By Sandeep Chaudhary

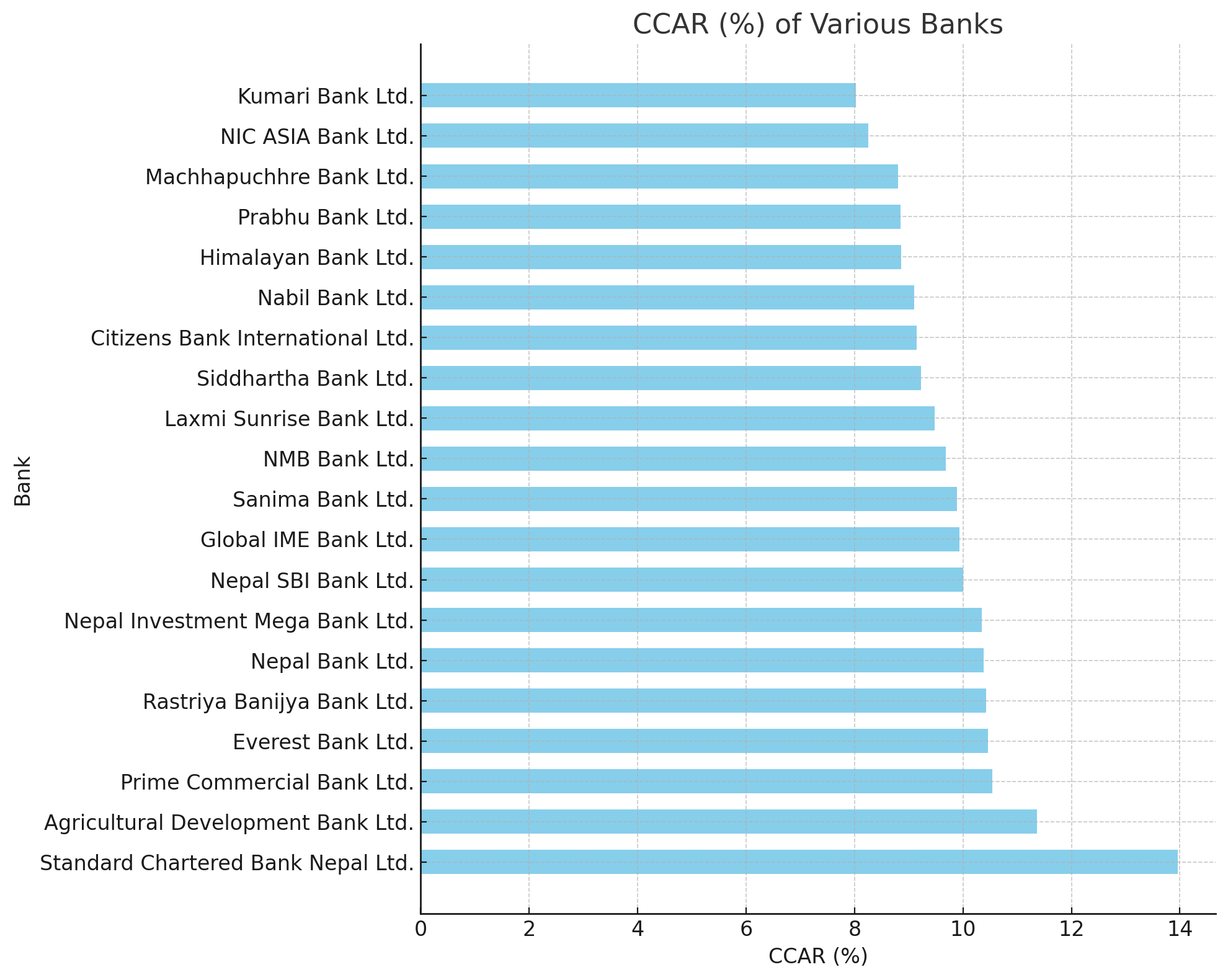

CCAR Non-Compliance: Kumari Bank Ltd. and NIC ASIA Bank Ltd. Face Bonus Distribution Ban

Based on the provided data and the NRB (Nepal Rastra Bank) regulation, banks with a CCAR (Capital to Risk-weighted Assets Ratio) below 8.5% are not permitted to distribute bonuses. Let's interpret the data accordingly:

Banks with CCAR Below 8.5%

Kumari Bank Ltd. - 8.03%

NIC ASIA Bank Ltd. - 8.25%

These banks, with CCAR values below 8.5%, are not allowed to distribute bonuses as per NRB regulations. This restriction ensures that banks maintain a sufficient capital buffer to safeguard their financial stability and protect depositors.

Banks with CCAR Above or Equal to 8.5%

The remaining banks have CCAR values above or equal to 8.5%, meaning they are eligible to distribute bonuses:

Machhapuchhre Bank Ltd. - 8.80%

Prabhu Bank Ltd. - 8.85%

Himalayan Bank Ltd. - 8.86%

Nabil Bank Ltd. - 9.10%

Citizens Bank International Ltd. - 9.15%

Siddhartha Bank Ltd. - 9.23%

Laxmi Sunrise Bank Ltd. - 9.48%

NMB Bank Ltd. - 9.68%

Sanima Bank Ltd. - 9.89%

Global IME Bank Ltd. - 9.93%

Nepal SBI Bank Ltd. - 10.00%

Nepal Investment Mega Bank Ltd. - 10.35%

Nepal Bank Ltd. - 10.38%

Rastriya Banijya Bank Ltd. - 10.43%

Everest Bank Ltd. - 10.46%

Prime Commercial Bank Ltd. - 10.54%

Agricultural Development Bank Ltd. - 11.36%

Standard Chartered Bank Nepal Ltd. - 13.96%

These banks have maintained their CCAR above the minimum threshold set by NRB, thus ensuring their ability to distribute bonuses and indicating a relatively stronger capital position.

In summary, only Kumari Bank Ltd. and NIC ASIA Bank Ltd. fall below the 8.5% CCAR requirement, and they are restricted from distributing bonuses. All other listed banks meet the regulatory requirement and are eligible to distribute bonuses.