By Sandeep Chaudhary

CPI Breakdown: What Lower Inflation in 2025/26 Means for Households and Investors

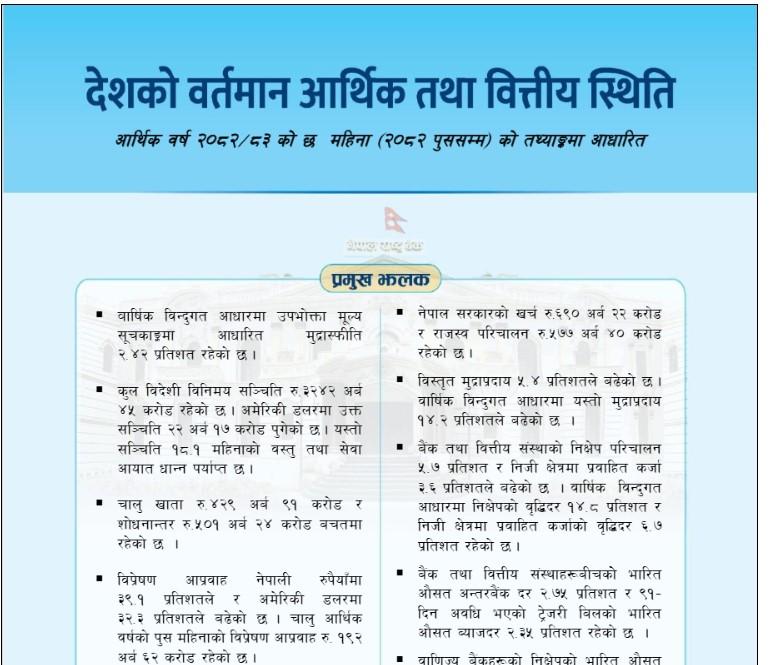

Nepal’s latest CPI data shows that inflation in 2025/26 has cooled to 1.68%, the lowest in four years, compared to 4.09% in 2024/25 and above 7% in earlier years. For households, this decline brings some relief, especially in food prices such as cereals, vegetables, and pulses, which have either stabilized or dropped. This means grocery bills are lighter than in previous years, allowing families to redirect spending toward other essentials. However, not all costs are easing—non-food and services like housing, utilities, education, and healthcare continue to rise, creating a steady squeeze on urban and middle-class households. In short, food inflation may have eased, but service-driven inflation is still shaping the cost of living.

For investors, lower inflation has mixed implications. On one hand, slowing price growth can improve consumer purchasing power, supporting demand in retail, banking, and other consumption-driven sectors. It also reduces pressure on the Nepal Rastra Bank to keep monetary policy tight, potentially lowering borrowing costs over time. On the other hand, persistently high service costs—especially in housing, utilities, and education—signal structural inflation risksthat could limit long-term growth if left unchecked. Investors may need to adjust strategies, focusing on sectors that benefit from stronger consumer confidence while staying cautious about industries exposed to rising service costs.