By Sandeep Chaudhary

Analysis of Nepal's Outstanding Government Debt

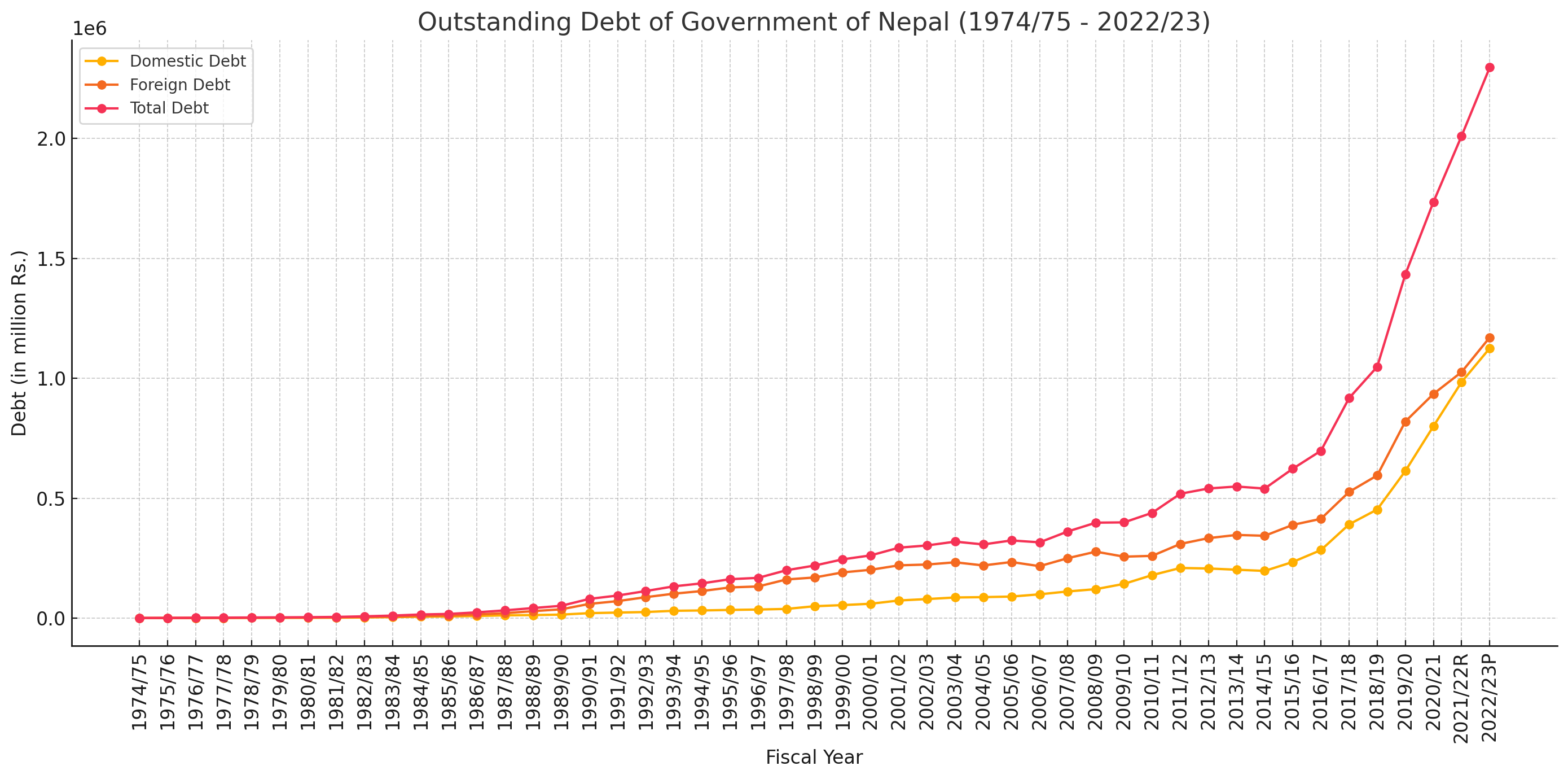

Over the past five decades, Nepal's outstanding government debt has shown significant growth, reflecting various economic, political, and social changes. Analyzing the data from 1974/75 to 2022/23, we can discern several key trends and interpret their implications for the country's economy.

Key Highlights:

Overall Growth in Debt:

In 1974/75, the total debt of Nepal was Rs. 945.4 million, with domestic debt at Rs. 599.3 million and foreign debt at Rs. 346.1 million. By 2022/23, the total debt has skyrocketed to Rs. 2,295,437.0 million, comprising Rs. 1,125,188.2 million in domestic debt and Rs. 1,170,248.8 million in foreign debt.

This indicates an approximate 2429-fold increase in total debt over this period.

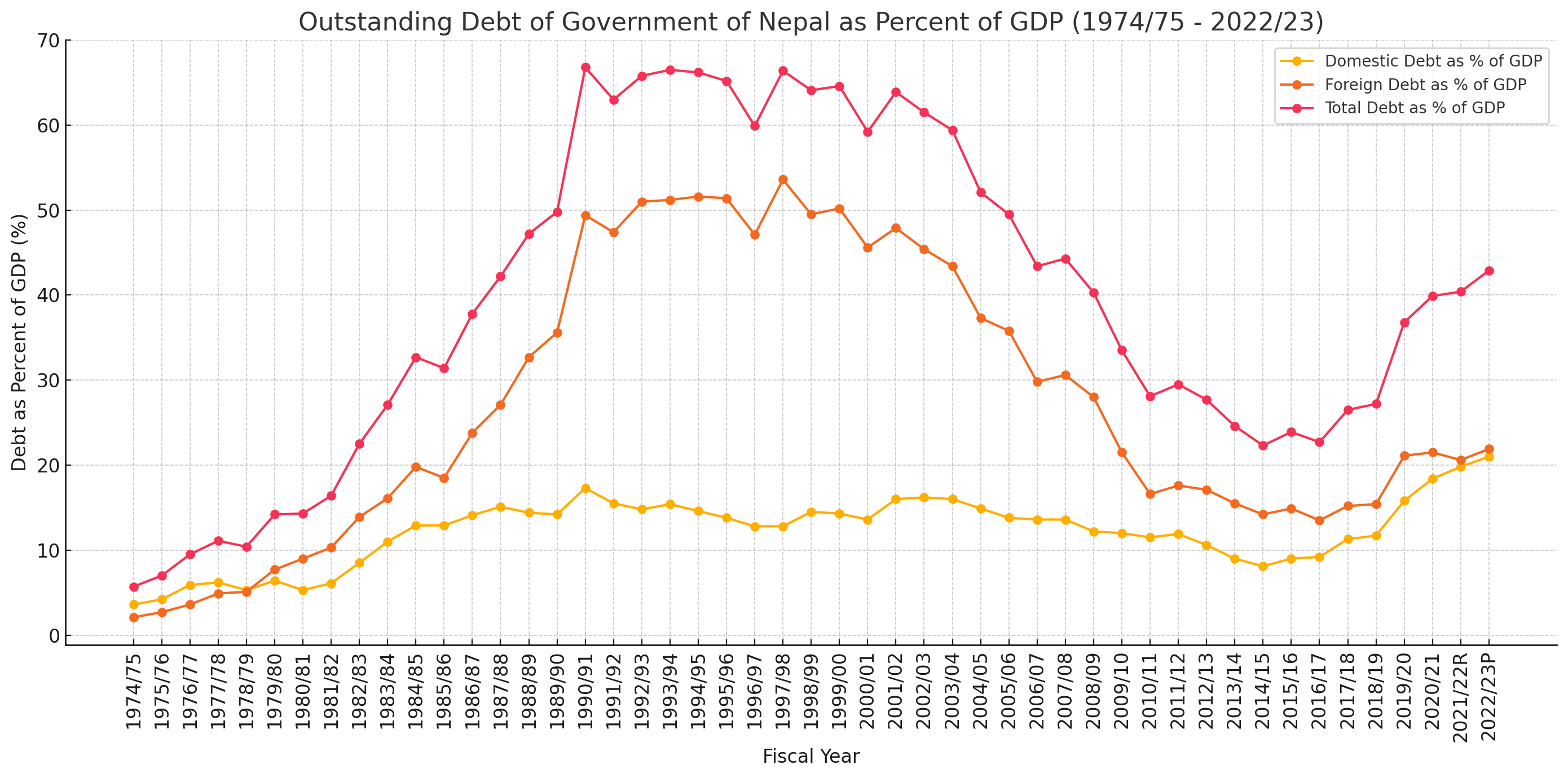

Debt as a Percentage of GDP:

The debt-to-GDP ratio is a critical indicator of economic health. Initially, in 1974/75, the total debt was 5.7% of GDP. Over the years, this ratio has fluctuated, reaching a peak of 66.8% in 1990/91.

In recent years, the ratio has been relatively stable, with the total debt-to-GDP ratio standing at 42.9% in 2022/23. This suggests that while debt levels are high, they have not grown proportionately to GDP in the last few decades.

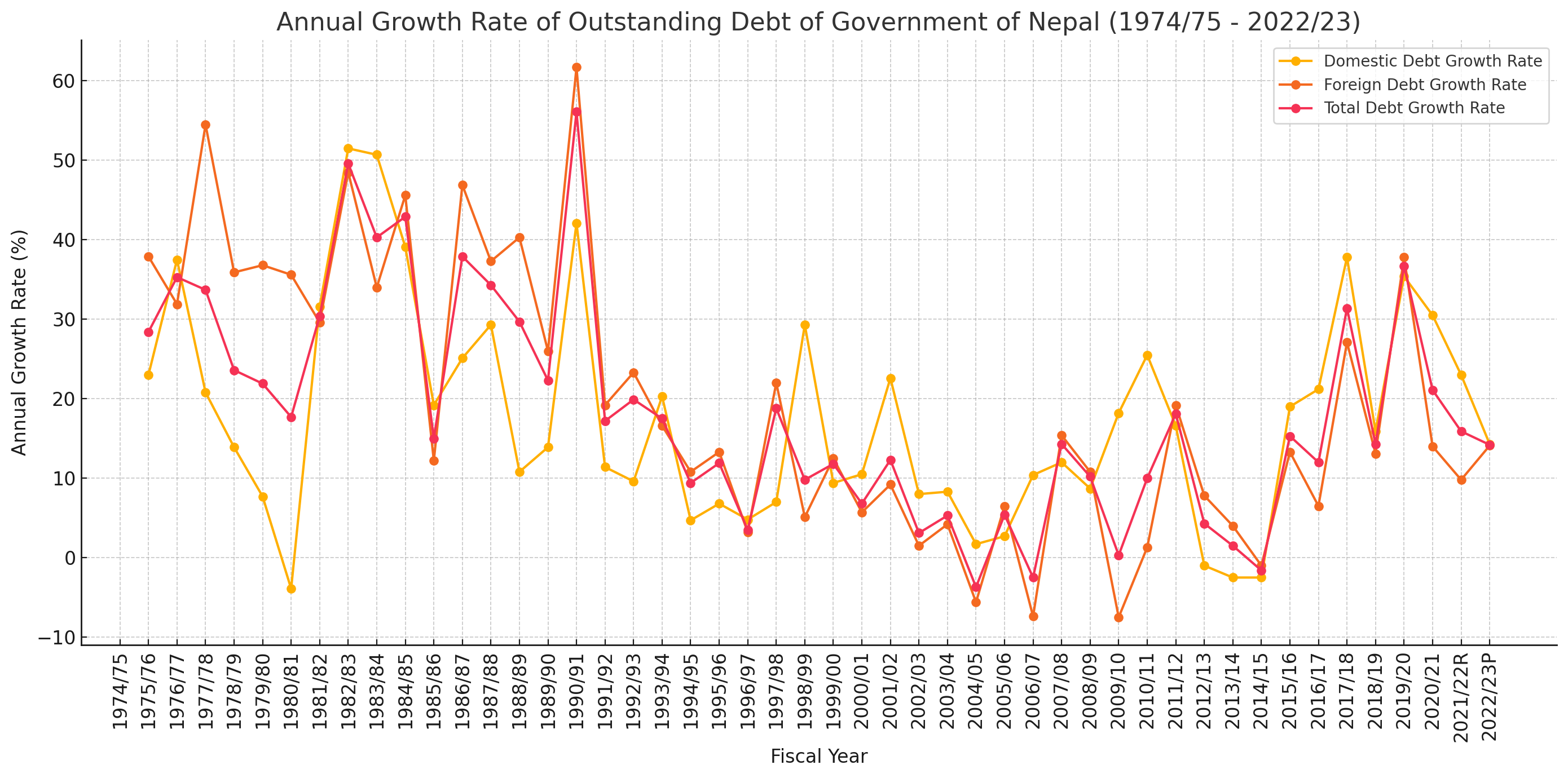

Annual Growth Rates:

The annual growth rate of total debt has also varied. Significant surges are observed in years like 1982/83 (49.6%), 1983/84 (40.3%), and 2017/18 (31.4%).

Conversely, there were periods of negative growth, notably in 2004/05 (-3.7%) and 2009/10 (0.3%). These fluctuations often correlate with economic policies, external aid, and global economic conditions.

Shift in Debt Composition:

There has been a noticeable shift towards a higher reliance on domestic debt over the years. For instance, in the early years, foreign debt constituted a significant portion of the total debt. However, in recent years, domestic debt has become more prominent.

This shift could indicate a growing confidence in the domestic financial market and a strategy to mitigate the risks associated with foreign exchange and international financial conditions.

Economic Interpretation:

The increasing trend in total debt signifies the growing financial needs of the Nepalese government, potentially for infrastructure development, social programs, and economic stimulus measures.

A high debt-to-GDP ratio can be a cause for concern as it might indicate an over-reliance on borrowing, which could lead to higher interest obligations and potential financial instability.

The shift towards domestic borrowing suggests efforts to manage external debt exposure and promote domestic investment.

Recent Trends:

In the last few years, particularly post-2019, there has been a sharp increase in debt levels, partly due to the economic impact of the COVID-19 pandemic. The government has likely increased borrowing to support economic recovery and health measures.

The growth rate of total debt in 2022/23 was 14.2%, indicating a continued but slightly moderated borrowing trend compared to the previous years.

Conclusion

Nepal's outstanding debt has grown substantially over the decades, reflecting the country's evolving economic needs and development strategies. While high debt levels can facilitate growth and development, it is crucial for the government to maintain a balanced approach to ensure long-term financial sustainability. Monitoring the debt-to-GDP ratio and managing the composition of debt will be essential to mitigate risks and promote economic stability.