By Sandeep Chaudhary

Major Banks in Nepal Report Significant Loan Portfolios: A Comprehensive Analysis

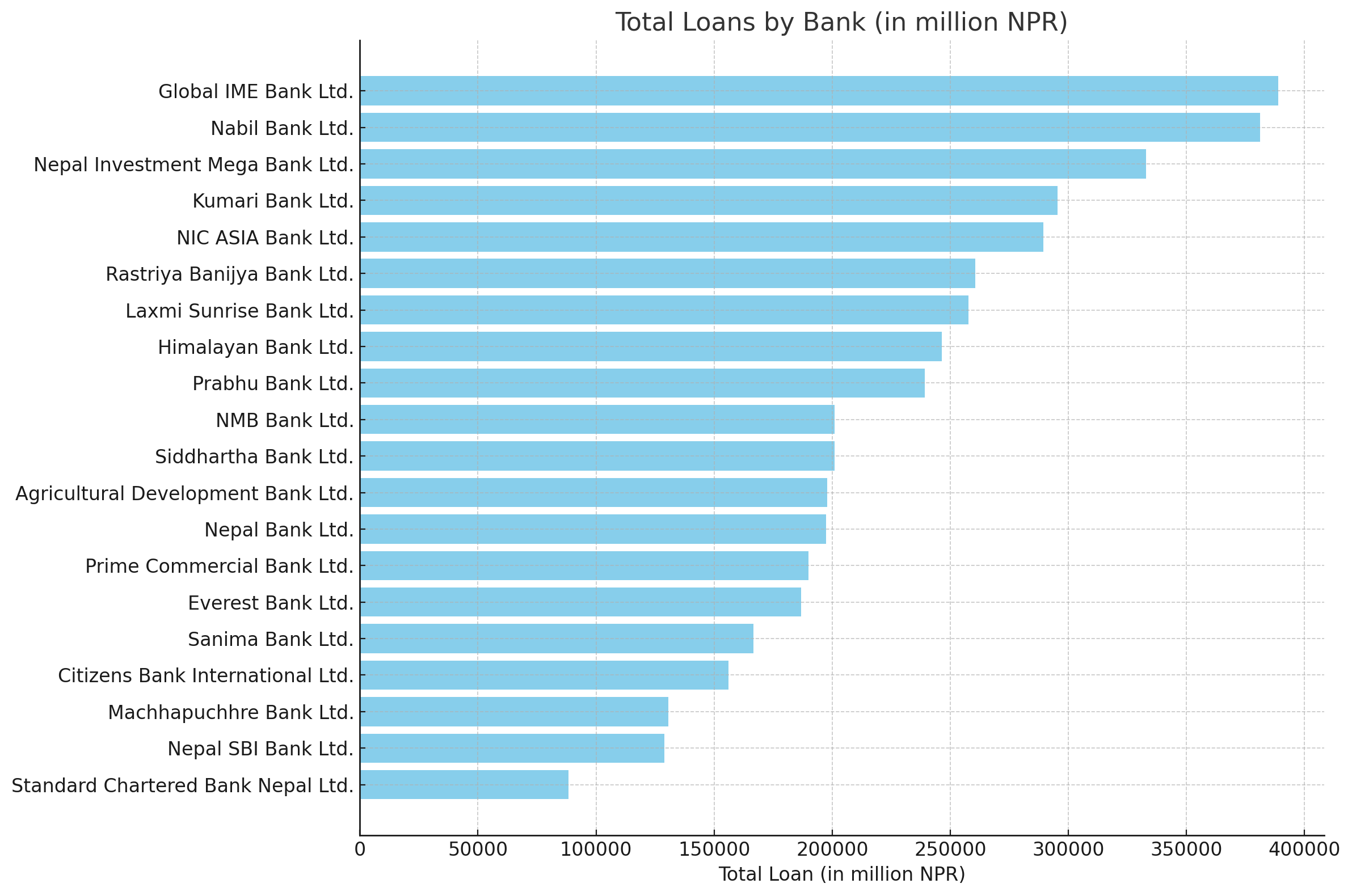

As of Chait end, 2080 (Mid-April 2024), several major banks in Nepal have reported their total loan portfolios, revealing significant lending activities across the sector. The data showcases the competitive landscape among the country's leading financial institutions and highlights the substantial role these banks play in the nation's economy.

Global IME Bank Ltd. leads the pack with an impressive total loan portfolio amounting to NPR 388,792 million. This substantial figure underscores the bank's aggressive lending strategy and its prominent position in the financial market. Closely following is Nabil Bank Ltd., with a total loan of NPR 381,128 million, further cementing its status as one of the top lenders in the country.

Nepal Investment Mega Bank Ltd. and Kumari Bank Ltd. also reported significant loan portfolios of NPR 332,837 million and NPR 295,417 million, respectively. These banks have demonstrated robust growth in their lending activities, contributing significantly to various sectors of the economy.

NIC ASIA Bank Ltd. recorded a total loan portfolio of NPR 289,296 million, showcasing its extensive reach in the lending market. Similarly, Rastriya Banijya Bank Ltd. reported NPR 260,484 million in loans, reflecting its strong presence in the public banking sector.

Among other notable mentions, Laxmi Sunrise Bank Ltd. and Himalayan Bank Ltd. have loan portfolios of NPR 257,747 million and NPR 246,495 million, respectively. Prabhu Bank Ltd. follows with NPR 239,166 million in total loans, indicating its competitive lending practices.

Mid-tier banks such as NMB Bank Ltd. and Siddhartha Bank Ltd. also play crucial roles, with loan portfolios of NPR 201,113 million and NPR 201,073 million, respectively. These figures highlight their steady performance and strategic lending approaches.

On the lower end of the spectrum, banks like Standard Chartered Bank Nepal Ltd. reported a total loan portfolio of NPR 88,435 million, which, while lower compared to its peers, still represents a significant amount in the market. Nepal SBI Bank Ltd. and Machhapuchhre Bank Ltd. also showcased substantial loan portfolios of NPR 129,022 million and NPR 130,540 million, respectively.

The disclosed data not only reflects the competitive dynamics within the Nepalese banking sector but also underscores the critical role these financial institutions play in supporting economic activities through their lending practices. As the economy continues to evolve, the performance and strategies of these banks will be pivotal in shaping the financial landscape of Nepal.

In summary, the significant loan portfolios reported by these banks as of Chait end, 2080 (Mid-April 2024) highlight their vital contributions to the economy, fostering growth and development across various sectors. As the banking sector navigates through challenges and opportunities, these institutions remain integral to the financial stability and progress of Nepal.