By Trading view

Nepal Income Tax Slab Rates for FY 2081/82 Explained in Detail

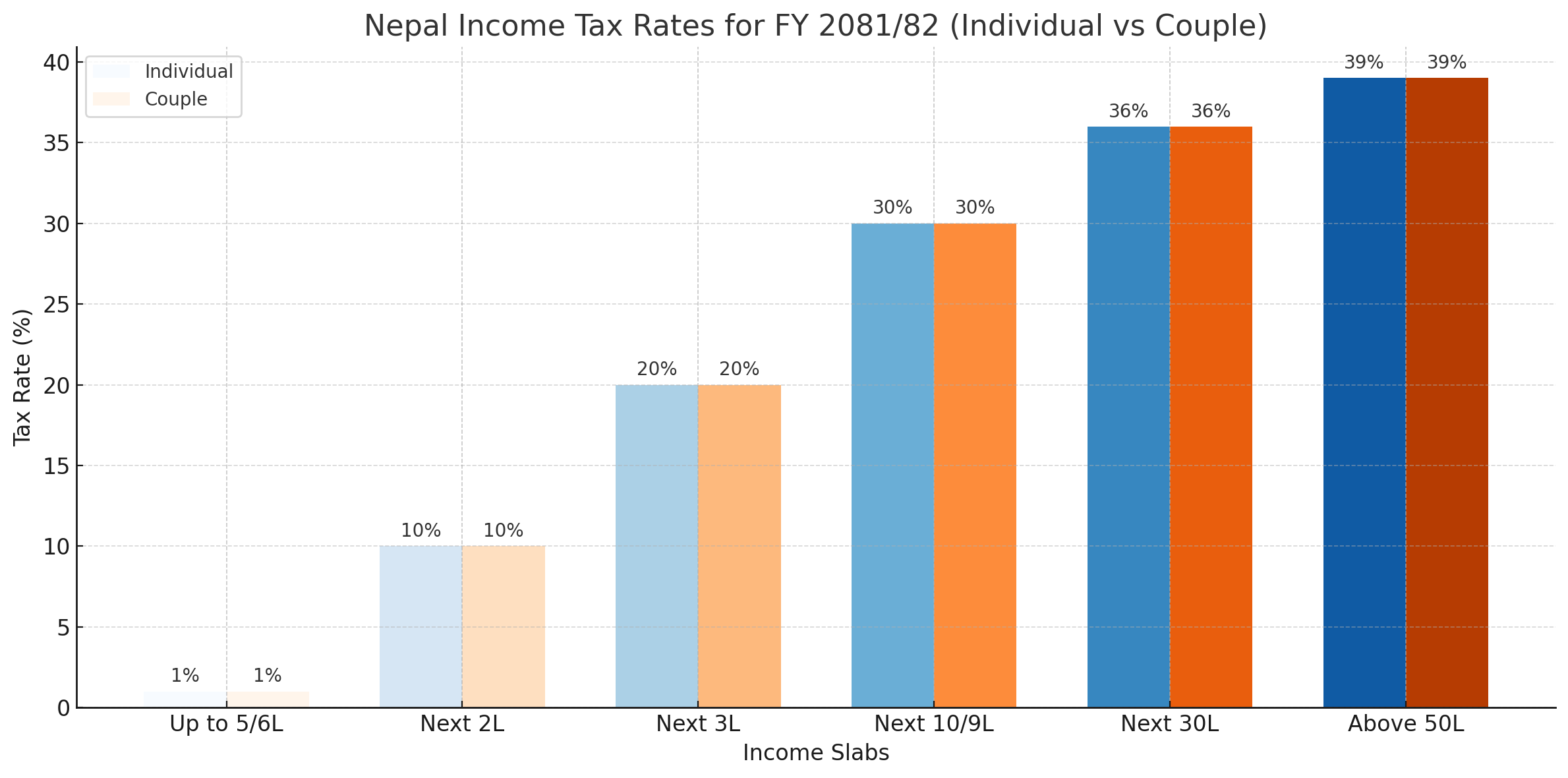

Income tax is one of the most important components of financial planning for both individuals and businesses. The Government of Nepal has published the Income Tax Slab Rates for Fiscal Year 2081/82, and the good news is that they remain unchanged from the previous fiscal year (FY 2080/81). This decision offers much-needed stability and predictability to taxpayers. The tax rates are categorized into three primary groups: Resident Individuals, Couples filing jointly, and Non-Resident Persons. Here's a comprehensive breakdown of each category to help you understand your tax obligations better.

For individuals assessed as resident persons, Nepal follows a progressive tax structure, meaning the tax rate increases with income. The base tax rate is just 1% for the first NPR 5,00,000 of annual income, which is designed to ease the burden on lower-income earners. After that, income is taxed at incremental rates: the next NPR 2,00,000 at 10%, the following NPR 3,00,000 at 20%, then NPR 10,00,000 at 30%, NPR 30,00,000 at 36%, and any income above NPR 50,00,000 is taxed at 39%. This setup ensures that high earners contribute more, while the initial income enjoys some relief. It’s also important to note that the 1% concessional rate does not apply to proprietorship income, pension income, contribution-based pension fund income, or employment income deposited in the Social Security Fund (SSF).

Married couples in Nepal can choose to file their taxes jointly for potential tax benefits. The income slab for couples offers a slightly higher tax-free threshold, starting at NPR 6,00,000 taxed at 1%. This allows couples to combine their income and still benefit from lower rates. The next NPR 2,00,000 is taxed at 10%, followed by NPR 3,00,000 at 20%, NPR 9,00,000 at 30%, then NPR 30,00,000 at 36%, and finally, any income above NPR 50,00,000 is taxed at 39%. This scheme encourages joint financial planning and can reduce the tax burden for families with dual earners. It also keeps the system equitable by slightly extending the tax bracket to account for combined household incomes.

Non-resident individuals and businesses operating in Nepal are taxed at flat rates based on the type of transaction. The standard rate for income earned through normal transactions is 25%, unchanged from the previous year. If the income is earned through shipping, air transport, telecommunication services, satellite operations, or optical fiber projects, a flat 5% tax applies. When it involves services passing through

Nepal’s territory, the tax rate drops to 2%. Additionally, income repatriated by a Foreign Permanent Establishment is taxed at a flat rate of 5%. These flat rates make it easier for non-residents to understand their tax liability and maintain compliance, while ensuring the government receives its fair share from international operations.

The decision to maintain the same tax rates as FY 2080/81 indicates a desire for stability from the Nepal government. This consistency is helpful for both citizens and businesses as it removes uncertainty and allows for better budgeting. Progressive taxation ensures that those with higher income contribute proportionately more, which is a fair approach in a developing economy. For couples, the tax structure offers slight relief through joint filing benefits. Meanwhile, flat-rate taxation for non-residents simplifies cross-border financial planning. Whether you're earning a salary, running a business, or investing from abroad, this tax structure provides clarity on what you owe.

Nepal’s income tax structure for FY 2081/82 reflects a balance between equity and simplicity. Individuals and couples benefit from a progressive system that aligns tax obligations with earning capacity, while non-residents enjoy a flat and transparent tax regime. Whether you're a salaried professional, an entrepreneur, or an international investor, understanding these slab rates is essential for planning your financial year. Make sure to consult a qualified tax advisor for personalized insights and ensure full compliance with Nepal’s tax laws.