By Trading view

Nepal’s General Tax Updates for FY 2081/82: A Detailed Overview

The Government of Nepal has introduced a comprehensive general tax framework for the fiscal year 2081/82. This framework is designed to enhance public health, improve infrastructure, promote environmental sustainability, regulate the entertainment industry, and manage outbound educational expenditures. Each tax measure has been carefully structured to meet specific policy goals while ensuring economic compliance across sectors. Here’s a detailed breakdown of each tax provision under the new guidelines:

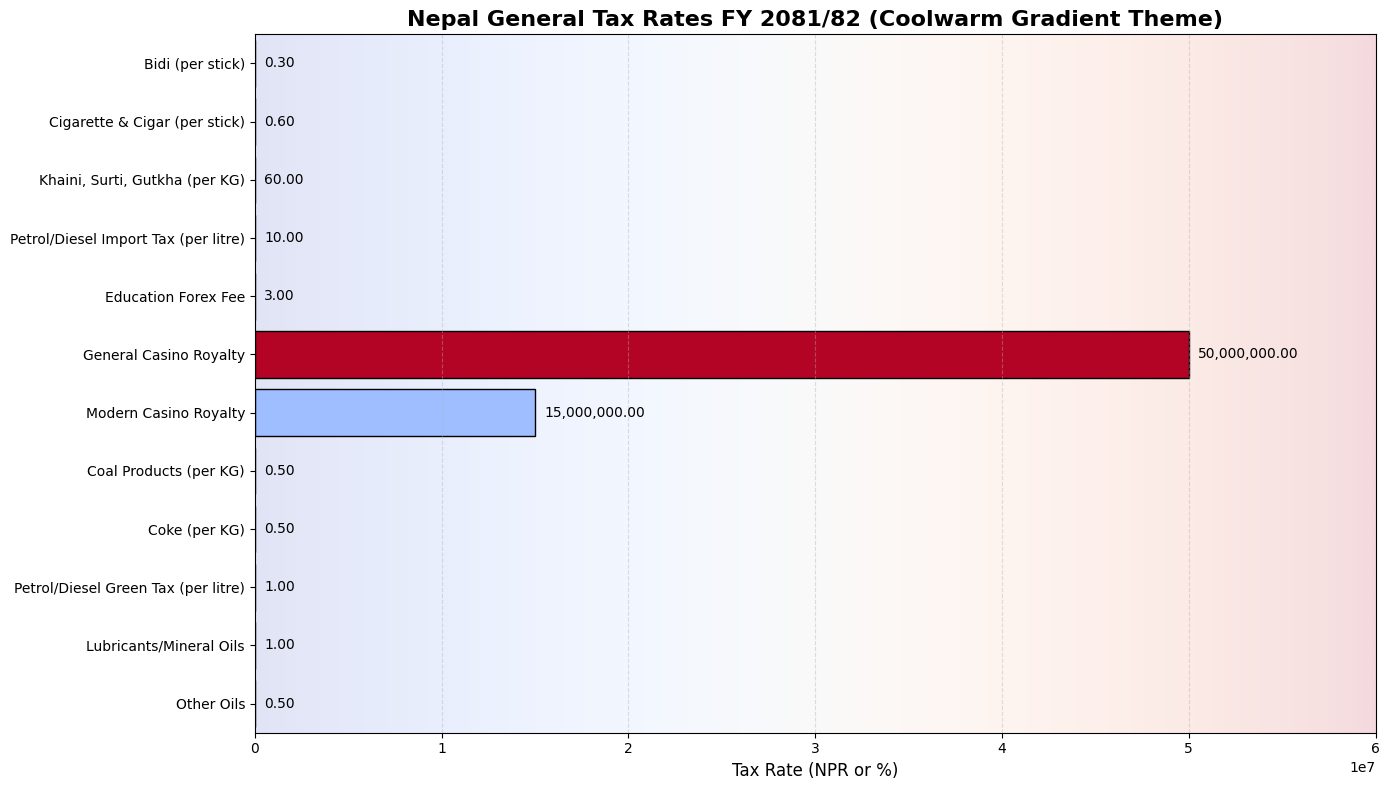

To curb the rising health costs associated with the consumption of harmful substances, the government has continued its focus on the Health Risk Tax. This tax is levied on products known to pose significant risks to public health. Under the updated structure, bidi is taxed at 30 paisa per stick, while cigarettes and cigars face a higher rate of 60 paisa per stick. Similarly, smokeless tobacco and chewable products like khaini, surti, pan masala, and gutkha are taxed at NPR 60 per kilogram. This tax aims to discourage consumption, raise awareness, and generate revenue to support healthcare programs.

In a bid to boost the nation's infrastructure, a dedicated Infrastructure Development Tax has been imposed on the import of fuel products. Importers of petrol and diesel are now required to pay NPR 10 per liter at the customs point. This move is expected to create a substantial revenue stream for infrastructure projects such as road expansion, bridge construction, and maintenance of transport networks across Nepal. The tax is direct, transparent, and aligned with the country’s long-term development goals.

To manage and regulate financial outflows associated with foreign education, the Nepalese government has introduced a new Education Service Fee. A 3% tax will be applied when students exchange foreign currency for studying abroad. This fee applies specifically to students undertaking currency exchange for tuition, accommodation, or living expenses. While this might increase the cost of overseas education slightly, the government views it as a necessary step to ensure better tracking of capital movement and to fund domestic educational initiatives.

The entertainment sector, particularly the casino industry, has also been addressed in the new tax framework. A fixed annual royalty has been established: NPR 50 million per year for general casinos and NPR 15 million per year for casinos using modern machine equipment. Operators must follow a staged payment structure—40% of the royalty must be paid by Poush End, 70% by Chaitra End, and the full amount by Ashad End. This staggered approach encourages timely payments and helps ensure sustained government revenue throughout the fiscal year.

In alignment with Nepal’s environmental commitments, the government has rolled out a dedicated Green Tax on fuel and pollution-intensive goods. The tax aims to reduce carbon emissions and promote eco-friendly alternatives. The structure includes a tax of 0.5 NPR per kg on coal and coal-based goods, 0.5 NPR per kg on coke and related products, and 1 NPR per liter on petrol and diesel. Additionally, lubricating oil, petroleum oils, and minerals are taxed at 1%, while other oils attract a 0.5% tax. These measures push industries to rethink their environmental footprint and adopt cleaner alternatives.

Nepal’s general tax framework for FY 2081/82 is a well-rounded strategy designed to meet the nation’s economic, environmental, and social objectives. From taxing health-damaging substances to encouraging sustainable practices through green taxation, the government has laid out a forward-thinking policy landscape. With precise levies on casinos, fuel imports, and educational forex transactions, this tax regime is expected to enhance regulatory oversight and ensure steady fiscal income for national development.