By Dipesh Ghimire

Retail Investors Pivot to Low-price Hydros as NEPSE Tests Key Resistance Levels

By Dipesh Ghimire Kathmandu — The Nepal Stock Exchange (NEPSE) is currently witnessing a tactical migration of capital, as retail investors increasingly shift their focus toward low-priced hydropower stocks. This shift, led by a speculative surge in Ankhu Khola Hydropower (AKJCL), suggests that despite a broader market correction, there is a strong "bottom-fishing" appetite for stocks trading near the NPR 200 threshold.

The Psychology of 'Penny' Hydros

The recent market movement reveals a classic retail phenomenon: the pursuit of volume over valuation. Analysts suggest that investors are gravitating toward companies like Upper Tamakoshi, Shiv Shree, and Himal Dolakha because they offer high leverage. In a market where high-priced blue chips move slowly, these low-cap hydros allow investors to hold larger quantities. Consequently, even a minor price increment of 10 to 20 rupees translates into a double-digit percentage return, a lure that has triggered a "FOMO" (Fear Of Missing Out) effect among small-scale traders.

This "charm" was most evident on Thursday when, despite the overall index falling, Himal Dolakha and Shiv Shree managed to hit the positive circuit level. This divergence indicates that the market is currently undergoing a "sector rotation," where money is flowing out of expensive development banks and into the energy sector.

Resilience Amidst Correction

While the benchmark index dipped by 17.53 points to close at 2,714.05, the underlying data tells a story of resilience. The market saw a massive turnover of NPR 14.56 billion, a figure that remains exceptionally high for a "down day." Usually, a falling index with low volume signals a bear run; however, a falling index with high volume—as seen on Thursday—indicates a healthy "Profit Booking" phase.

This suggests that while some investors are exiting to lock in gains made in December, a new wave of buyers is entering at these slightly lower prices, preventing a total market collapse. The activity in Ngadi Group Power, which led the turnover with nearly NPR 600 million, reinforces the narrative that the energy sector remains the primary engine of current market liquidity.

Technical Hurdles and Support Zones

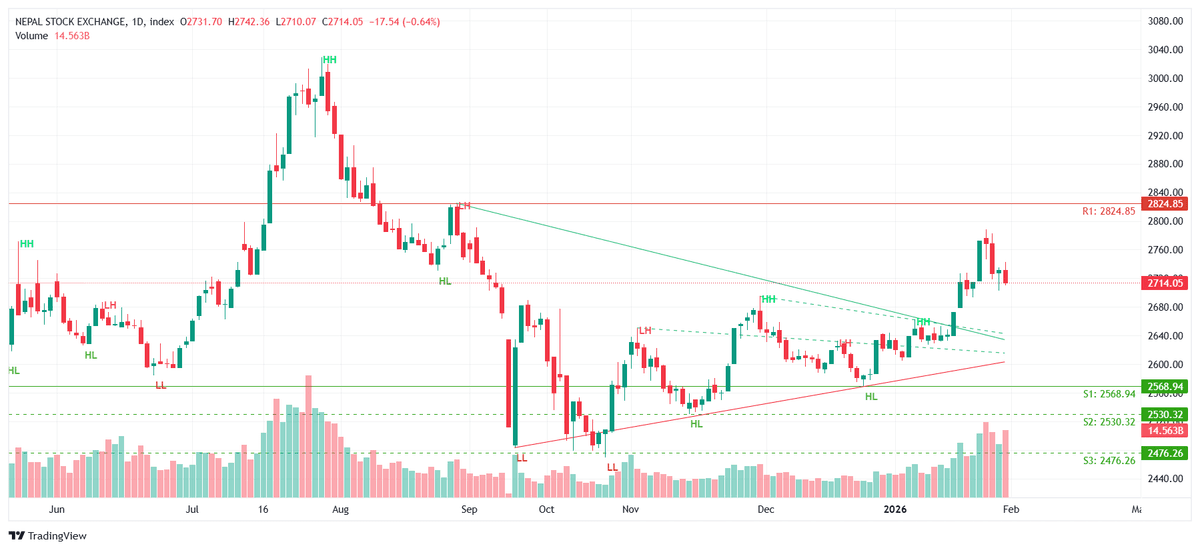

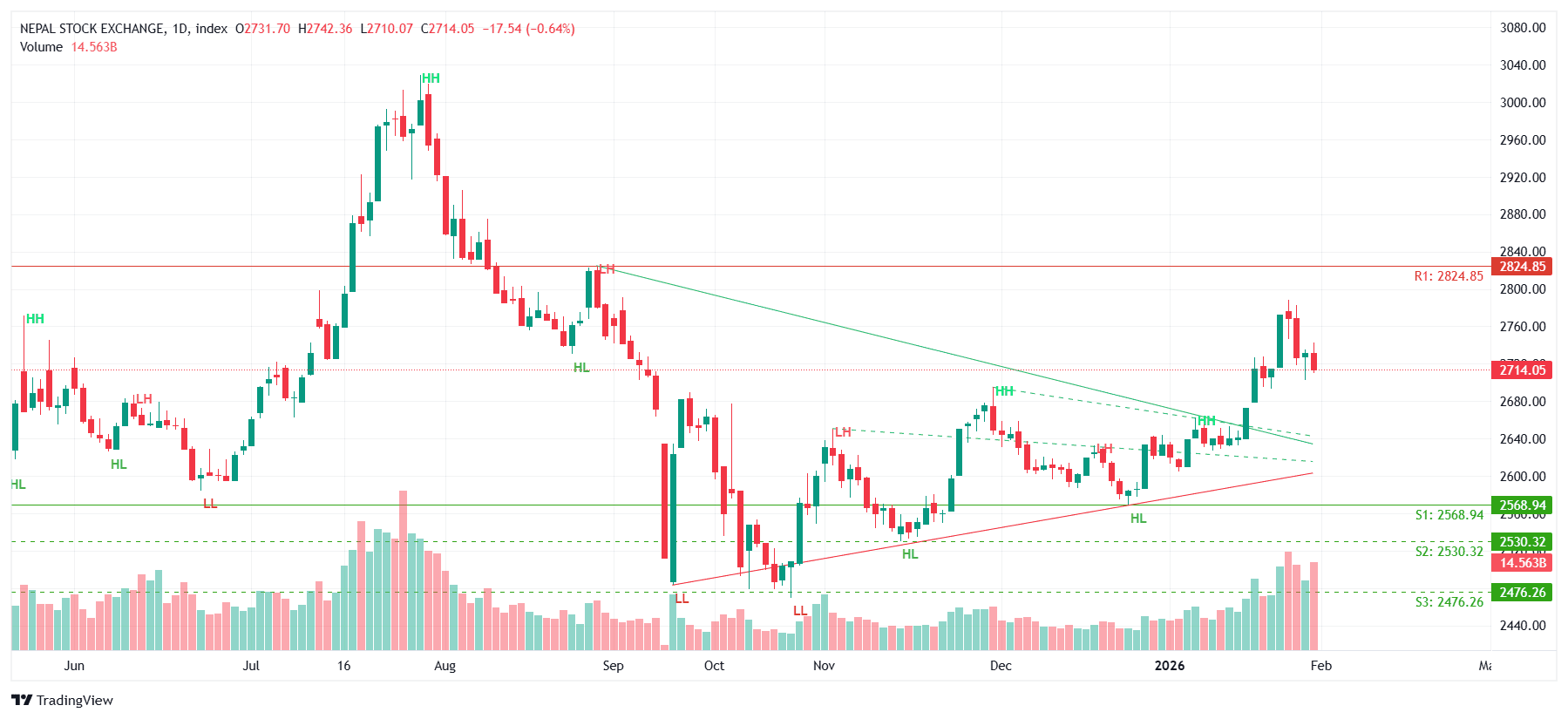

From a technical standpoint, the market is currently battling a "supply zone" near the 2,825 mark. This level has historically acted as a stiff resistance. For the bulls to regain total control, the index needs to breach this ceiling with a high-volume breakout. Until then, the market is expected to remain in a "Consolidation Phase"—a period where prices move sideways as the market decides its next big move.

On the downside, technical indicators identify 2,568.94 as the primary safety net. If the index continues to slide, this support level is where institutional buyers are expected to intervene. Currently, the fact that NEPSE is sustaining itself above the psychological floor of 2,700 provides a cushion of confidence for the upcoming trading sessions.

Sectoral Shift: Gains and Losses

The day was not favorable for all; the development bank and microfinance sectors faced significant heat. Corporate Development Bank and Mithila Laghubitta both hit negative circuits, shedding 10% of their value. This sharp decline in the banking sector, contrasted with the surge in low-priced hydros, confirms that the market is no longer moving in unison. Instead, it is becoming a "Stock Picker's Market," where profit depends heavily on choosing the right sector at the right time.

Ultimately, while the red candles on the chart might seem discouraging, the heavy turnover and the "circuit-level" interest in low-cap stocks suggest that the secondary market is far from losing its steam. The next few weeks will be crucial in determining whether the 2,825 resistance becomes a barrier or a springboard to new historical highs.