By Trading view

Finance Bill 2081 Brings Sweeping Changes to Export and Import Tariffs

The Government of Nepal has introduced sweeping reforms in customs duty through the Finance Bill 2081, which will be effective in fiscal year 2081/82. These changes mark a clear shift toward protecting domestic industries, curbing the outflow of raw materials, and reducing dependency on luxury and non-essential imports. The amendments affect both export and import duties, with significant implications across sectors such as agriculture, forestry, automobiles, household goods, and consumer items.

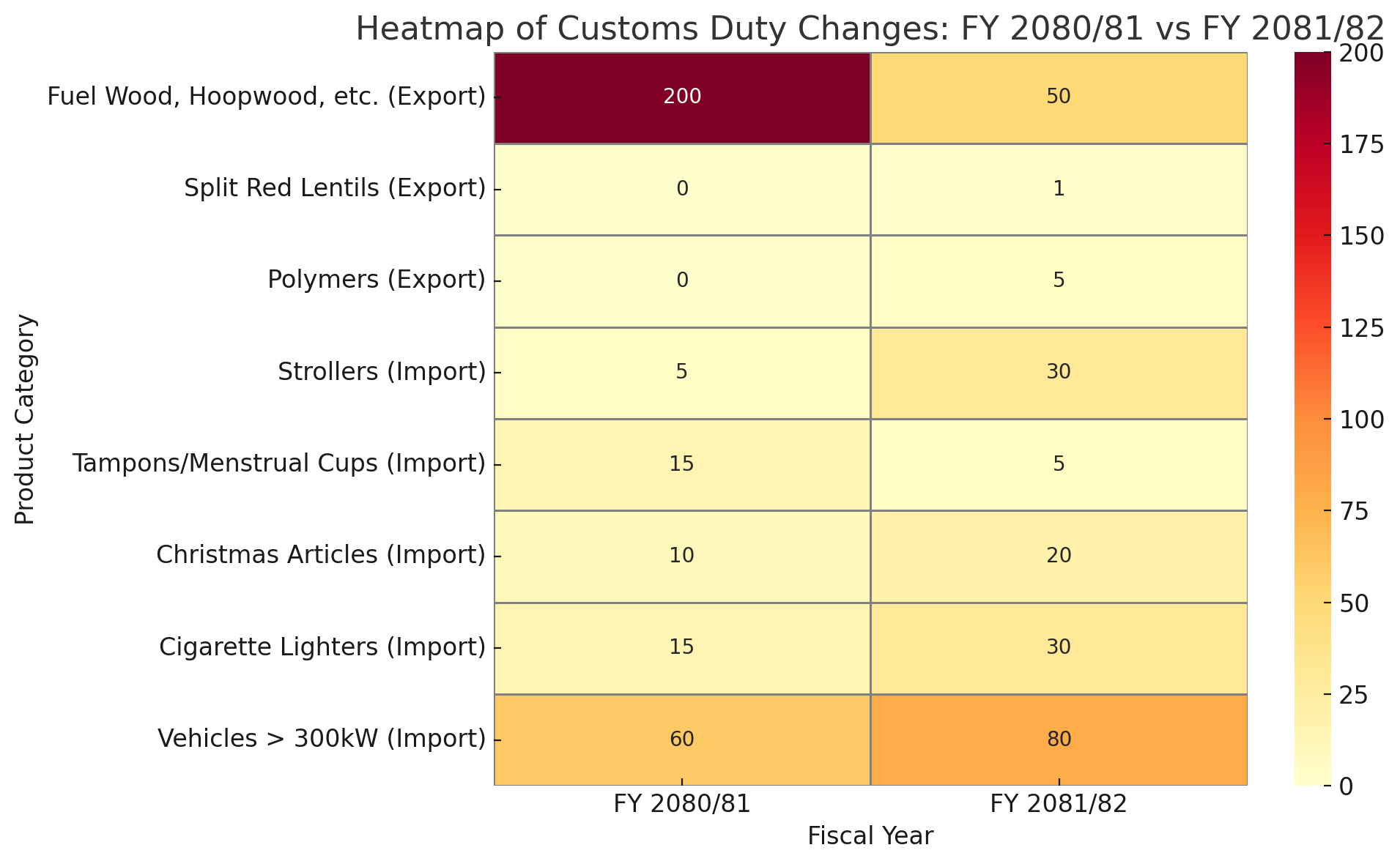

On the export front, the government has aggressively hiked duties on wood and forest-based raw materials. The export duty on items such as fuel wood, hoopwood, and sawn wood has been quadrupled—from 50% in FY 2080/81 to 200% in FY 2081/82. Similarly, new duties have been introduced on items like sawdust and wood waste, which were previously exempt. These changes indicate the government’s intent to discourage the export of raw forest resources and instead promote value-added processing within Nepal. Additionally, red lentils (split) have now been brought under the export duty regime with a tariff of Rs. 1 per kilogram, whereas it was previously duty-free. In contrast, the export duty on primary polymers of propylene has been removed, likely to promote synthetic material exports or aid in industrial use.

In terms of import duty, there has been a significant increase across a broad range of products. Items such as baby strollers, cigarette lighters, festive decorations, brushes, and LED lighting components have all seen their import duties hiked—often doubled. For example, the duty on strollers has increased from 5% to 30%, and on cigarette lighters from 15% to 30%, suggesting a clampdown on non-essential or luxury imports. On the other hand, in a progressive move aimed at improving access to menstrual hygiene products, the import duty on tampons and menstrual cups has been slashed from 15% to 5%. This move is likely to be welcomed by health advocates and social welfare groups.

The automobile sector has also undergone a major tariff overhaul, with import duties now linked more closely to the engine power of the vehicle. The higher the power output, the steeper the import duty. For example, vehicles with engines exceeding 300 kW will now attract an import duty of 80%, compared to 60% in the previous year. This move appears to target luxury vehicles and aims to discourage their import. Even mid-range vehicles with power output between 100–200 kW will now attract a 30% duty, up from 20%. The unassembled versions of these vehicles are taxed at the same higher rates, hinting at a uniform policy regardless of assembly status.

Household items and utility goods have not been spared either. Import duties on tableware, porcelain kitchenware, cast iron goods, and even gold have increased by 5 percentage points across the board. Items like LED lamps and filament bulbs now carry higher duties as well, reflecting a possible push to encourage local production or reduce the trade deficit. The import duty on unwrought or semi-manufactured gold has risen from 15% to 20%, a move that could help slow down luxury imports and reduce pressure on foreign currency reserves.

Overall, the Finance Bill 2081 sends a strong message about the government’s economic priorities. It emphasizes import substitution, protection of domestic industries, and discouragement of raw material exports and luxury imports. While the reforms will likely boost local manufacturing and improve the balance of trade, consumers may feel the pinch due to increased prices on several imported goods. However, targeted reductions in duties—such as on menstrual hygiene products—show that the government is also factoring in public welfare and equity in its tariff policy. These structural shifts in customs duties reflect Nepal’s broader vision for economic self-reliance and industrial development.