By Sandeep Chaudhary

New Developments in Interest Rates: Key Changes from Mid-July 2022 to Mid-April 2024

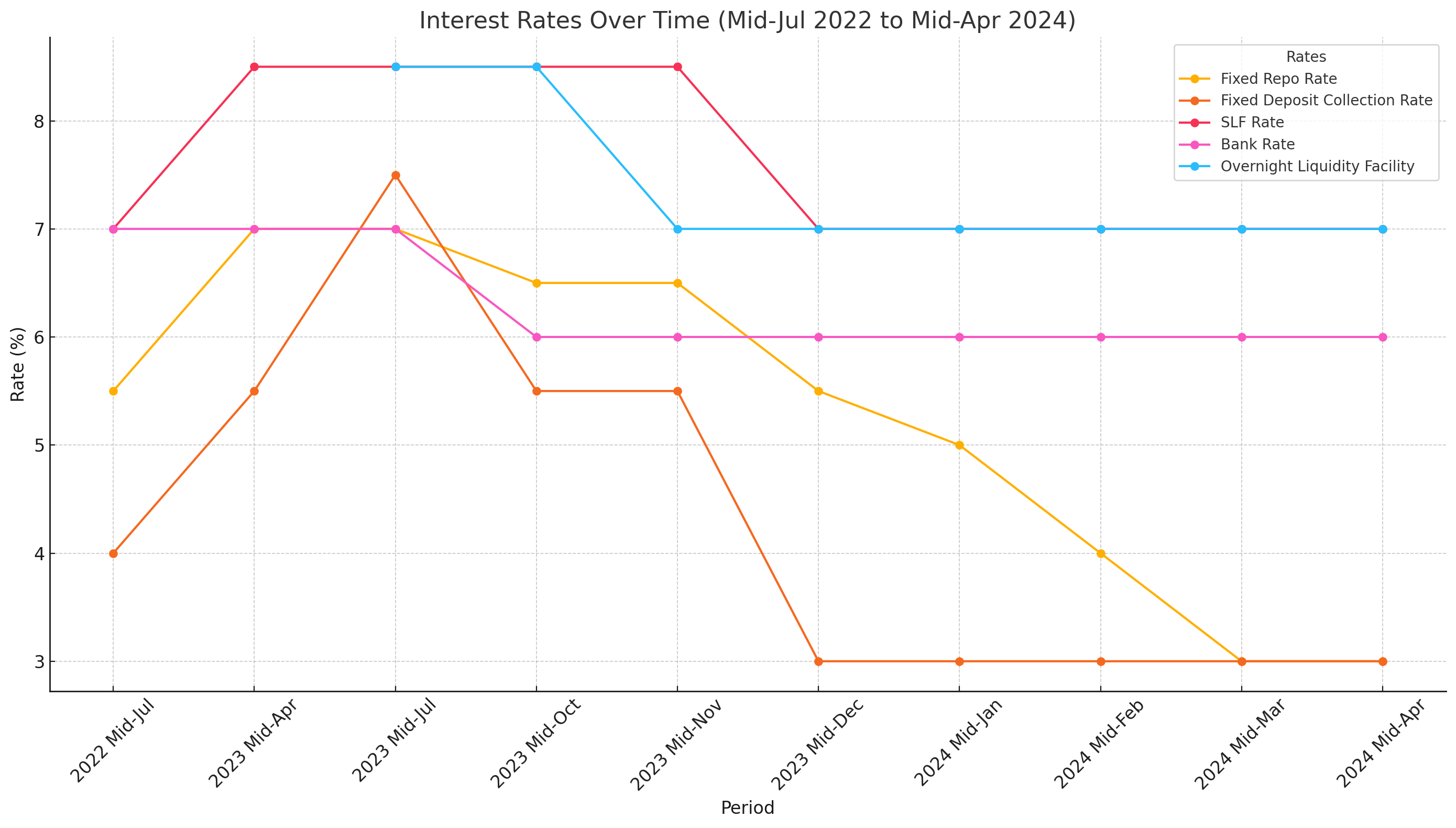

The table illustrating the structure of interest rates from mid-July 2022 to mid-April 2024 reveals significant trends and changes in the financial landscape. Here's an analysis of the key updates and their potential implications.

Here's a visual representation of the interest rates over the period from mid-July 2022 to mid-April 2024. The chart illustrates the trends and fluctuations in various rates such as the Fixed Repo Rate, Fixed Deposit Collection Rate, SLF Rate, Bank Rate, and Overnight Liquidity Facility. This visualization helps in understanding the monetary policy adjustments and their potential impact on the financial landscape

A. Policy Rates

Fixed Repo Rate (Corridor): Starting at 5.5% in mid-July 2022, the rate saw a notable increase to 7.0% by mid-April 2023. It experienced fluctuations, peaking at 7.5% in mid-July 2023, before declining steadily to 5.5% by mid-April 2024.

Fixed Deposit Collection Rate (Corridor): Similar to the repo rate, this rate climbed from 4.0% in mid-July 2022 to 6.5% in mid-October 2023, then dropped to 3.0% by mid-April 2024.

Standing Liquidity Facility (SLF) Rate: This rate showed an upward trend, rising from 7.0% to 8.5% within a year, before settling at 7.0% in mid-April 2024.

Bank Rate: Consistently stayed at 7.0% until a decrease to 6.0% in mid-November 2023, maintaining this rate into mid-April 2024.

Overnight Liquidity Facility: Introduced in mid-July 2023 at 8.5%, it dropped to 7.0% by mid-December 2023 and held steady.

B. Refinance Rates

Special Refinance: The rate remained at 2.0% until mid-October 2023, where it saw an increase to 4.5%, then returned to 2.0% by mid-April 2024.

General Refinance: Starting at 5.0% in mid-July 2022, it decreased to 4.0% by mid-April 2024, with a brief rise to 4.5% in mid-2023.

MSME Refinance: Maintained a steady 4.0% rate throughout the period, with minor increases to 4.5% in mid-2023.

C. CRR (Cash Reserve Ratio)

Commercial Banks: Initially at 3.0%, the CRR increased to 4.0% by mid-April 2023 and stayed consistent through mid-April 2024.

Development Banks: Followed a similar pattern, remaining at 4.0%.

Finance Companies: Also consistent at 4.0% from mid-April 2023 onwards.

D. Government Securities

T-bills: Rates for various tenures of T-bills showed substantial volatility. For example, 91-day T-bills decreased from 10.64% in mid-July 2022 to 5.47% in mid-April 2024.

Development Bonds: These bonds had a steady interest rate, holding at approximately 2.65%-10.93% throughout the period.

E. Interest Rates (Commercial Banks)

Weighted Average Interbank Rate: The interbank rate started at 6.99% and saw fluctuations, ending at 3.26% by mid-April 2024.

Weighted Average Deposit Rate: This rate increased from 7.41% in mid-July 2022 to a peak of 11.62% in mid-July 2023, then declined to 7.41% by mid-April 2024.

Weighted Average Lending Rate: Showed an upward trend, reaching 12.34% by mid-April 2023 before dropping to 10.03% in mid-April 2024.

F. Interest Rates (Development Banks)

The average rates fluctuated similarly to those of commercial banks, with lending rates peaking at 13.91% in mid-July 2023.

G. Interest Rates (Finance Companies)

Weighted Average Deposit Rate: Increased significantly to 11.40% in mid-April 2023 before decreasing to 7.82% by mid-April 2024.

Weighted Average Lending Rate: Followed a similar trend, peaking at 14.61% in mid-April 2023.

H. Weighted Average Interbank Rate (BFIs)

The rate started at 7.01% in mid-July 2022, experienced a dip to 3.14% in mid-July 2023, and rose to 4.67% by mid-April 2024.

Implications for Stakeholders

These shifts in interest rates indicate significant monetary policy adjustments in response to economic conditions. Higher policy rates suggest an effort to curb inflation, while the subsequent decreases align with efforts to stimulate economic growth. The stability in refinance and CRR rates provides a foundation for predictable financial planning for businesses.

Investors, financial institutions, and borrowers should stay informed about these changes to optimize their strategies and maintain financial health. Continuous monitoring and adaptation to the evolving interest rate environment will be crucial for success in the coming years.