By Sandeep Chaudhary

What is Real GDP at basic price ? Analyzing Real GDP at Basic Prices of NEPAL

Real GDP at basic prices is a fundamental economic indicator that provides a comprehensive measure of a country’s economic performance. This concept is crucial for students, professionals, and anyone interested in understanding the economic health and productivity of a nation.

What is Real GDP?

Gross Domestic Product (GDP) is the total value of all goods and services produced within a country over a specific period. Real GDP adjusts this value for inflation, providing a more accurate reflection of an economy’s size and growth over time. By removing the effects of price changes, real GDP allows for comparisons across different time periods and helps identify genuine economic growth.

Basic Prices Explained

When we talk about GDP at basic prices, we refer to the value of goods and services at the price received by producers, excluding taxes on products and including subsidies on products. This approach focuses on the production side of the economy, highlighting the contributions of various industries without the distortions caused by taxes and subsidies.

Importance of Real GDP at Basic Prices

Accurate Economic Measurement: By adjusting for inflation and excluding taxes and subsidies, real GDP at basic prices provides a clearer picture of economic activity. It reflects the true value added by producers in the economy.

Policy Making: Governments and policymakers rely on real GDP data to make informed decisions. It helps in designing effective economic policies, setting interest rates, and planning public spending.

Investment Decisions: Investors use real GDP at basic prices to assess the economic environment. A growing real GDP indicates a healthy economy, encouraging investment, while a declining GDP may signal economic trouble.

Comparative Analysis: Real GDP at basic prices allows for meaningful comparisons between different time periods and regions. It helps in understanding long-term economic trends and regional economic disparities.

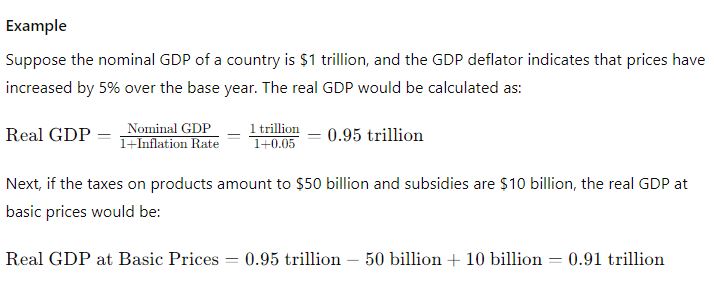

Calculating Real GDP at Basic Prices

The calculation of real GDP at basic prices involves the following steps:

Aggregate Output: Measure the total output of goods and services produced within the country.

Adjust for Inflation: Use a price index, such as the GDP deflator, to remove the effects of inflation from the nominal GDP.

Exclude Taxes and Include Subsidies: Adjust the GDP value by subtracting taxes on products and adding any subsidies on products to arrive at the basic prices.

Analyzing Real GDP at Basic Prices of NEPAL : Trends and Interpretations from 2018 to 2024

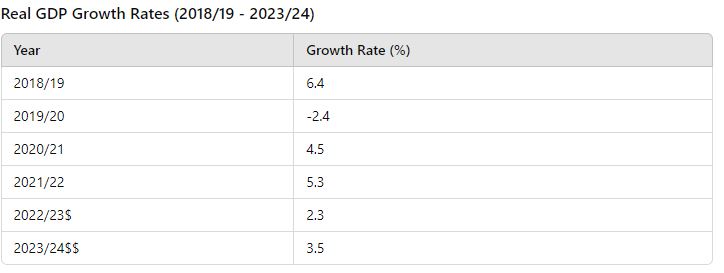

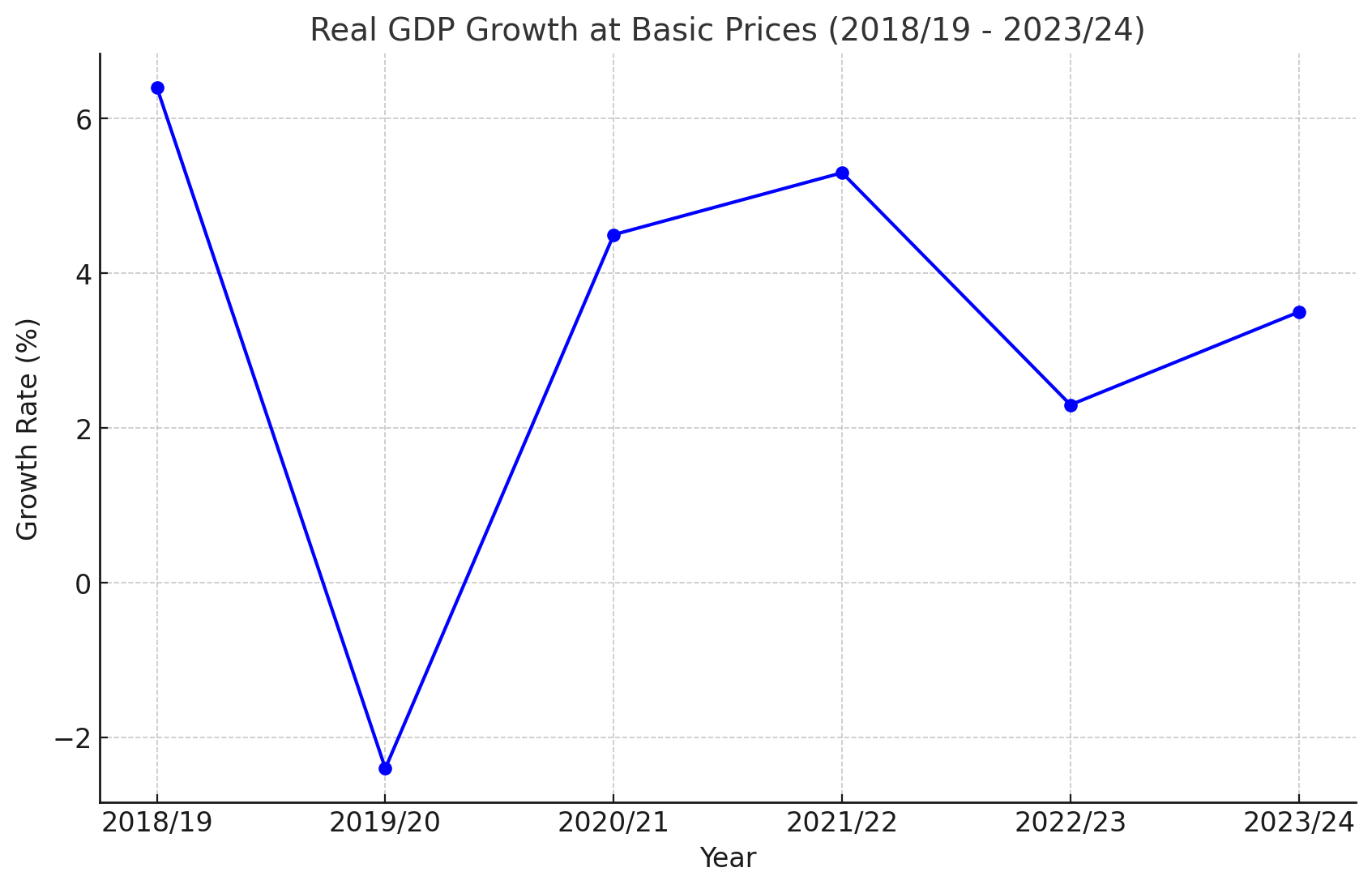

Interpretation of the Data

Strong Growth in 2018/19:

The Real GDP at basic prices grew by 6.4% in 2018/19, indicating robust economic activity. This period likely saw increased production, investment, and consumption across various sectors, reflecting a healthy and expanding economy.

Economic Contraction in 2019/20:

A significant contraction of -2.4% occurred in 2019/20. This negative growth rate could be attributed to several factors, including economic shocks, reduced consumer spending, or global economic conditions. Such a decline often indicates recessions, increased unemployment, and reduced industrial output.

Recovery in 2020/21:

The economy rebounded with a growth rate of 4.5% in 2020/21. This recovery might have been driven by stimulus measures, increased investment, and a resurgence in consumer confidence and spending. It suggests that the economy started to stabilize and recover from the previous year's downturn.

Continued Growth in 2021/22:

With a growth rate of 5.3% in 2021/22, the economy continued to strengthen. This period likely saw further improvements in industrial production, higher levels of investment, and possibly better export performance, indicating sustained economic momentum.

Slowdown in 2022/23:

The growth rate slowed to 2.3% in 2022/23. Several factors could contribute to this slowdown, including inflationary pressures, tightening monetary policies, or external economic challenges. A lower growth rate signifies a deceleration in economic activities and possibly growing economic uncertainties.

Moderate Recovery in 2023/24:

The projected growth rate for 2023/24 is 3.5%. This moderate recovery suggests that while the economy is improving, it is doing so at a cautious pace. This could be due to ongoing structural adjustments, efforts to curb inflation, or external economic conditions stabilizing.