By Sandeep Chaudhary

Ensuring Bank Stability: Understanding Capital Adequacy Ratios According to NRB Guidelines

Capital Adequacy Ratios (CAR) are fundamental indicators of a bank's financial health and stability. Mandated by the Nepal Rastra Bank (NRB), these ratios ensure that banks maintain sufficient capital to cover their risk-weighted assets. The primary components of CAR are the Core Capital Adequacy Ratio (CCAR) and the Total Capital Adequacy Ratio (CAR), each serving a critical role in safeguarding the banking sector.

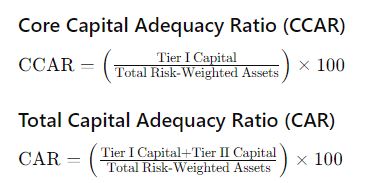

The Core Capital Adequacy Ratio (CCAR) focuses on Tier I Capital, which includes paid-up equity capital, share premium, non-redeemable preference shares, general reserves, retained earnings, capital redemption reserves, and other free reserves. This capital is the most secure and permanent, providing a robust buffer against losses.

On the other hand, the Total Capital Adequacy Ratio (CAR) encompasses both Tier I and Tier II Capital. Tier II Capital adds supplementary elements like subordinated debt, hybrid capital instruments, revaluation reserves, general loan loss reserves, undisclosed reserves, and exchange equalization reserves. These additional resources further strengthen the bank's capacity to absorb shocks.

To calculate these ratios, the NRB uses the following formulas:

Maintaining robust Capital Adequacy Ratios is crucial for financial stability. These ratios ensure that banks have enough capital to absorb potential losses, manage various risks, and comply with regulatory requirements. High CAR values not only protect depositors but also enhance investor confidence and attract capital investments, ultimately promoting a sound and stable banking environment.

In conclusion, Capital Adequacy Ratios are indispensable for the health and resilience of the banking sector. By adhering to NRB guidelines, banks can ensure they are well-capitalized, effectively managing risks and maintaining operational stability even in challenging economic conditions.