By Sandeep Chaudhary

Nepal’s Economic Indicators 2025/26: Growth, Inflation, and Reserves Explained

The Nepal Rastra Bank (NRB), in its Mid-September 2025/26 Macroeconomic Report, presents a comprehensive overview of Nepal’s latest economic performance — highlighting moderate GDP growth, record-high foreign exchange reserves, and the lowest inflation in years. The report reflects a period of macroeconomic stability, with steady growth momentum supported by improved liquidity, rising remittances, and effective monetary management.

Economic Growth: Gradual but Stable Expansion

According to NRB’s revised estimates, Nepal’s real GDP at basic prices is expected to grow by 4.0% in FY 2024/25, up from 3.4% in FY 2023/24. At purchasers’ prices, GDP growth is projected at 4.6%, signaling a modest economic recovery across key sectors. The nominal GDP has reached Rs. 6,107 billion, representing a 7% annual increase. This growth has been driven by the services sector, followed by agriculture and industry, which are gradually regaining momentum after the recent slowdown.

The Gross National Income (GNI) grew by 6.7%, while the Gross National Disposable Income (GNDI) increased by 7.4%, reflecting rising remittance inflows and improved purchasing power. Despite the moderate expansion, challenges such as low private investment, delayed capital expenditure, and reliance on remittance-driven consumption continue to constrain higher growth potential.

Inflation: Price Stability Achieved

The report reveals a sharp fall in consumer inflation. The year-on-year Consumer Price Index (CPI) dropped to 1.87% in mid-September 2025/26 — the lowest inflation rate in nearly five years. This was primarily due to deflation in food prices (-1.34%) and controlled increases in non-food prices (3.7%). The Wholesale Price Index (WPI) also eased to 2.10%, indicating lower production costs for manufacturers.

NRB attributes this decline to adequate food supply, lower global oil prices, stable exchange rates, and cautious monetary policy. The central bank’s balance between liquidity support and inflation control has maintained price stability, protecting household purchasing power and creating a favorable environment for businesses.

External Sector: Record Reserves and Strong Balance

Nepal’s external position has strengthened significantly. Foreign exchange reserves hit a record Rs. 2.88 trillion (USD 20.41 billion), enough to sustain over 13 months of imports, the strongest reserve position in the nation’s history. The Balance of Payments (BOP) recorded a surplus of Rs. 153.7 billion, and the current account remained in surplus at Rs. 130.7 billion, driven by a surge in remittance inflows and a rebound in exports.

Remittances increased by 33%, reaching Rs. 352 billion, while exports jumped 88.6% to Rs. 47.3 billion. Imports grew moderately by 16.2% to Rs. 305.2 billion, helping narrow the trade deficit. These trends indicate a more balanced external sector and stronger foreign currency liquidity.

Financial Sector: Liquidity and Stability

NRB data shows that total deposits in the banking system rose by 12.4% to Rs. 7.29 trillion, while credit to the private sector grew by 7.3% to Rs. 5.54 trillion. Broad money (M2) expanded by 12.4%, and reserve money grew by 10.1%, reflecting healthy liquidity. The base rate of banks dropped to 5.72%, while the average lending rate fell to 7.66%, indicating a low-interest environment that supports credit expansion.

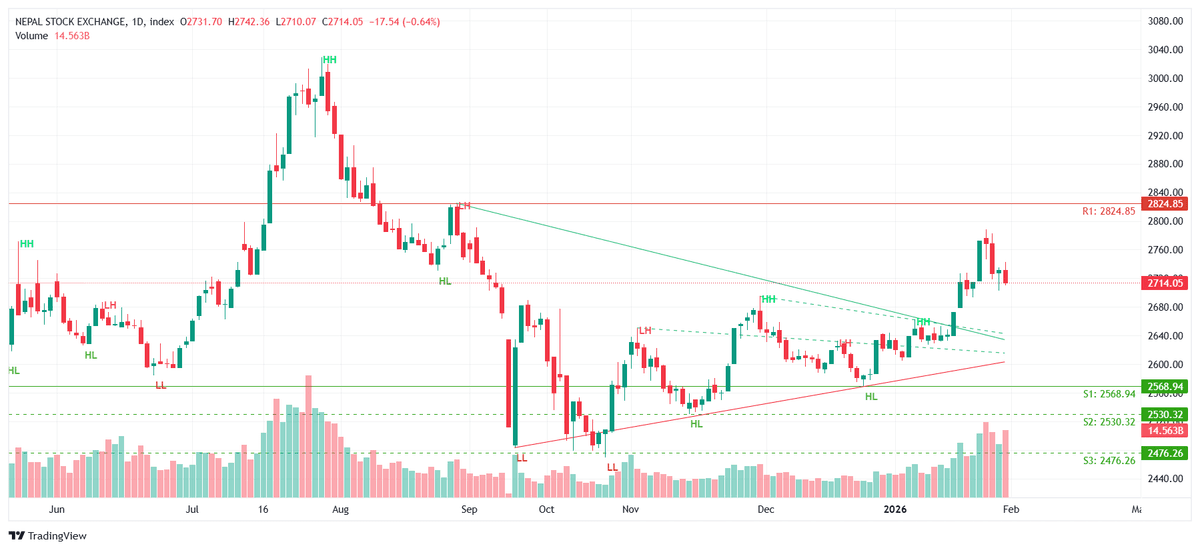

The NEPSE Index closed at 2,672 points, with market capitalization reaching 73.1% of GDP, showing renewed investor confidence. Meanwhile, domestic and external debt totaled Rs. 2.73 trillion, equivalent to 43.7% of GDP, a sustainable level compared to global standards.

Monetary and Fiscal Balance

With inflation under control, liquidity improving, and foreign reserves at record highs, NRB’s report portrays a stable and resilient macroeconomic environment. However, it also highlights fiscal challenges — government revenue fell by 5.3%, while expenditure rose 31%, underscoring the need for improved revenue mobilization and expenditure efficiency.

Economists note that the combination of low inflation, monetary easing, and external stability gives Nepal a solid foundation for sustained growth. Yet, structural issues such as low capital utilization, high import dependency, and limited industrial diversification must be addressed to achieve long-term economic resilience.