By Dipesh Ghimire

Nepal Rastra Bank: Regulator of the Country's Monetary System

Nepal Rastra Bank (NRB) is the central bank of Nepal, established on April 27, 1956 (Vaishak 14, 2013 BS). Its primary mandate is to regulate and operate the monetary system of the country. The bank manages and oversees the issuance and management of Nepalese currency notes and coins.

Main Objectives of Nepal Rastra Bank:

- Management of Nepalese Currency: NRB is responsible for the production and management of currency notes and coins across Nepal.

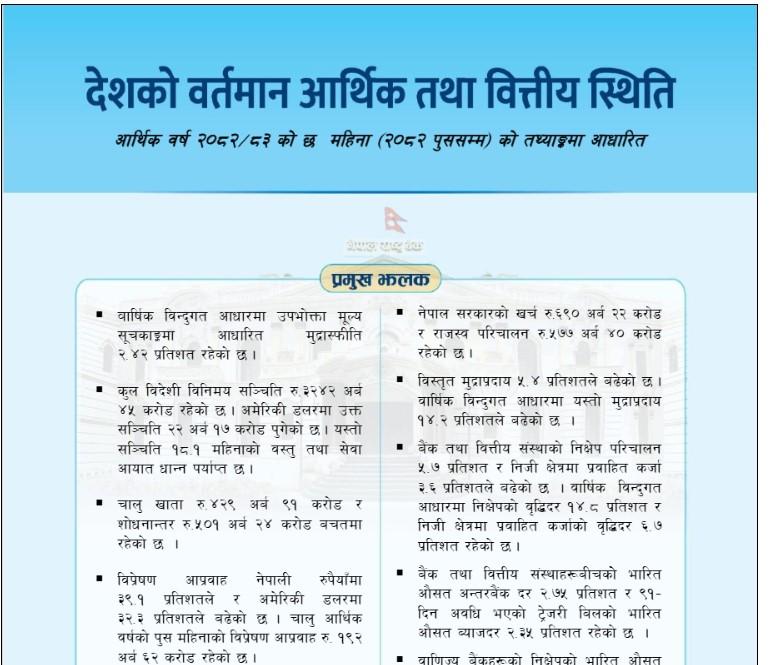

- Monetary Policy and Implementation: It formulates and implements various monetary policies and plans to maintain monetary stability in Nepal.

- Foreign Exchange Policy and Implementation: NRB regulates and ensures the proper management of foreign exchange operations to stabilize foreign exchange rates.

- Maintaining Financial Stability: NRB manages and monitors the stability and liquidity of banks and financial institutions.

- Regulation, Inspection, and Supervision: It regulates, inspects, supervises, and monitors banks and financial institutions to ensure compliance with regulations.

Roles, Duties, and Powers of Nepal Rastra Bank:

- Manufacture and management of banknotes and coins.

- Formulation and implementation of monetary policy.

- Formulation and implementation of foreign exchange policy.

- Determination of exchange rate systems.

- Management and operation of foreign exchange reserves.

- Authorization and supervision of banks and financial institutions to conduct financial transactions.

- Establishment and enhancement of payment, clearing, and settlement systems.

Nepal Rastra Bank contributes to the overall stability and prosperity of the economy through these functions and endeavors.