By Sandeep Chaudhary

Seven Types of Income: Understanding How Wealth Is Built

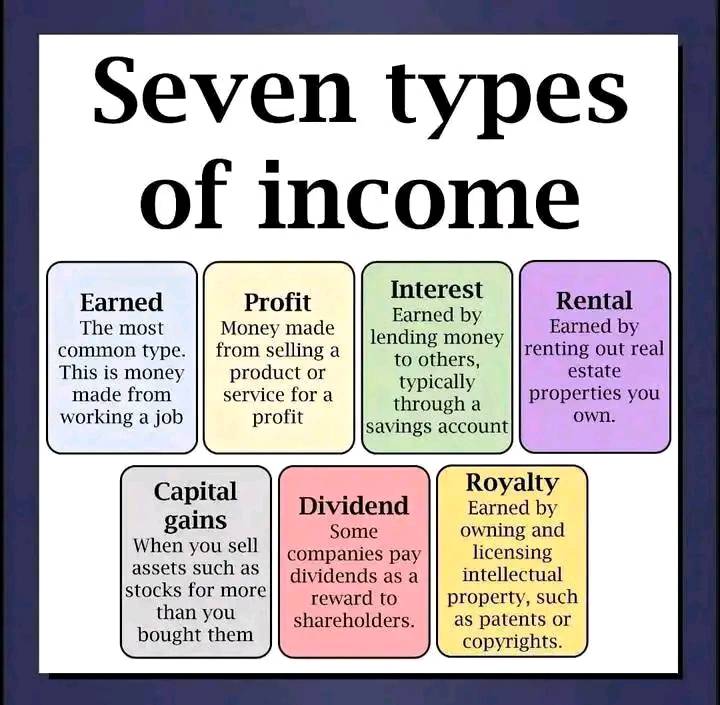

In the modern world of finance and personal development, understanding the different types of income is crucial for financial independence and wealth creation. According to financial literacy experts, income isn’t limited to just a paycheck. There are seven distinct streams through which individuals can earn money, and becoming familiar with them can be a game-changer in one’s journey toward financial freedom.

The first and most common form is Earned Income, which is the money made from working a job. Whether you’re a salaried employee, hourly worker, or freelancer, this type of income requires trading time for money. It’s predictable but limited by your working hours and physical capability.

Next comes Profit Income, which stems from selling goods or services for more than they cost to produce or acquire. This is the backbone of entrepreneurship and business. Many individuals generate profit income by running small businesses, engaging in side hustles, or launching startups.

Interest Income is another vital stream, earned by lending money to others—typically through savings accounts, fixed deposits, bonds, or peer-to-peer lending platforms. It’s a form of passive income that grows over time with compounding, often providing a safe return on surplus cash.

Rental Income is earned from leasing out real estate properties. This could include renting a house, apartment, office space, or even farmland. With property values and rental rates generally appreciating over time, this income stream is considered a cornerstone of long-term financial security.

Capital Gains refer to the profits made from selling assets like stocks, mutual funds, or real estate for more than their purchase price. While it often requires careful market timing and financial knowledge, capital gains can be a powerful source of wealth when managed strategically.

Dividend Income is money distributed to shareholders from a company’s profits. By investing in dividend-paying stocks, individuals can earn consistent income without having to sell their investment. It’s a favorite among long-term investors looking for both growth and income.

Finally, Royalty Income is earned from intellectual property such as books, music, patents, or software. Once a piece of work is created and licensed, the creator continues to receive payments—often for years—making it a highly rewarding passive income source for creatives and innovators.

Together, these seven types of income form a comprehensive blueprint for building wealth. By diversifying income streams—especially incorporating passive sources like interest, rental, and royalties—individuals can reduce financial risk, improve stability, and unlock new opportunities for growth. Financial advisors often recommend aiming to build multiple income streams to ensure a balanced and sustainable financial future.