like rent, groceries, utilities, and transportation.

30% should be allocated to wants, such as vacations, eating out, and entertainment.

The remaining 20% goes to goals, which includes savings, investments, or paying off debt faster.

This rule not only simplifies budgeting but also ensures you’re covering your responsibilities while still enjoying life and planning for the future.

2. The Rule of 72 – Understand Compound Growth

If you want to double your money through investing, the Rule of 72 helps you estimate how long it will take. Simply divide 72 by the annual interest rate (as a percent) of your investment.

For example, at a 10% return, your investment will double in approximately 7.2 years (72 ÷ 10).

This rule highlights the power of compound interest and is particularly helpful for long-term retirement or investment planning. The higher the rate, the faster your money grows.

3. 3x to 6x Emergency Fund Rule – Be Prepared

Life is unpredictable. That’s why experts recommend building an emergency fund worth 3 to 6 months of living expenses. This cash reserve can protect you in emergencies like job loss, medical bills, or sudden repairs.

Only use it for genuine emergencies—think vet bills, a flat tire, or a medical issue.

An emergency fund saves you from falling into high-interest debt and gives you peace of mind in uncertain times.

4. The 300 Rule – Retirement Goal Planning

Wondering how much you need to retire comfortably? The 300 Rule offers a rough estimate. Multiply your current monthly expenses by 300 to calculate how much you need saved to maintain your lifestyle after retirement.

So, if your monthly expenses are $2,000, aim to save $600,000 ($2,000 × 300).

It’s a rule of thumb, not a hard formula—but it sets a realistic goalpost to start planning your long-term financial independence.

5. The 20/4/10 Rule – Smart Car Financing

Buying a car? Don’t overextend yourself. The 20/4/10 rule keeps your auto purchase reasonable:

20% down payment minimum

4 years is the max you should finance it for

10% or less of your gross income should be the monthly payment

Cars depreciate quickly, so this rule prevents you from throwing away money on excessive interest or overpaying for a vehicle that loses value rapidly.

6. 3x Rent Rule – Keep Housing Costs in Check

The 3x Rent Rule says your rent should not exceed one-third (1/3) of your gross monthly income.

Why? Because housing is a major expense, and if you spend too much on rent, you’ll struggle to save, invest, or even cover daily expenses.

For example, if you earn $3,000 a month, your rent shouldn’t be more than $1,000. Following this rule keeps your budget balanced and reduces financial stress.

Final Thoughts: Build Your Financial Foundation Now

These six finance rules aren’t just trendy hacks—they’re time-tested principles that help you gain financial control. Whether it’s budgeting with the 50/30/20 rule, preparing for emergencies, or investing wisely, applying these practices consistently will set you up for long-term security and freedom.

Don’t wait until your 40s or 50s to get serious about money. Start now. Master these basics and make smarter financial choices—your future self will thank you