By Sandeep Chaudhary

Highlights of Nepal Monetary Policy for FY 2079/80: Key Economic Indicators and Strategic Measures

Introduction

Nepal's Monetary Policy for FY 2079/80 (2022/23) has been formulated to promote macroeconomic stability while maintaining price and external sector stability. This policy is crucial for fostering economic growth, controlling inflation, and managing liquidity in the financial system. The Nepal Rastra Bank (NRB), as the central bank, has outlined various targets and measures in this policy to achieve these objectives.

Economic Outlook

The economic outlook for Nepal in FY 2079/80 is cautiously optimistic, with the government targeting an economic growth rate of 8% and an inflation rate of 7%. These targets are set against a backdrop of global economic uncertainty, internal economic challenges, and the need for substantial economic reforms to sustain growth.

Economic and Monetary Targets

The primary economic and monetary targets for FY 2079/80 are:

Economic Growth Rate: 8%

Inflation Rate: 7%

Foreign Exchange Reserves: To cover at least 7 months of imports

The ability to maintain adequate foreign exchange reserves is critical for ensuring that the country can support the import of goods and services. This is particularly important given the pressures on the balance of payments and the need to stabilize the external sector.

Monetary Measures

Interest Rate Corridor

One of the key measures in the monetary policy is the adjustment of the interest rate corridor. The NRB has increased the rates within the corridor by 1.5% to maintain the following:

Bank Rate: 8.5%

Policy Rate: 7%

Deposit Collection Rate: 5.5%

These adjustments are intended to manage liquidity and ensure that interest rates remain conducive to economic stability.

Liquidity Management

Liquidity in the financial system will be managed through open market transactions based on the status of operating targets. The NRB will continue to use the weighted average interbank interest rate between banks and financial institutions as an operational target. This measure is designed to strengthen interest rate transmission and ensure effective dissemination of monetary policy.

Credit Growth

The growth of comprehensive money lending is expected to be 12%, while the growth rate of loans to the private sector is targeted at 12.6%. These targets reflect the NRB's commitment to supporting economic growth through increased credit availability.

Economic Growth

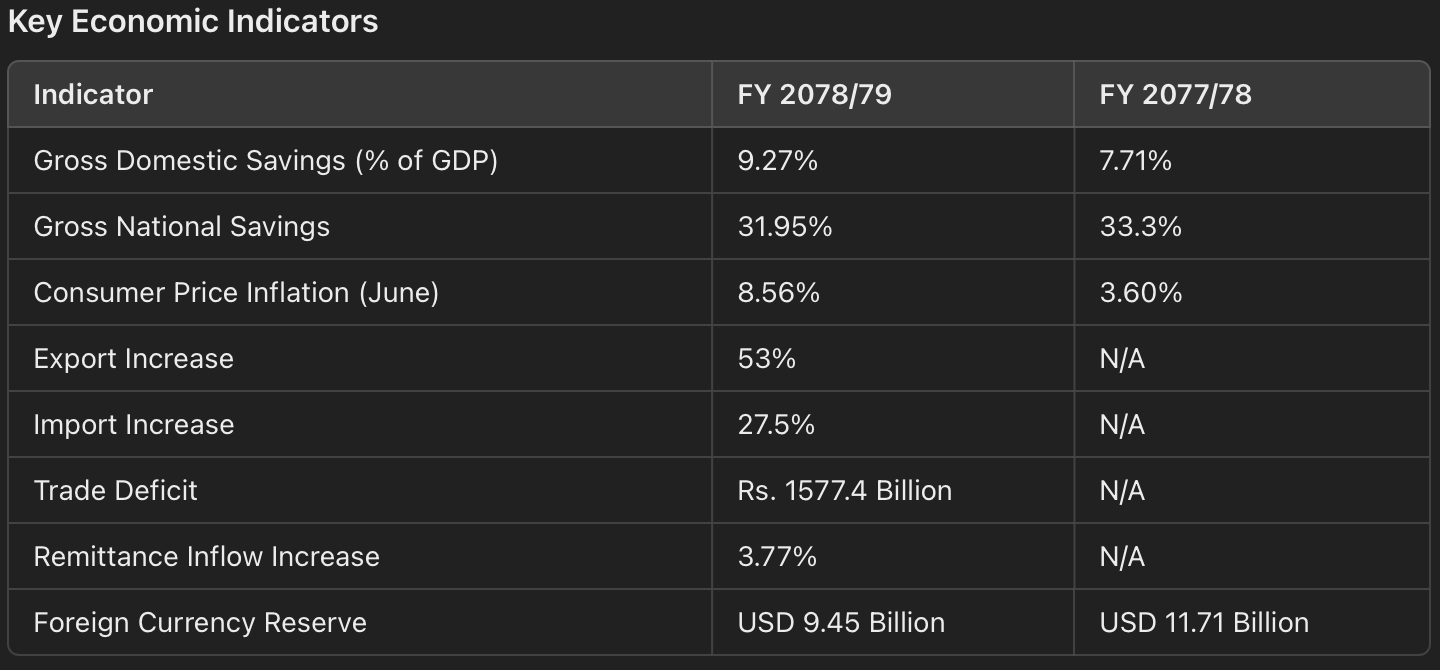

Key Economic Indicators

The key economic indicators for Nepal in FY 2079/80 highlight the government's efforts to stabilize and grow the economy. The table below summarizes these indicators:

These indicators show an overall positive trend, with significant growth in exports and remittance inflows. However, the trade deficit remains a challenge, and the decrease in foreign currency reserves highlights the need for careful management of external sector stability.

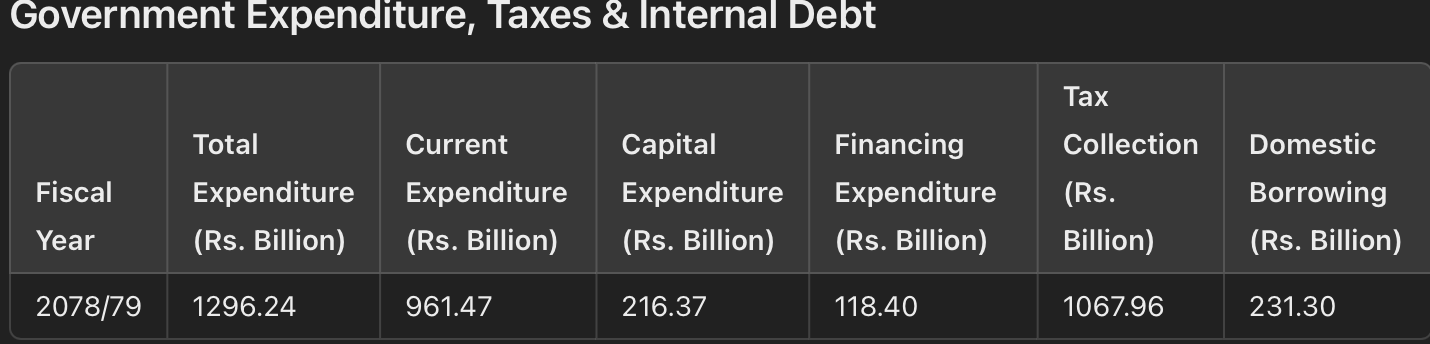

Government Expenditure, Taxes, and Internal Debt

The fiscal policy for FY 2079/80 outlines the government's expenditure, tax collection, and internal debt management strategies. The table below provides a summary of these aspects:

These figures illustrate the government's efforts to manage its finances prudently while supporting economic growth through capital expenditure and financing.

Banking Sector Situation

The banking sector plays a critical role in the economic stability and growth of Nepal. The following key points summarize the situation in the banking sector for FY 2079/80:

Deposit Mobilization: Increased by 5.7% to Rs. 4,928.50 Billion during the review period.

Credit to BFIs: Increased by 13.5% to Rs. 4637.50 Billion during the review period.

Non-Performing Loans: Average non-performing loans (NPLs) for commercial banks, development banks, and finance companies stood at 1.32%, 1.49%, and 7% respectively.

The NRB has also facilitated the merger of banks and financial institutions (BFIs) to strengthen the banking sector. As of mid-July 2022, a total of 245 BFIs have been engaged in the merger process, with licenses of 178 institutions revoked and 67 institutions retained.

Capital Market Situation

The capital market in Nepal has experienced significant fluctuations. The NEPSE index and market capitalization have both seen decreases over the past year. Key points include:

NEPSE Index: Decreased from 2883.41 to 2009.46.

Market Capitalization: Decreased from Rs. 4010.96 Billion to Rs. 2869.34 Billion.

Debentures Issued: SEBON has approved the issue of debentures, ordinary shares, right shares, and mutual fund units totaling Rs. 28.15 Billion in FY 2078/79.

Summary of Provisions for BFIs

The monetary policy includes several provisions for BFIs to enhance their stability and performance. Some of these provisions are:

Credit Deposit Ratio (CD): BFIs were required to maintain a CD ratio of 90% by Ashad end 2079. However, the CD ratio maintained was 86.22%.

Loan Premium: The premium for loans up to Rs. 1 crore to agriculture, handicraft, and skill-based businesses shall not exceed 2% above the base rate.

Regulation and Supervision

Regulation and supervision are critical components of the monetary policy. The NRB has introduced several measures to ensure the stability and soundness of the financial system, including:

Credit Deposit Ratio: BFIs are required to maintain a CD ratio of 90% by Ashad end 2079.

Loan Restructuring and Rescheduling: Necessary reviews will be conducted on regulatory arrangements such as loan restructuring and rescheduling, interest capitalization, and dividend distribution.

Financial Sector Stability Review (FSSR): Conducted with the help of the International Monetary Fund (IMF) to maintain financial stability and improve loan quality.

Countercyclical Capital Buffer: Arrangements will be made to implement this buffer, which was postponed during the COVID-19 pandemic.

Financial Sector Reforms and Regulatory Provisions

The monetary policy includes several reforms and regulatory provisions aimed at strengthening the financial sector. These include:

Digital Lending Guidelines: Implemented to streamline the loan sanction process, reduce lending costs, and extend credit facilities.

Margin Loans: An individual or institution can take margin loans against the collateral of shares up to Rs. 120 million from one or all financial institutions combined.

Payment System

The NRB aims to promote electronic payment transactions and has declared FY 2079/80 as the year of promotion for electronic payments. Key initiatives include:

Electronic Payment Promotion: Necessary institutional coordination will be provided to promote electronic payments.

Innovation Center or Regulatory Sandbox: Studies will be conducted to establish these facilities.

Financial Literacy and Financial Inclusion

The monetary policy emphasizes the importance of financial literacy and inclusion. Key measures include:

Financial Inclusion Index: To measure the actual status of financial access.

Financial Literacy Framework 2022: To cover guidelines for financial consumer protection and digital financial literacy. Financial literacy will also be introduced in the curriculum of schools and colleges in coordination with the Ministry of Education.

Foreign Exchange Management

Effective management of foreign exchange is crucial for maintaining external sector stability. The NRB has outlined several measures, including:

Foreign Investment and Foreign Loan Management Byelaws, 2078: Amendments will be made to simplify the process of automation of foreign investment flows and support foreign investment.

Remittance Flow: Policies will be introduced to widen the scope of remittance flow into Nepal from Nepali citizens, foreign citizens, and overseas organizations/associations.

Conclusion

Nepal's Monetary Policy for FY 2079/80 outlines a comprehensive approach to achieving macroeconomic stability, supporting economic growth, and maintaining price and external sector stability. The policy includes a range of measures to manage liquidity, promote credit growth, strengthen the banking and financial sector, and enhance financial inclusion and literacy. By implementing these measures, the NRB aims to create a stable and conducive environment for economic development and prosperity in Nepal.