By Sandeep Chaudhary

Rising NPLs in Nepali Banks Signal Financial Instability Concerns

High NPLs in Nepali Banks: An Alarming Indicator for Financial Stability

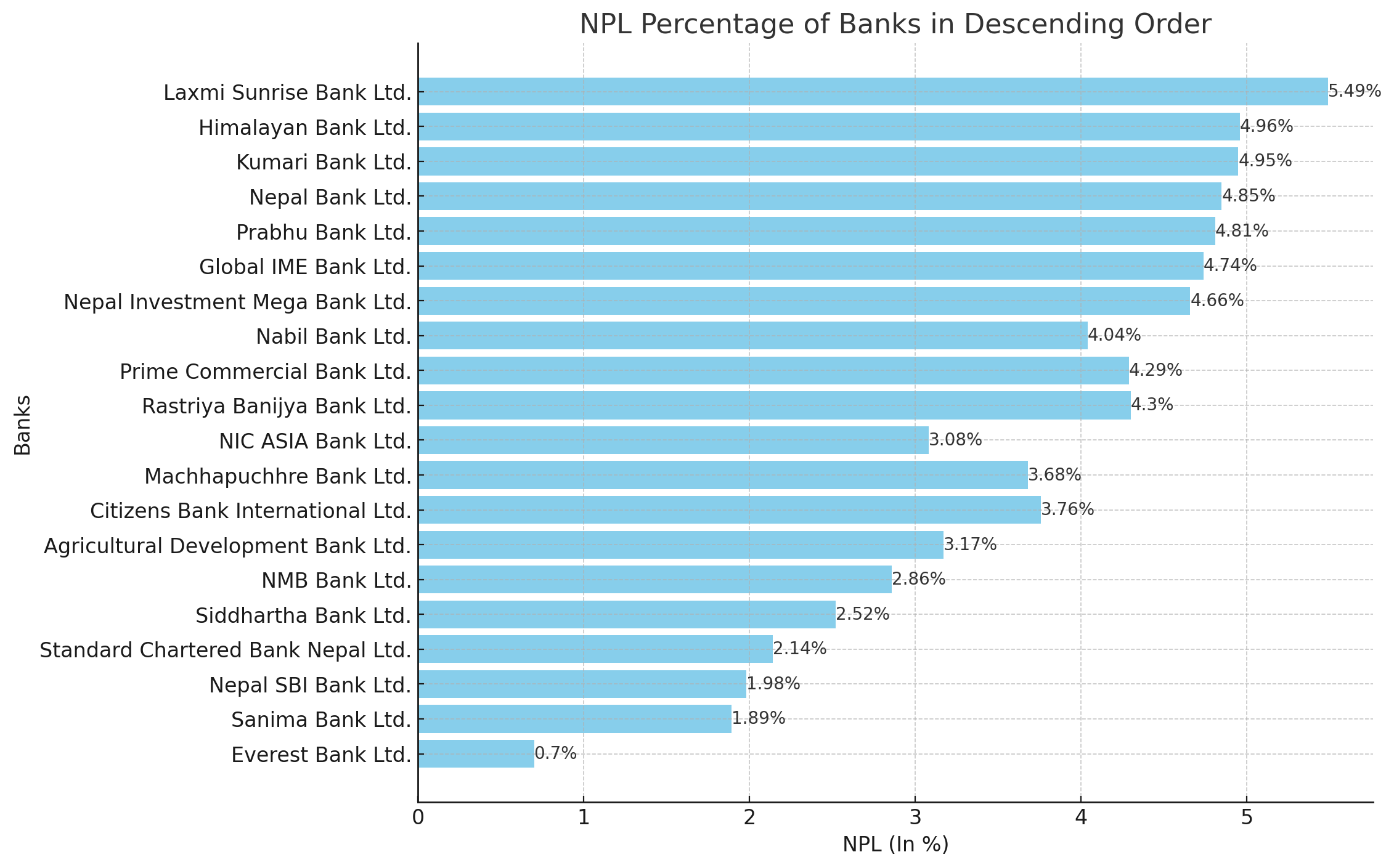

The latest data analysis of Non-Performing Loans (NPLs) reveals significant concerns within Nepal's banking sector. NPLs, a critical measure of financial health, indicate the proportion of loans that are in default or close to being in default. An NPL percentage exceeding 5% is generally considered the borderline for severe financial distress, raising red flags for stakeholders and regulators alike.

Top Banks with Elevated NPLs

Laxmi Sunrise Bank Ltd. tops the list with an alarming NPL rate of 5.49%. This is closely followed by Himalayan Bank Ltd. at 4.96% and Kumari Bank Ltd. at 4.95%. Nepal Bank Ltd. and Prabhu Bank Ltd. also report high NPLs of 4.85% and 4.81%, respectively. These figures suggest potential vulnerabilities in the loan portfolios of these banks, which could lead to broader financial instability if not addressed promptly.

Sub-Totals and Grand Totals

When aggregating the data, the first group of banks shows a sub-total NPL percentage of 4.12%, while the second group stands at 3.85%. The overall grand total for the NPL percentage across all banks is 3.89%. Although this aggregate figure is below the critical 5% threshold, individual banks' high NPL rates are cause for concern.

Banks with Lower NPLs

On a positive note, some banks have managed to maintain relatively low NPL percentages. Everest Bank Ltd. reports an impressive 0.70%, followed by Sanima Bank Ltd. at 1.89% and Nepal SBI Bank Ltd. at 1.98%. These banks exemplify prudent lending practices and effective risk management strategies, serving as benchmarks for others in the sector.

Implications and Recommendations

The high NPL percentages in several prominent banks necessitate immediate attention from both bank management and regulatory authorities. Measures should be taken to reassess lending practices, strengthen risk assessment frameworks, and enhance recovery processes for defaulted loans. Ensuring financial stability is paramount, and mitigating the risk of escalating NPLs is crucial for the health of Nepal's banking sector.

In conclusion, while the overall NPL percentage remains below the critical 5% mark, the high NPL rates in several major banks indicate underlying risks that must be managed proactively. Stakeholders must prioritize actions to bolster financial health and safeguard against potential crises.