By Dipesh Ghimire

PRVU Bank's Financial Health: Trends in EPS, NPL, and Networth Per Share

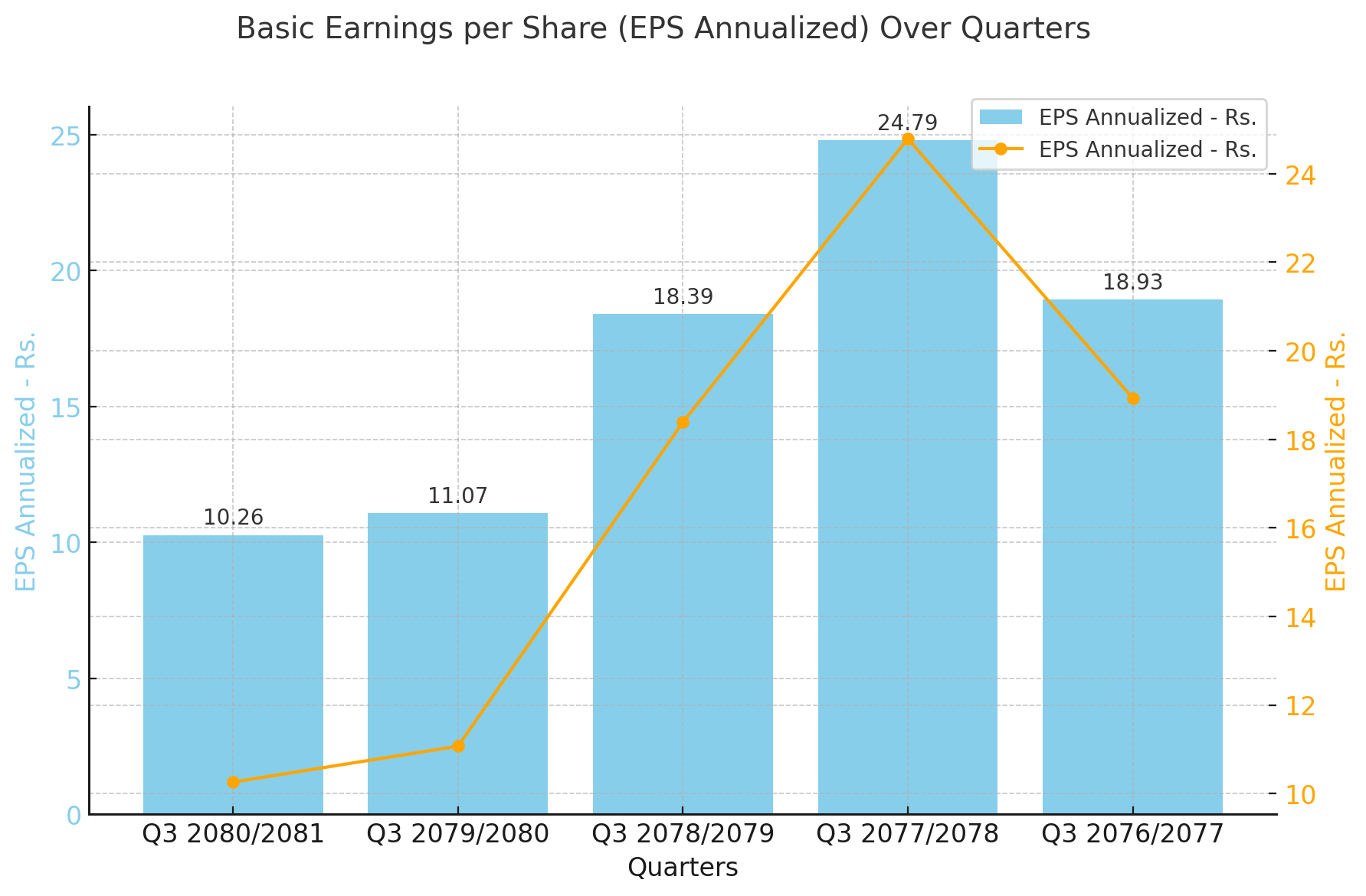

Banking Sector Analysis: Basic Earnings Per Share (EPS) Trends for PRVU Bank

The recent financial data reveals insightful trends in the basic earnings per share (EPS) for PRVU Bank, a key player in Nepal's banking sector. The EPS, an important indicator of a company's profitability, provides investors with a measure of the company's earnings allocated to each outstanding share of common stock. Here, we analyze the EPS trends over the past five years, highlighting the bank's financial health and performance.

Quarterly EPS Trends:

1. Q3 2080/2081: The EPS stands at Rs. 10.26, indicating a slight decline from the previous year.

2. Q3 2079/2080: PRVU Bank reported an EPS of Rs. 11.07, showing a recovery phase.

3. Q3 2078/2079: A notable increase to Rs. 18.39, marking a significant growth phase.

4. Q3 2077/2078: The highest EPS in this period was Rs. 24.79, representing a peak in the bank's profitability.

5. Q3 2076/2077: The EPS was Rs. 18.93, reflecting strong performance but not as high as the subsequent peak.

Interpretation and Insights:

The EPS data for PRVU Bank over the past five years showcases a dynamic financial journey. The initial year (Q3 2076/2077) showed strong performance, with an EPS of Rs. 18.93. This was followed by an impressive peak in Q3 2077/2078, where the EPS soared to Rs. 24.79. This peak signifies a period of high profitability, likely driven by effective financial strategies, robust market demand, or favorable economic conditions.

However, the subsequent year (Q3 2078/2079) saw a decline to Rs. 18.39, suggesting possible market challenges, increased competition, or changes in economic policies affecting the banking sector. Despite this dip, the bank managed to recover partially in Q3 2079/2080, with an EPS of Rs. 11.07, indicating resilience and adaptation to changing market conditions.

The most recent data from Q3 2080/2081 shows a slight decline to Rs. 10.26. This could be attributed to a variety of factors including economic slowdowns, regulatory changes, or internal financial restructuring. The bank’s ability to maintain a double-digit EPS despite these challenges reflects its underlying financial strength and strategic management.

Conclusion:

The EPS trend analysis for PRVU Bank reveals a story of peaks and troughs, reflecting the inherent volatility and challenges within the banking sector. Investors and stakeholders should consider these trends while making informed decisions. The recent decline calls for a cautious approach, but the bank's historical resilience suggests potential for future recovery and growth. Monitoring upcoming financial reports and market conditions will be crucial in assessing the bank's ongoing performance.

For more detailed insights and continuous updates, stay tuned to our financial analysis section.

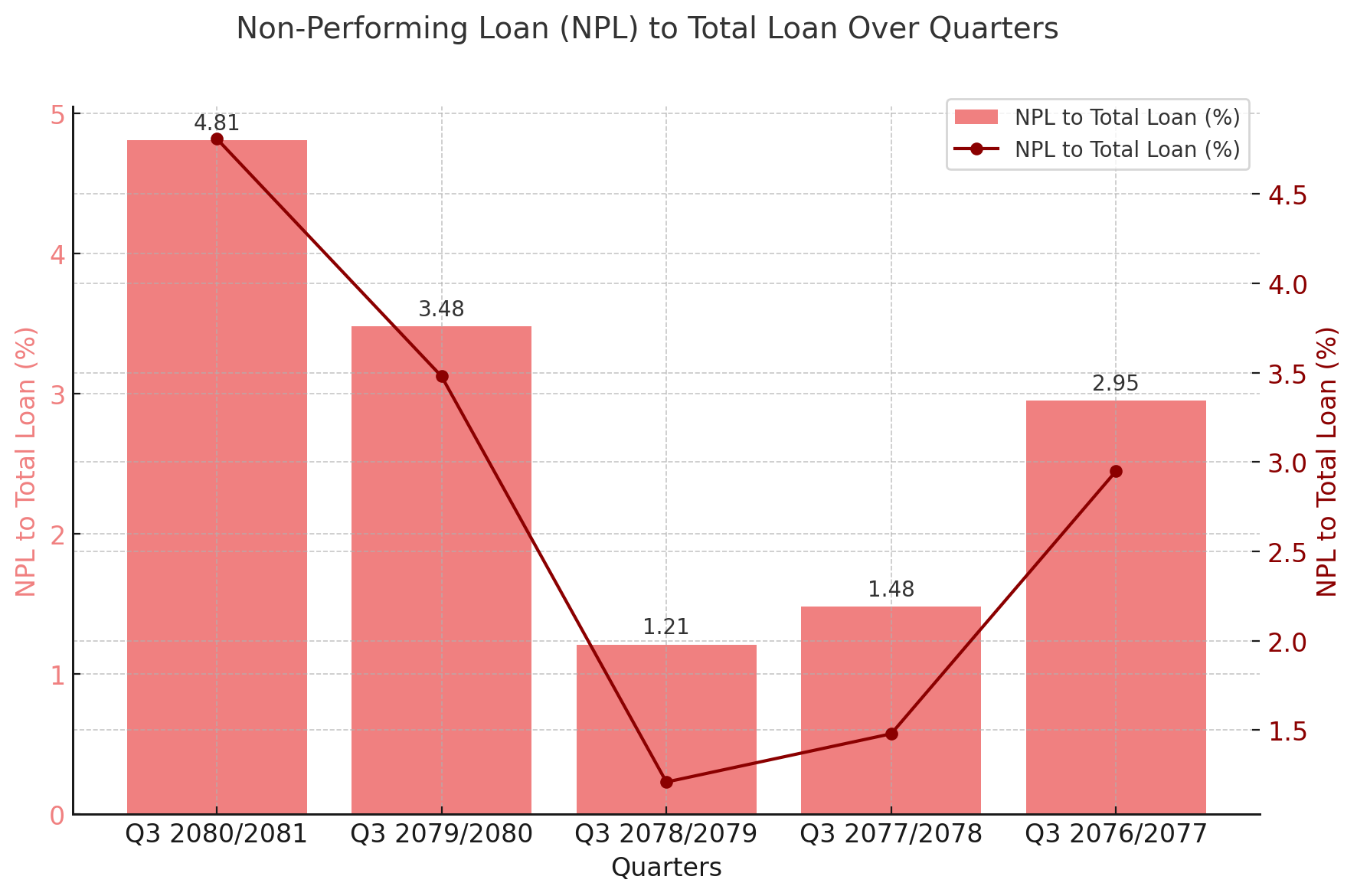

Banking Sector Analysis: Non-Performing Loan (NPL) Trends for PRVU Bank

The financial health of PRVU Bank has been closely monitored through its Non-Performing Loan (NPL) ratios over the past five years. The NPL ratio, which represents the percentage of loans that are in default or close to being in default, is a crucial indicator of a bank's asset quality and risk management efficacy. Here, we analyze the NPL trends for PRVU Bank, shedding light on its credit risk and financial stability.

Quarterly NPL Trends:

1. Q3 2080/2081: The NPL ratio is 4.81%, reflecting an increase in the percentage of defaulting loans.

2. Q3 2079/2080: The NPL ratio stood at 3.48%, indicating a rising trend from the previous year.

3. Q3 2078/2079: The bank reported its lowest NPL ratio in this period at 1.21%, showcasing a period of strong credit performance.

4. Q3 2077/2078: The NPL ratio was 1.48%, maintaining a low level of non-performing loans.

5. Q3 2076/2077: The NPL ratio was 2.95%, higher than the subsequent years but lower than the recent spike.

Interpretation and Insights:

The NPL data for PRVU Bank highlights significant fluctuations in the bank's credit quality over the past five years. The initial year (Q3 2076/2077) showed a moderate NPL ratio of 2.95%, suggesting some challenges in managing loan defaults. The subsequent years (Q3 2077/2078 and Q3 2078/2079) saw a marked improvement, with the NPL ratio dropping to 1.48% and further to 1.21%. This period indicates effective risk management and strong credit control measures implemented by the bank.

However, starting from Q3 2079/2080, there has been a concerning upward trend in the NPL ratio, rising to 3.48%. The most recent data for Q3 2080/2081 shows a further increase to 4.81%. This spike could be attributed to several factors, including economic downturns, increased loan defaults due to market conditions, or internal issues within the bank's lending practices.

The rising NPL ratio in the last two years suggests a potential deterioration in the bank's asset quality, raising concerns about its financial stability and risk management practices. The increase in non-performing loans could lead to higher provisioning costs, affecting the bank's profitability and overall financial health.

Conclusion:

The NPL trend analysis for PRVU Bank underscores the importance of robust credit risk management and proactive measures to address rising loan defaults. While the bank demonstrated strong performance in reducing NPLs during the mid-period, the recent upward trend calls for immediate attention and corrective actions. Stakeholders and investors should closely monitor the bank's strategies to manage and mitigate credit risk, ensuring sustainable growth and financial stability.

For more detailed insights and continuous updates, stay tuned to our financial analysis section.

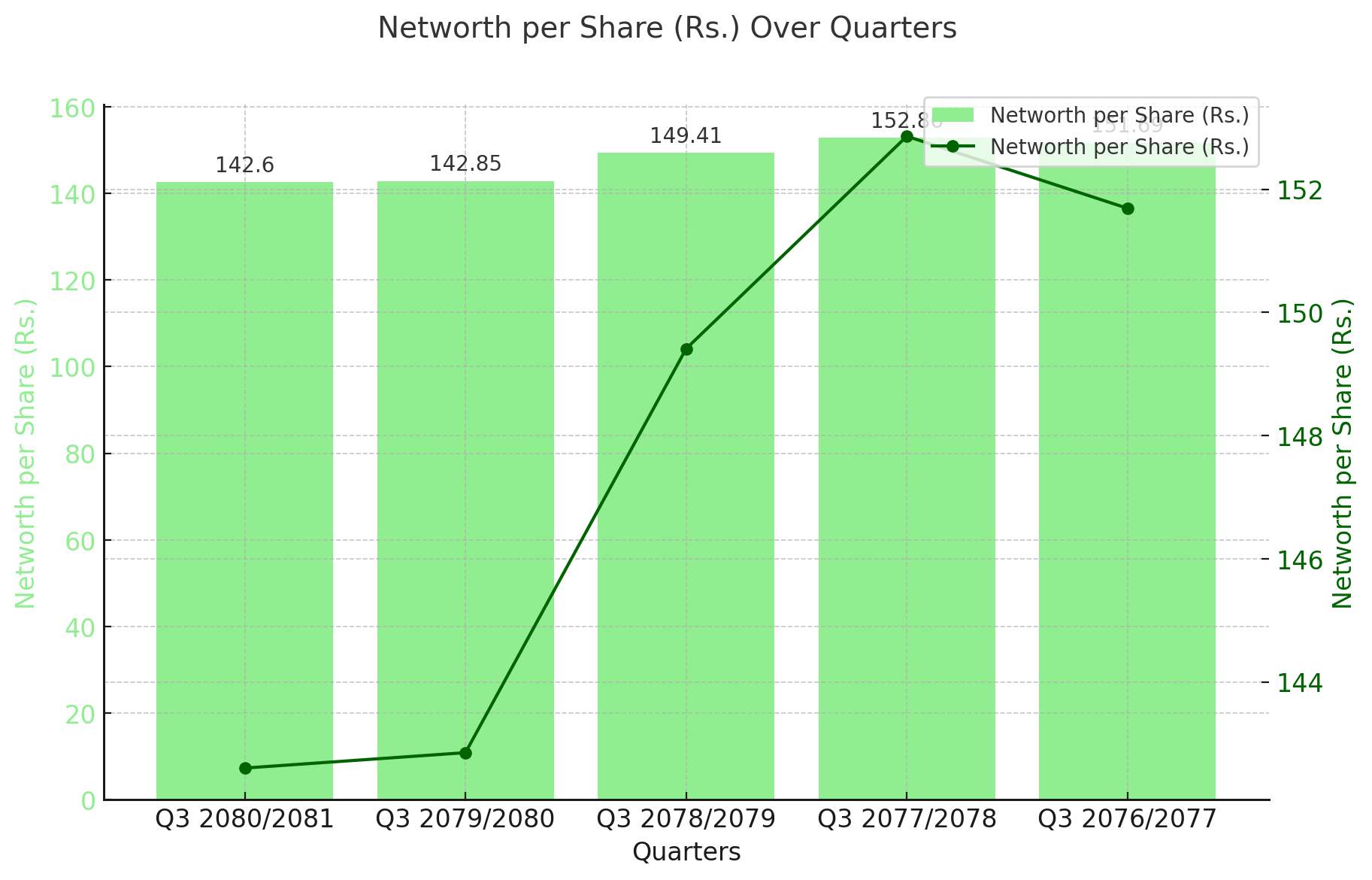

Banking Sector Analysis: Networth per Share Trends for PRVU Bank

The financial data for PRVU Bank over the past five years reveals important trends in its Networth per Share, a critical metric indicating the value of a company's equity on a per-share basis. Here, we analyze these trends to understand the bank's financial health and shareholder value.

Quarterly Networth per Share Trends:

1. Q3 2080/2081: The Networth per Share is Rs. 142.6, indicating a slight decrease from the previous year.

2. Q3 2079/2080: The value stands at Rs. 142.85, showing a minor decline from earlier years.

3. Q3 2078/2079: The Networth per Share was Rs. 149.41, marking a decline from the previous peak.

4. Q3 2077/2078: The highest value in this period was Rs. 152.86, reflecting peak financial health.

5. Q3 2076/2077: The Networth per Share was Rs. 151.69, showing strong shareholder value.

Interpretation and Insights:

The Networth per Share data for PRVU Bank over the past five years illustrates a story of fluctuating shareholder value. The initial year (Q3 2076/2077) showed a strong performance with a Networth per Share of Rs. 151.69. This was followed by a peak in Q3 2077/2078, where the value soared to Rs. 152.86, indicating robust financial health and a strong equity position.

However, in the subsequent years, there was a noticeable decline. In Q3 2078/2079, the Networth per Share dropped to Rs. 149.41, and further down to Rs. 142.85 in Q3 2079/2080. The most recent data for Q3 2080/2081 shows a slight decrease to Rs. 142.6. This downward trend could be attributed to various factors such as market conditions, changes in the bank's asset valuations, or adjustments in equity.

Despite the recent decline, the Networth per Share remains above Rs. 140, indicating that PRVU Bank still maintains a relatively strong equity position. The decline may reflect broader economic challenges or internal financial adjustments rather than a significant deterioration in the bank's fundamental value.

Conclusion:

The Networth per Share trend analysis for PRVU Bank highlights the importance of maintaining a strong equity base and managing financial health. While the recent downward trend calls for attention, the overall values suggest that the bank still holds substantial shareholder value. Investors and stakeholders should monitor the bank's strategic responses to these trends and any measures taken to enhance equity value and financial stability.