By Sandeep Chaudhary

Analyzing the Trends in Listed Companies and Market Capitalization from 2022 to 2024

Introduction: The Nepal Stock Exchange (NEPSE) recently released its latest report on the trends in listed companies and their market capitalization from mid-April 2022 to mid-April 2024. The data presents an insightful view of the changes across various sectors in the Nepali stock market.

Number of Listed Companies: Over the three-year period, the total number of listed companies has increased from 229 in 2022 to 272 in 2024, marking an overall growth. Notably, the Hydro Power sector saw a significant rise in the number of companies, growing from 47 in 2022 to 91 in 2024. The Financial Institutions sector, however, experienced a decline in the number of listed companies, decreasing from 145 in 2022 to 134 in 2024.

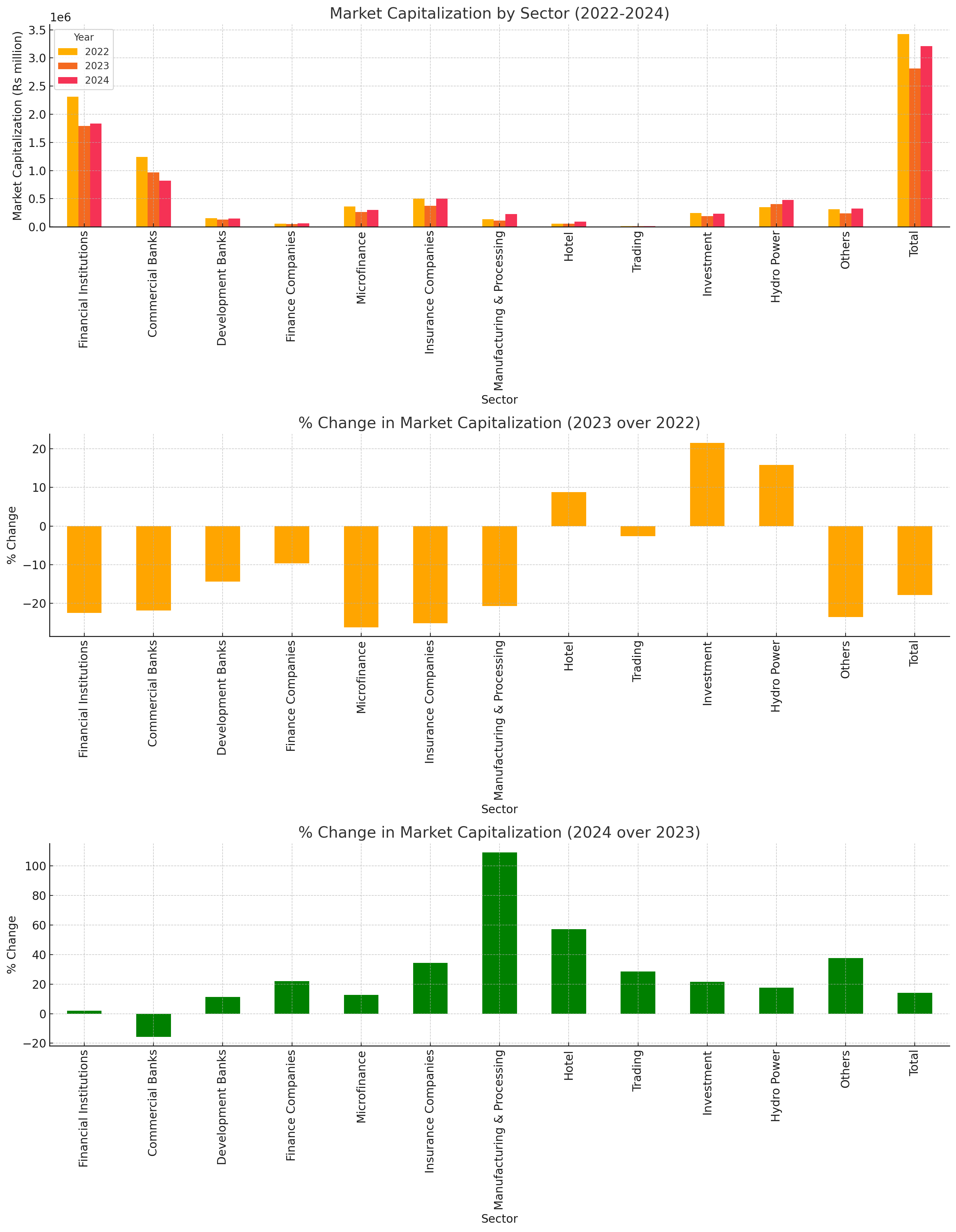

Market Capitalization Overview: Despite the increase in the number of companies, the total market capitalization exhibited fluctuations. The total market capitalization of listed companies decreased from Rs. 3426 billion in 2022 to Rs. 2813 billion in 2023, but rebounded to Rs. 3212 billion in 2024. This represents a 17.9% decline from 2022 to 2023, followed by a 14.2% increase from 2023 to 2024.

Sector-wise Market Capitalization:

Financial Institutions: This sector continues to hold the largest share of market capitalization, although it dropped from 67.6% in 2022 to 57.1% in 2024. Within this sector, Commercial Banks saw a substantial decrease in market value, falling from Rs. 1240 billion in 2022 to Rs. 817 billion in 2024.

Insurance Companies: The market capitalization of insurance companies saw a notable increase, reaching Rs. 504 billion in 2024, up from Rs. 375 billion in 2023, showing a 34.4% rise.

Manufacturing & Processing: This sector showed a significant growth in market capitalization, more than doubling from Rs. 109 billion in 2023 to Rs. 229 billion in 2024, indicating a 109.1% increase.

Hydro Power: The Hydro Power sector also demonstrated a positive trend with its market capitalization increasing by 17.7% from 2023 to 2024, reaching Rs. 477 billion.

Hotel Sector: The hotel sector's market capitalization increased steadily, from Rs. 54 billion in 2022 to Rs. 92 billion in 2024, reflecting a 57.3% growth over the period.

Here are the visualizations based on the provided data:

Market Capitalization by Sector (2022-2024): This bar chart shows the market capitalization for each sector over the years 2022, 2023, and 2024.

% Change in Market Capitalization (2023 over 2022): This bar chart illustrates the percentage change in market capitalization for each sector from 2022 to 2023.

% Change in Market Capitalization (2024 over 2023): This bar chart shows the percentage change in market capitalization for each sector from 2023 to 2024.

Conclusion: The NEPSE report highlights the dynamic nature of the stock market in Nepal, with significant sector-wise variations in both the number of listed companies and their market capitalization. While some sectors like Hydro Power and Manufacturing & Processing have shown robust growth, others such as Financial Institutions have experienced declines. These insights are crucial for investors and stakeholders to understand the evolving market trends and make informed decisions.