By Dipesh Ghimire

Insurance Companies Invest Over NPR 1.54 Trillion in Nepal’s Stock Market

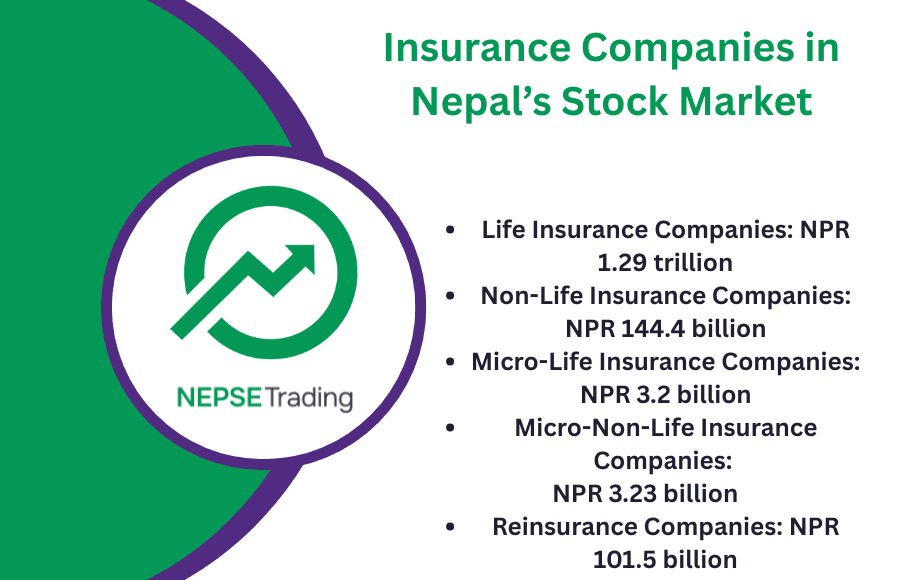

Insurance companies in Nepal have collectively invested more than NPR 1.54 trillion in different categories of company shares and securities, according to the latest data from the Nepal Insurance Authority (NIA). The investments span across ordinary shares, preference shares, debentures, bonds, and promoter shares of both listed and unlisted companies.

Breakdown of Investments

Life Insurance Companies: NPR 1.29 trillion

Non-Life Insurance Companies: NPR 144.4 billion

Micro-Life Insurance Companies: NPR 3.2 billion

Micro-Non-Life Insurance Companies: NPR 3.23 billion

Reinsurance Companies: NPR 101.5 billion

Altogether, insurance companies’ exposure to the equity and debt market demonstrates their significant role in capital mobilization in Nepal’s financial system.

Listed public company shares: NPR 408.3 billion

Preference shares, bonds, debentures, and loans of financial institutions: NPR 648.1 billion

Listed company bonds/debentures: NPR 212.4 billion

Investment company shares: NPR 63.9 billion

Promoter shares: NPR 188.8 billion

Unlisted public company shares: NPR 21.7 billion

Regulatory Breaches – Exceeding Investment Limits

The NIA found that micro-insurance and reinsurance companies exceeded the regulatory ceiling for investment in listed ordinary shares.

Micro Life Insurance: NPR 2.83 billion (12.34% of their total portfolio)

Micro Non-Life Insurance: NPR 3.13 billion (12.5% of their total portfolio)

Reinsurance Companies: NPR 52.8 billion (12.87% of their total portfolio)

This breaches the previous NIA directive, which allowed insurers to invest only up to 10% of their total portfolio in listed ordinary shares. By contrast, large life and non-life insurers remained below this threshold, with life insurers investing 4% and non-life insurers 6%.

Sector-Wise Investment Interpretation

Ordinary Shares: Life insurers and larger firms remain conservative, but micro and reinsurance firms are showing aggressive equity exposure, which could increase their risk profile.

Bonds & Debentures: Life insurers allocated 7.84% of their portfolio, while non-life insurers invested 4.31%. This remains well below the 30% cap for life insurers and 20% for non-life insurers, signaling room for further fixed-income allocation.

Investment Companies: NIA regulations permit up to 5% exposure. Current allocations by life insurers (0.36%), non-life insurers (3.88%), and reinsurers (2.55%) remain within limits.

Promoter Shares: Investments are modest, ranging between 2–3.88% for different categories.

Unlisted Public Shares: Negligible exposure (0.21% life, 0.02% non-life, and 1.23% reinsurers), reflecting the limited liquidity and transparency of this segment.

New Directive – Higher Investment Limits

The NIA has recently raised the limit for investments in listed public company shares from 10% to 15% of total portfolio. This move aims to encourage capital market participation and channel more institutional funds into the stock exchange.

Increased the minimum allocation for government/Nepal Rastra Bank bonds to 35% (from the previous 25%).

Allowed commercial bank and infrastructure bank fixed deposits as alternatives if sufficient government bonds are unavailable.

Raised the limit for development bank deposits to 15% (from 10%).

Increased the limit for finance company deposits to 7% (from 5%).

Interpretation – What This Means for Nepal’s Market

Capital Market Boost: By raising shareholding limits, the NIA is encouraging insurers to inject more liquidity into NEPSE, potentially improving market depth.

Risk Exposure for Small Players: Micro-insurance and reinsurance companies’ higher-than-allowed equity allocations highlight aggressive investment behavior, which could pose risks if market volatility spikes.

Fixed-Income Security Preference: Larger life insurers still prefer safer government bonds and debentures, aligning with global norms for long-term institutional investors.

Policy Shift: The increase in required government bond investment (35%) strengthens fiscal financing for the state while ensuring insurer portfolios remain relatively stable.

Nepal’s insurance companies have invested heavily—over NPR 1.54 trillion—into shares, bonds, and other securities. While large insurers remain within regulatory limits, smaller insurers and reinsurance firms have exceeded their equity exposure caps. The new NIA directive raises permissible equity investment to 15%, signaling greater institutional participation in Nepal’s stock market, but also calls for cautious monitoring of portfolio risks.