By Sandeep Chaudhary

NRB Monetary Operations: A Comprehensive Review

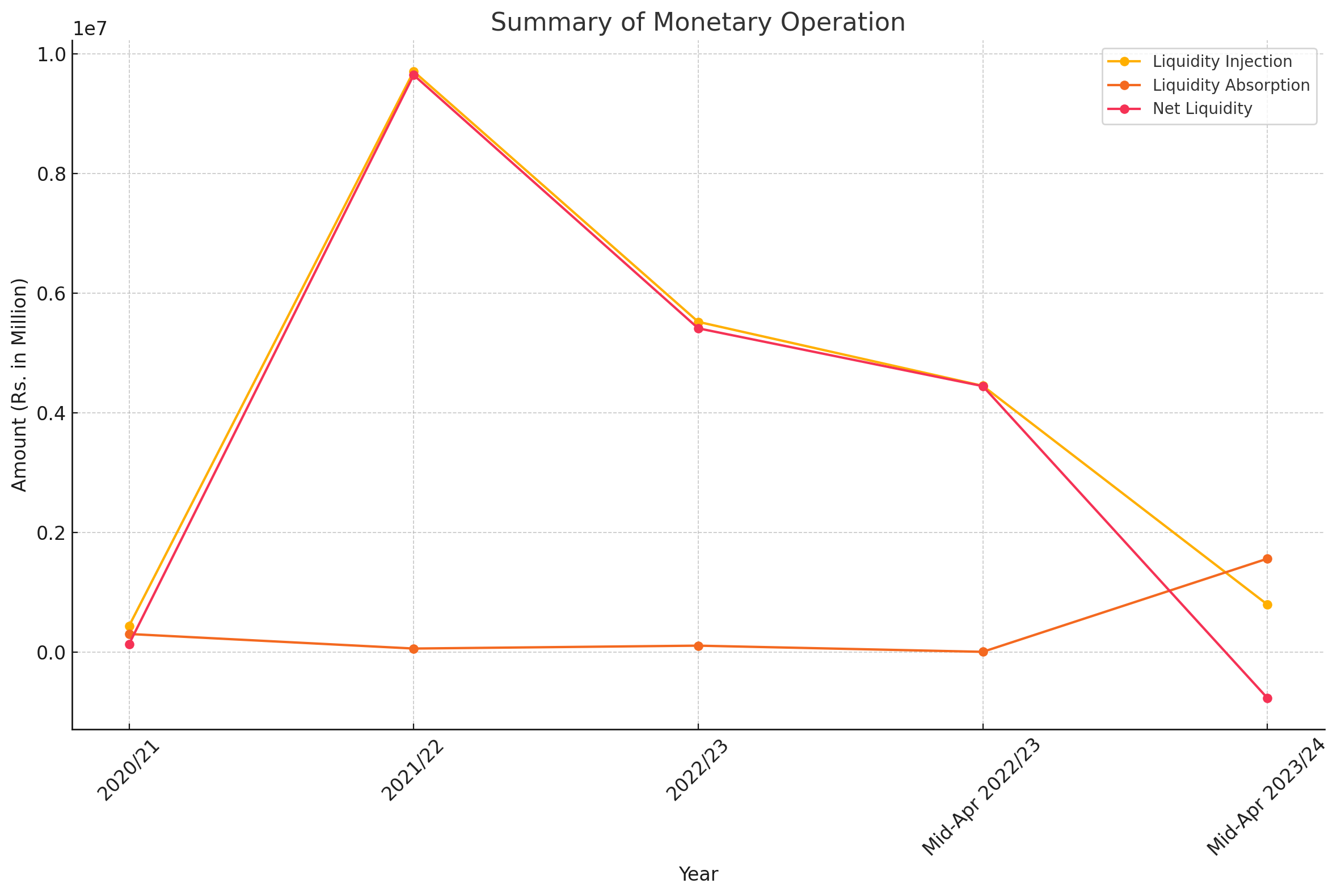

Kathmandu, Nepal – The latest monetary operations summary from the Central Bank provides an insightful look into the evolving landscape of liquidity management in Nepal. The data, spanning from the fiscal year 2020/21 to mid-April 2024, reveals significant trends and shifts in both liquidity injection and absorption measures.

Liquidity Injection

The central bank's efforts to inject liquidity into the financial system have seen notable fluctuations over the past few years. In the fiscal year 2020/21, the total liquidity injection was Rs. 438,277.10 million. This figure dramatically increased to Rs. 9,702,410.00 million in 2021/22, reflecting a robust monetary response possibly due to economic challenges such as the pandemic. However, this injection decreased to Rs. 5,518,186.20 million in 2022/23 and further to Rs. 4,449,085.09 million by mid-April 2023/24, with the latest recorded figure at Rs. 795,212.58 million for mid-April 2023/24.

Key components of liquidity injection include:

Repo: Starting from Rs. 50,000.00 million in 2020/21, this has steadily increased to Rs. 316,500.00 million by mid-April 2023/24.

Outright Purchase: This peaked in 2021/22 at Rs. 55,915.90 million but saw no activity in subsequent years.

Repo Auction: A consistent tool with Rs. 206,388.90 million in 2021/22, this method was again used to inject Rs. 97,472.40 million by mid-April 2023/24.

Standing Liquidity Facility: Witnessing an uptick from Rs. 370,340.10 million in 2020/21 to Rs. 2,726,814.30 million by mid-April 2023/24.

OLF: Operational since 2022/23 with Rs. 1,218,869.30 million injected and Rs. 794,012.58 million by mid-April 2023/24.

Liquidity Absorption

Liquidity absorption activities, designed to control excess liquidity, show varied utilization over the same period. The total liquidity absorption was Rs. 303,290.00 million in 2020/21, peaking in 2022/23 at Rs. 108,200.00 million, and significantly rising to Rs. 1,561,400.00 million by mid-April 2023/24.

Major absorption tools include:

Reverse Repo: Varied usage, peaking at Rs. 28,350.00 million in 2021/22.

Outright Sale: Only used in 2022/23 for Rs. 80,200.00 million.

Deposit Collection Auction: A marked increase to Rs. 693,050.00 million by mid-April 2023/24.

Deposit Collection Auction and Standing Deposit Facility*: Newer tools with substantial uptake, the latter absorbing Rs. 868,350.00 million by mid-April 2023/24.

Net Liquidity Position

The net liquidity position, calculated as the difference between liquidity injection and absorption, shows significant changes:

2020/21: Rs. 134,987.10 million

2021/22: Rs. 9,642,410.00 million

2022/23: Rs. 5,409,986.20 million

Mid-April 2023/24: Rs. (766,187.42) million, indicating a net absorption.

Interpretation

The central bank's approach to monetary operations reflects the dynamic economic conditions. The substantial liquidity injection during 2021/22 suggests an aggressive stance to counteract economic disruptions. The subsequent reduction and shift towards absorption tools indicate efforts to balance liquidity and curb potential inflationary pressures as the economy stabilizes.

The evolving tools and strategies, including increased reliance on standing liquidity facilities and deposit collection auctions, highlight the central bank's adaptability in managing monetary conditions. This balanced approach aims to ensure sufficient liquidity for economic growth while preventing overheating in the financial system.

Conclusion

The monetary operation summary showcases the central bank's proactive and adaptive measures in managing Nepal's liquidity landscape. These operations are crucial for maintaining financial stability and supporting economic growth, reflecting a careful balance between injecting liquidity to stimulate the economy and absorbing excess liquidity to prevent inflation.

As Nepal navigates its economic recovery and growth, the central bank's monetary policy decisions will continue to play a pivotal role in shaping the financial environment.