By Sandeep Chaudhary

Analyzing Mixed Performance Trends in Security-Wise Outstanding Credit of Banks and Financial Institutions (2022-2024)

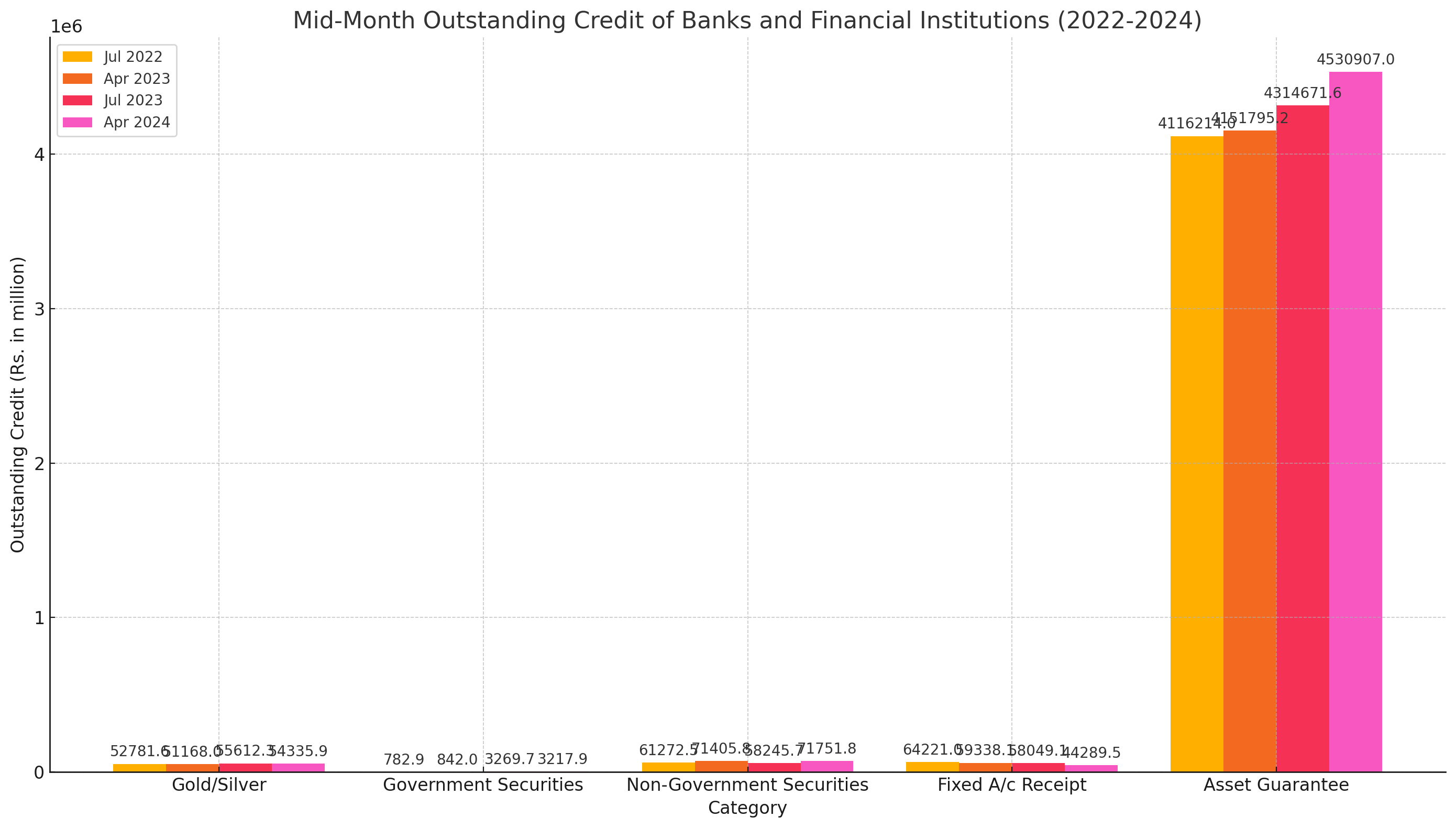

In the mid-month review of April 2024, the outstanding credit of banks and financial institutions revealed a mixed performance across various securities. The data indicates both significant growth in certain areas and notable declines in others, reflecting the dynamic nature of the financial sector.

Key Highlights:

1. Gold/Silver: The outstanding credit for Gold/Silver decreased from Rs. 55,612.3 million in July 2023 to Rs. 54,335.9 million in April 2024, a decline of Rs. 1,276.4 million or 2.3%. This trend suggests a reduced demand or lower valuations for gold and silver assets over the period.

2. Government Securities: Government securities experienced a slight decrease, from Rs. 3,269.7 million in July 2023 to Rs. 3,217.9 million in April 2024, a drop of Rs. 51.8 million or 1.6%. This minor contraction may indicate stability but with a slight investor shift away from government bonds.

3. Non-Government Securities: Non-government securities saw a significant increase, rising from Rs. 58,245.7 million in July 2023 to Rs. 71,751.8 million in April 2024. This represents a substantial growth of Rs. 13,506.1 million or 23.2%, highlighting strong investor confidence in private sector securities.

4. Fixed A/c Receipt: This category saw a notable decline, dropping from Rs. 58,049.1 million in July 2023 to Rs. 44,289.5 million in April 2024, a decrease of Rs. 13,759.6 million or 23.7%. The reduction reflects a significant shift away from fixed account receipts, possibly due to changing interest rates or better investment opportunities elsewhere.

5. Asset Guarantee: Asset guarantees grew from Rs. 4,314,671.6 million in July 2023 to Rs. 4,530,907.0 million in April 2024, an increase of Rs. 216,235.4 million or 5.0%. This growth suggests an expanding use of assets as collateral, indicating higher confidence in asset-backed financing.

Detailed Observations:

Gold/Silver: The consistent decline across both review periods (2022/23 and 2023/24) indicates a general trend of decreasing reliance or value in precious metals within the financial portfolios.

Government Securities: The minor decrease points to a relatively stable government bond market with a slight shift that could be attributed to various economic factors including inflation or changes in fiscal policy.

Non-Government Securities: The robust increase reflects a strong private sector with higher investor confidence in non-government securities, potentially driven by better returns or favorable market conditions.

Fixed A/c Receipt: The substantial decline suggests a significant change in investor behavior, possibly moving towards more liquid or higher-yield investments, reflecting a dynamic adjustment to market conditions.

Asset Guarantee: The steady growth in asset guarantees highlights a trend towards more secured lending, with financial institutions increasingly relying on assets as collateral to mitigate risks.

Conclusion:

The overall security-wise outstanding credit scenario reveals a sector adjusting to various economic forces, with certain areas like non-government securities and asset guarantees showing strong growth, while others like fixed account receipts and precious metals seeing declines. These trends underscore the importance of adaptive strategies in financial management and the evolving preferences of investors in the current economic landscape.