By Dipesh Ghimire

Excess Liquidity Persists as Credit Demand Remains Weak in Nepal’s Banking System

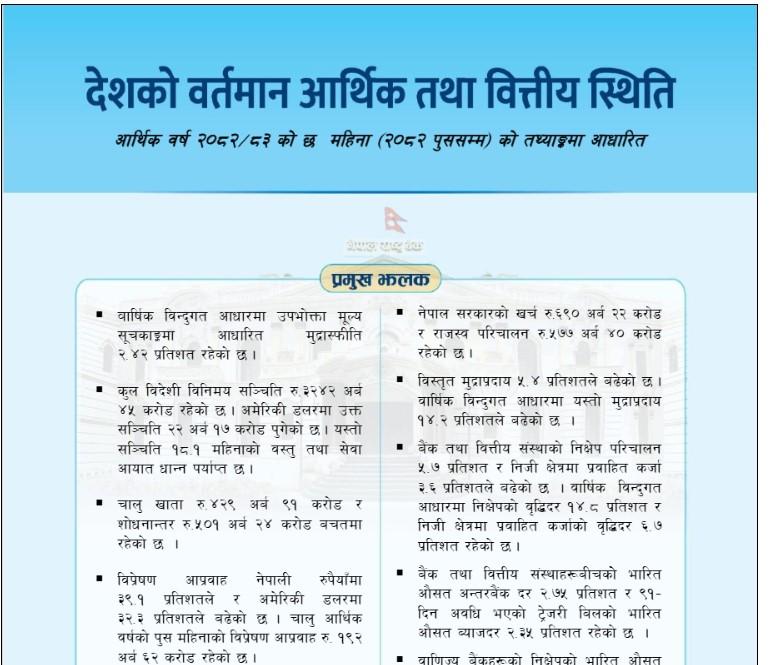

Despite a continued rise in deposits, Nepal’s banking system has failed to translate abundant liquidity into productive credit expansion in the current fiscal year. Data released by Nepal Rastra Bank show that while banks and financial institutions are flush with funds, private sector credit demand remains subdued, deepening the challenge of excess liquidity management and slowing domestic economic momentum.

The central bank notes that interest rates have fallen to historically low levels this fiscal year, a condition that would normally encourage borrowing and investment. Anticipating surplus liquidity, Nepal Rastra Bank issued bonds worth NPR 200 billion in the month of Poush alone to absorb excess funds from the system. However, even after these interventions, pressure on interest rates has not fully eased, suggesting that liquidity absorption measures have been insufficient relative to the scale of surplus funds.

As bond issuance failed to adequately mop up excess liquidity, the central bank intensified the use of long-term deposit collection instruments and the Standing Deposit Facility (SDF). Banks have reportedly been placing funds into the SDF almost every alternate day. Yet, the overall liquidity glut has persisted, reflecting structural weaknesses on the demand side rather than temporary imbalances.

By Sunday, a total of NPR 864 billion had accumulated at the central bank through the Standing Deposit Facility. Nepal Rastra Bank is required to pay an average interest rate of 2.75 percent on this amount—the lower bound of the interest rate corridor. This effectively sets a floor under deposit rates, preventing banks from offering savers lower interest rates, even when they have little incentive to attract additional deposits.

Bankers say the situation has reached an unusual point where they cannot even encourage depositors to withdraw funds, despite limited lending opportunities. The absence of new investment avenues and the reluctance of existing businesses to take on fresh loans have compounded the problem. According to banks, the lack of bankable projects and weak business confidence are at the core of the liquidity trap.

Although a marginal rise in credit was observed in Poush, banks caution that this may not reflect new economic activity. Instead, they believe it largely stems from the settlement of outstanding transactions linked to the end of the second quarter, rather than fresh investment or expansion decisions.

Banks attribute weak credit demand to broader economic and political factors. Sluggish economic growth, political uncertainty, and limited expansion in industrial and commercial activities have dampened borrowing appetite. In some cases, older industries have either shut down or scaled back production, further reducing demand for credit. Rising default risks and the absence of clearly identifiable safe investment sectors have also made banks more cautious in extending loans.

Liquidity Management Becomes Increasingly Challenging

In the first six months of the current fiscal year, Nepal Rastra Bank absorbed liquidity worth NPR 2,871.24 billion through various monetary instruments. This included NPR 142.55 billion through deposit collection auctions, NPR 2,708.69 billion via the Standing Deposit Facility, and NPR 200 billion through central bank bonds. After injecting NPR 12.5 billion through overnight liquidity facilities, net liquidity absorption stood at NPR 2,869.99 billion.

The central bank has also remained active in foreign exchange operations. During the review period, it purchased USD 3.47 billion from commercial banks, injecting NPR 493.04 billion into the system. In the same period last year, USD 2.52 billion had been purchased, injecting NPR 340.06 billion. On the other hand, the central bank sold USD 2.06 billion to purchase Indian currency worth NPR 292.91 billion, compared to USD 1.90 billion and NPR 256.51 billion respectively in the previous year.

Interbank transactions, however, declined significantly. In the first six months of the fiscal year, interbank dealings among commercial banks totaled NPR 396.41 billion, while transactions among other financial institutions reached NPR 73.88 billion, bringing the total to NPR 470.29 billion. This represents a sharp drop from NPR 837.98 billion recorded during the same period last year, indicating reduced interbank activity amid surplus liquidity.

Where Is Credit Demand Concentrated?

During the review period, private sector credit increased by 3.6 percent, or NPR 197.47 billion, reaching NPR 5,695.17 billion. In contrast, private sector credit had grown by 5.2 percent, or NPR 265.56 billion, during the same period last fiscal year. On an annual point-to-point basis, credit growth stood at 6.7 percent by mid-January, a relatively weak rate by historical standards.

Of the total credit extended to the private sector, 62.7 percent went to non-financial institutional borrowers, while 37.3 percent flowed to individuals and households. A year earlier, the respective shares were 64.2 percent and 35.8 percent, indicating a gradual shift toward household borrowing.

By institution type, commercial banks increased lending by 3.7 percent, development banks by 2.9 percent, and finance companies by just 1.2 percent. In terms of collateral, 15 percent of loans were backed by current assets such as agricultural and non-agricultural goods, while a dominant 63.9 percent were secured by real estate. These ratios have changed only marginally from last year, underscoring banks’ continued reliance on property-backed lending.

Loan-type data show that margin lending rose by 8.3 percent, trust receipt (import) loans by 7.8 percent, hire-purchase loans by 7.3 percent, and cash credit by 3 percent. Demand and working capital loans increased by 2.9 percent, real estate loans by 2.5 percent, and term loans by 2.4 percent. Overdraft lending, however, declined by 3.3 percent.

Meanwhile, total deposits in banks and financial institutions rose by 5.7 percent to NPR 7,681.35 billion, compared to a 3.7 percent increase in the same period last year. On an annual basis, deposits grew by a strong 14.8 percent. Of total deposits, current, savings, and fixed deposits accounted for 6.9 percent, 41.3 percent, and 42.8 percent respectively, while institutional deposits made up 35.1 percent.

A Liquidity-Rich but Credit-Starved Economy

Overall, Nepal’s banking system is facing a paradoxical situation: abundant liquidity but weak credit demand. While there is no shortage of funds, the lack of new industries, limited business expansion, and cautious investment sentiment have prevented meaningful growth in lending. Analysts warn that unless structural issues are addressed and confidence in productive sectors improves, excess liquidity will continue to strain interest rate management and keep domestic economic activity sluggish.

Turning surplus liquidity into productive investment remains the central challenge. Without targeted policy support, clearer investment pathways, and renewed private sector confidence, the banking system’s excess funds are likely to remain parked at the central bank rather than fueling economic growth.