Solu Hydropower Limited to Issue IPO from November 22 (Mangsir 7)

Author

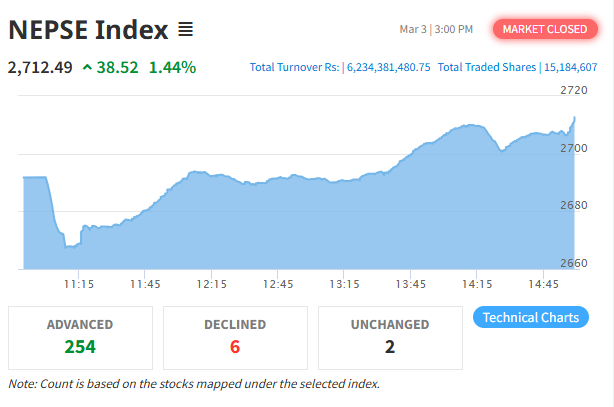

NEPSE TRADING

Solu Hydropower Limited is set to issue its first phase of Initial Public Offering (IPO) for project-affected locals and Nepali citizens working abroad starting from Mangsir 7. The company had received approval from the Securities Board of Nepal (SEBON) on Kartik 24 to issue 20 million ordinary shares worth Rs. 2 billion at a par value of Rs. 100 per share.

In the first phase, the company will issue a total of 11 million shares. Out of these, 10 million shares have been allocated exclusively for the project-affected residents of the Solu region. Additionally, 1 million shares (10%) have been reserved for Nepali citizens working abroad who hold a valid labor permit from the Government of Nepal.

Within the project-affected area, the share distribution has been divided into two categories. A total of 4 million shares has been reserved for residents of the highly affected wards—Solu Dudhkunda Municipality Wards 7 and 11, and Thulung Dudhkoshi Rural Municipality Ward 1. Likewise, 6 million shares have been allocated for residents of other affected wards, ensuring broader participation among communities near the project site.

Applicants can apply for a minimum of 10 shares and a maximum of 100,000 shares. For project-affected locals, the application window will close as early as Mangsir 21 or remain open until Poush 7, depending on subscription status. For Nepali migrant workers, the IPO closing date will be Mangsir 10 at the earliest and Mangsir 21 at the latest.

Project-affected locals can submit applications through Global IME Bank’s Salleri Branch, Laxmi Sunrise Bank’s Nele Branch, and the Tingla branch in Solukhumbu. Meanwhile, Nepali citizens working abroad can apply from all SEBON-approved ASBA member banks, financial institutions, their designated branches, and also through the online Mero Share portal.

The company is currently constructing the 82 MW Lower Solu Hydroelectric Project, with an estimated total cost of Rs. 16.30 billion. The estimated cost per megawatt stands at Rs. 198.8 million. The project still has 25 years remaining on its generation license. The simple payback period is estimated at 7.68 years, while the discounted payback period is 12.09 years, indicating long-term financial viability.

Nabil Investment Banking Limited and Himalayan Capital Limited are serving as the issue and sales managers for the IPO. After completing the first-phase issuance for migrant workers and project-affected residents, the company will move forward with its second phase of IPO issuance for the general public.