By Dipesh Ghimire

GBBL's Financial Trends: Stability Amid Economic Fluctuations

GBBL Reports Stable Earnings Despite Economic Fluctuations

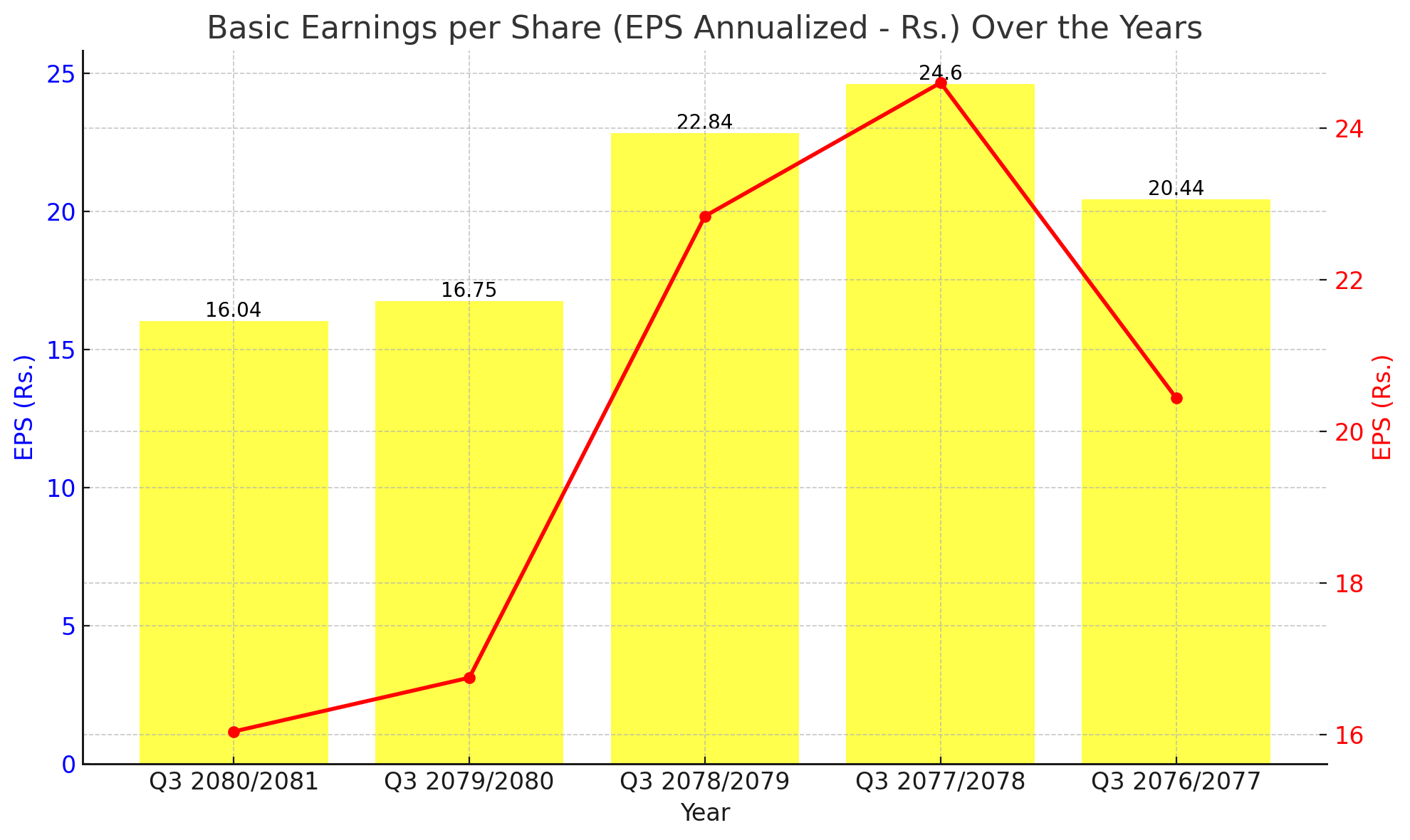

Garima Bikas Bank Limited (GBBL) has reported its Basic Earnings per Share (EPS) for the third quarter of the fiscal year 2080/2081. The latest figures show an EPS of Rs. 16.04, reflecting a slight decrease from the previous year's Rs. 16.75. Despite this minor drop, GBBL has maintained a stable performance in a challenging economic environment.

Historical Performance and Trends

Over the past five years, GBBL's EPS has demonstrated a relatively stable trend with some fluctuations:

Q3 2080/2081: Rs. 16.04, a slight decrease from Rs. 16.75 in Q3 2079/2080.

Q3 2079/2080: Rs. 16.75, showing a decline from Rs. 22.84 in Q3 2078/2079.

Q3 2078/2079: Rs. 22.84, a decrease from Rs. 24.6 in Q3 2077/2078.

Q3 2077/2078: The highest EPS in this period at Rs. 24.6.

Q3 2076/2077: Rs. 20.44, reflecting strong performance.

Interpretation of EPS Trends

The observed trends in GBBL’s EPS highlight several key points:

Stable Earnings: Despite minor fluctuations, GBBL has maintained relatively stable earnings over the past five years, indicating strong financial management.

Economic Impact: Broader economic conditions may have influenced the slight declines in recent years, but GBBL's resilience is evident in its ability to sustain positive EPS.

Operational Efficiency: Effective operational strategies and financial management have contributed to GBBL's stable performance.

Future Outlook

To continue its stable performance and potentially improve EPS, GBBL should focus on strategic initiatives:

Enhancing Profitability: Implementing measures to boost profitability, such as expanding revenue streams and optimizing costs.

Operational Efficiency: Further streamlining operations to improve efficiency and financial performance.

Market Expansion: Exploring new market opportunities to drive growth and enhance shareholder value.

Conclusion

GBBL’s EPS of Rs. 16.04 for Q3 2080/2081 highlights its stable performance in a challenging economic environment. The bank's effective financial management and operational strategies have ensured sustained earnings. Stakeholders can remain optimistic about GBBL's future performance, provided it continues to implement sound strategic measures.

GBBL Reports Increase in Non-Performing Loans Over the Years

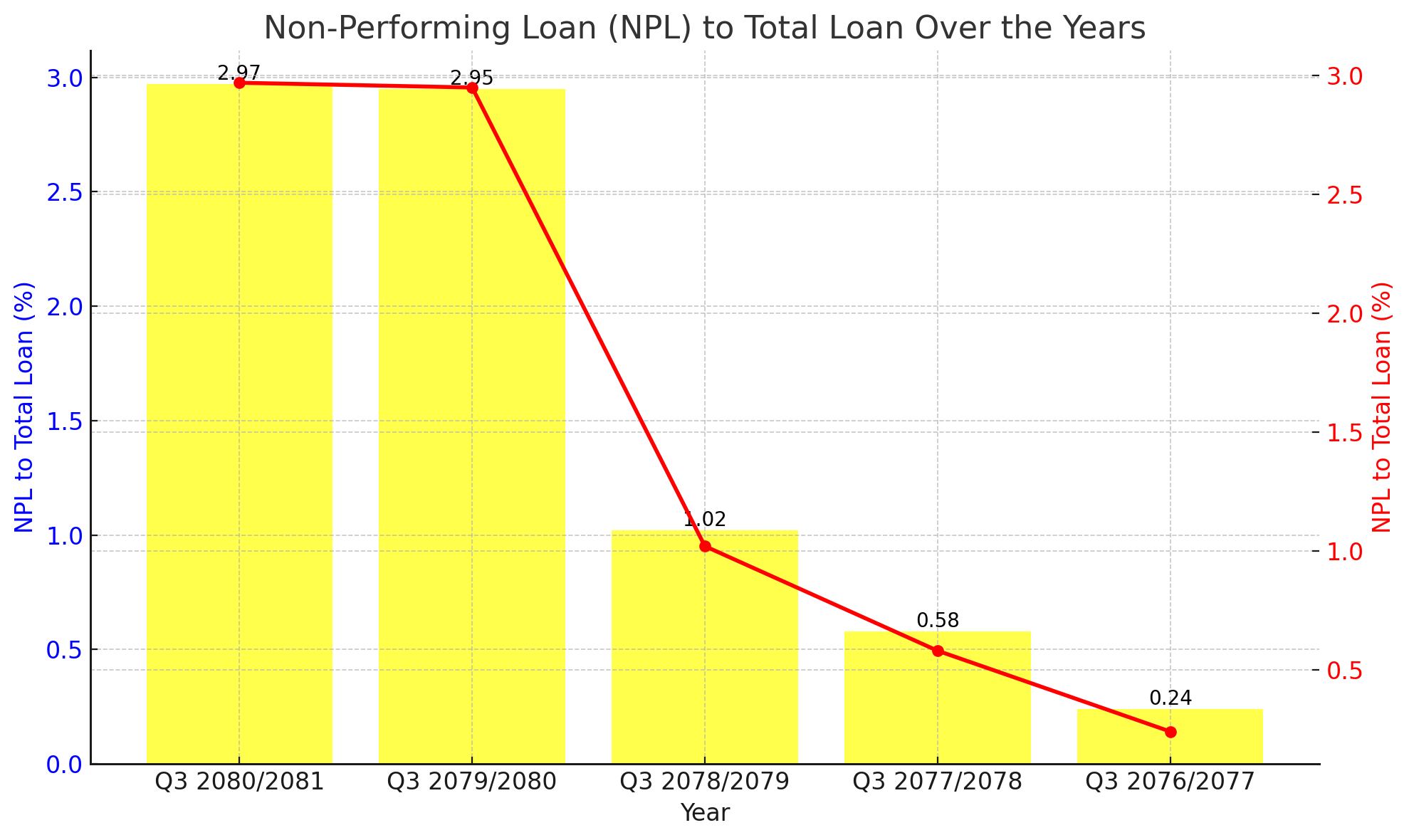

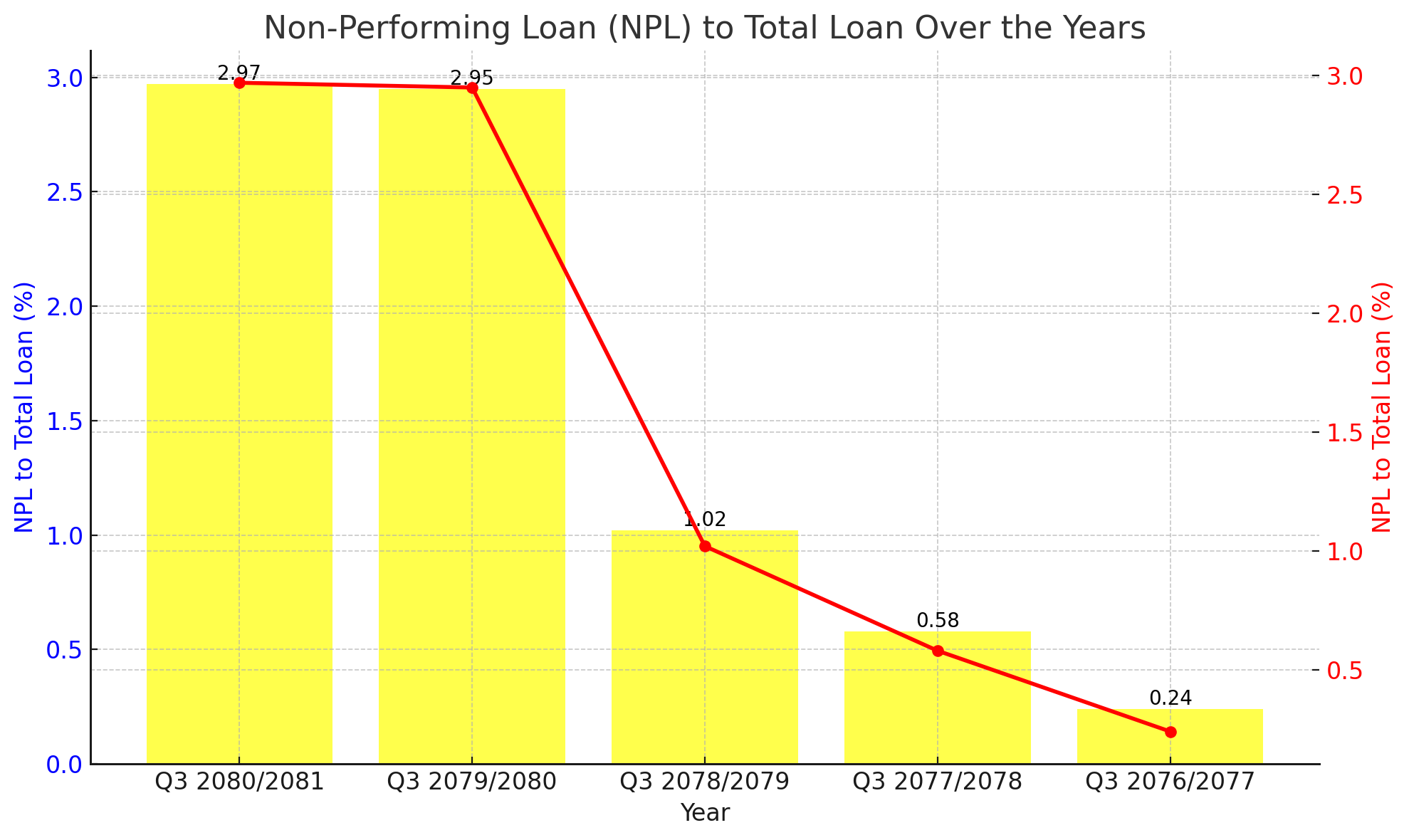

Garima Bikas Bank Limited (GBBL) has reported its Non-Performing Loan (NPL) to Total Loan ratio for the third quarter of the fiscal year 2080/2081. The latest figures show an NPL ratio of 2.97%, slightly higher than the previous year's 2.95%, indicating a gradual increase in non-performing loans over the past few years.

Historical Performance and Trends

Analyzing the past five years, GBBL's NPL ratio has shown a notable upward trend:

Q3 2080/2081: The NPL ratio stands at 2.97%, a slight increase from 2.95% in Q3 2079/2080.

Q3 2079/2080: The NPL ratio was 2.95%, a significant increase from 1.02% in Q3 2078/2079.

Q3 2078/2079: The NPL ratio was 1.02%, showing an increase from 0.58% in Q3 2077/2078.

Q3 2077/2078: The NPL ratio was 0.58%, higher than 0.24% in Q3 2076/2077.

Q3 2076/2077: The lowest NPL ratio in this period, at 0.24%.

Interpretation of NPL Trends

The observed upward trend in GBBL’s NPL ratio suggests several underlying issues:

Loan Quality Deterioration: The gradual increase in the NPL ratio indicates a deterioration in the quality of the bank's loan portfolio.

Economic Impact: Broader economic challenges may have contributed to the rising NPL ratio, affecting borrowers' ability to repay loans.

Operational Challenges: Potential inefficiencies in loan management and recovery processes may have contributed to the increase in non-performing loans.

Future Outlook

To address these challenges and improve the NPL ratio, GBBL must focus on strategic initiatives:

Enhanced Credit Assessment: Improving the credit assessment process to ensure better loan quality.

Effective Recovery Strategies: Implementing more effective loan recovery strategies to reduce the NPL ratio.

Operational Improvements: Streamlining operations to improve efficiency and loan performance.

Conclusion

GBBL’s NPL ratio of 2.97% for Q3 2080/2081 highlights the need for the bank to address the rising trend in non-performing loans. By implementing strategic measures to improve loan quality and recovery processes, GBBL can work towards reducing its NPL ratio in the coming quarters. Stakeholders will be closely monitoring the bank's efforts to manage its loan portfolio effectively.

GBBL Shows Positive Trend in Networth per Share Over Five Years

Garima Bikas Bank Limited (GBBL) has reported its Networth per Share for the third quarter of the fiscal year 2080/2081. The latest figures show a Networth per Share of Rs. 148.55, reflecting a positive trend compared to previous years and demonstrating GBBL's strong financial position.

Historical Performance and Trends

Analyzing the past five years, GBBL's Networth per Share has shown a steady increase:

Q3 2080/2081: Rs. 148.55, an increase from Rs. 138.57 in Q3 2079/2080.

Q3 2079/2080: Rs. 138.57, a slight decrease from Rs. 140.27 in Q3 2078/2079.

Q3 2078/2079: Rs. 140.27, an increase from Rs. 138.92 in Q3 2077/2078.

Q3 2077/2078: Rs. 138.92, an increase from Rs. 131.52 in Q3 2076/2077.

Q3 2076/2077: The lowest Networth per Share in this period at Rs. 131.52.

Interpretation of Networth Trends

The observed upward trend in GBBL’s Networth per Share suggests several positive indicators:

Financial Strength: The steady increase in networth per share indicates GBBL's strong financial health and ability to generate shareholder value.

Operational Efficiency: Effective operational management and strategic decision-making have contributed to the growth in networth.

Resilience: GBBL's ability to maintain and grow its networth per share amidst economic fluctuations highlights its resilience.

Future Outlook

To continue its positive trajectory, GBBL should focus on the following strategic initiatives:

Sustainable Growth: Implementing strategies to ensure sustainable growth in networth and shareholder value.

Operational Excellence: Further enhancing operational efficiencies to maintain financial strength.

Market Expansion: Exploring new market opportunities to drive growth and diversify revenue streams.

Conclusion

GBBL’s Networth per Share of Rs. 148.55 for Q3 2080/2081 demonstrates its strong financial performance and positive growth trend. The bank's effective management and strategic initiatives have resulted in increased shareholder value. Stakeholders can remain optimistic about GBBL's future performance, given its consistent financial growth.

GBBL Reports Decline in Return on Equity Over the Years

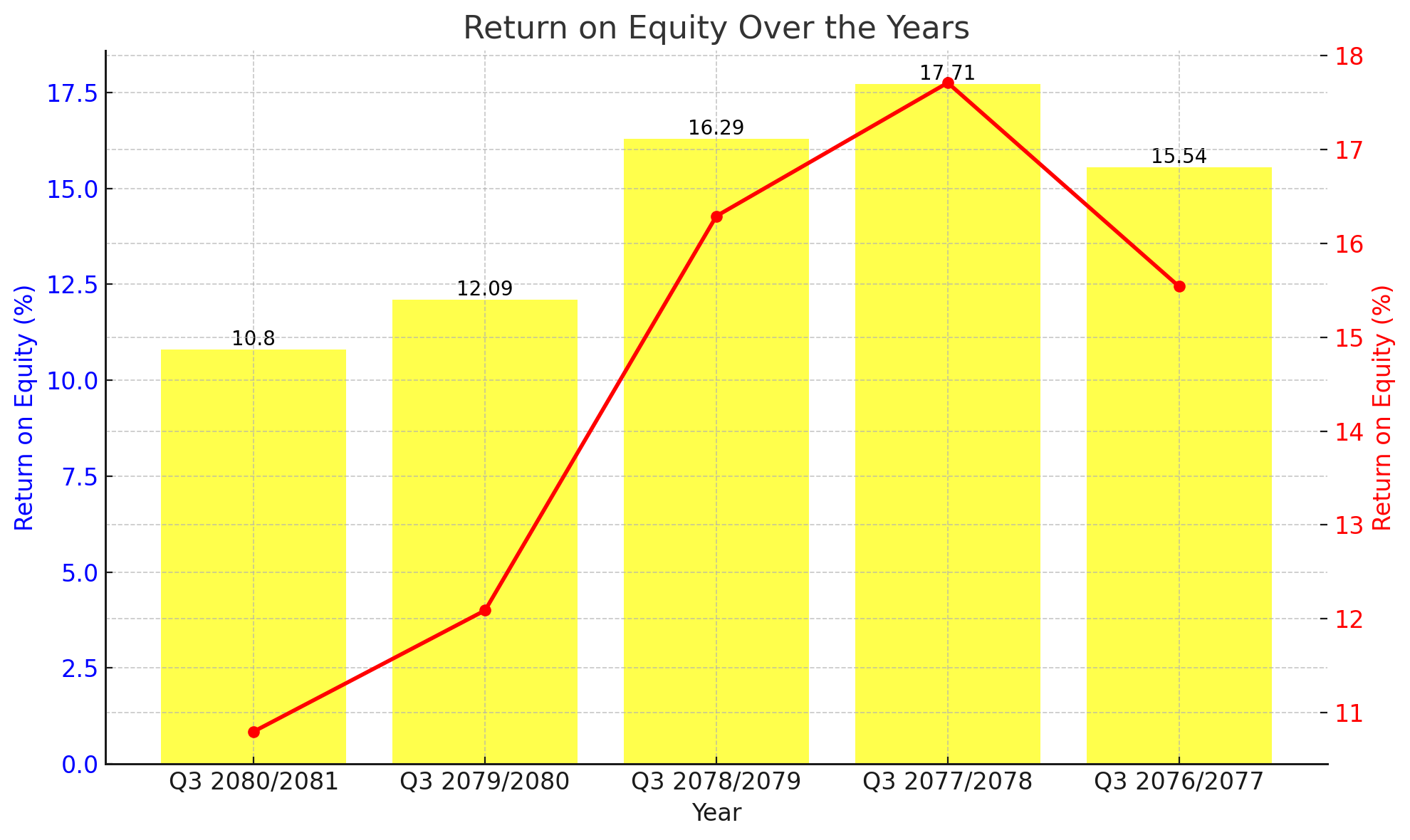

Garima Bikas Bank Limited (GBBL) has reported its Return on Equity (ROE) for the third quarter of the fiscal year 2080/2081. The latest figures show an ROE of 10.8%, reflecting a decline from the previous year's 12.09%. This downward trend highlights ongoing challenges in maintaining profitability.

Historical Performance and Trends

Analyzing the past five years, GBBL's ROE has shown a declining trend:

Q3 2080/2081: ROE stands at 10.8%, a decrease from 12.09% in Q3 2079/2080.

Q3 2079/2080: ROE was 12.09%, showing a significant decline from 16.29% in Q3 2078/2079.

Q3 2078/2079: ROE stood at 16.29%, reflecting a reduction from 17.71% in Q3 2077/2078.

Q3 2077/2078: The highest ROE in this period at 17.71%.

Q3 2076/2077: A strong ROE of 15.54%, showcasing consistent profitability.

Interpretation of ROE Trends

The observed decline in GBBL’s ROE suggests several underlying issues:

Profitability Challenges: The consistent decline in ROE indicates challenges in maintaining profitability.

Economic Impact: Broader economic conditions may have adversely affected the bank’s profitability, leading to lower ROE.

Operational Efficiency: Potential inefficiencies in operations and financial management could have contributed to the declining ROE.

Future Outlook

To address these challenges and improve ROE, GBBL must focus on strategic initiatives:

Enhancing Profitability: Implementing measures to boost profitability, such as expanding revenue streams and reducing costs.

Operational Improvements: Streamlining operations to improve efficiency and financial performance.

Strategic Investments: Making strategic investments to drive growth and enhance shareholder value.

Conclusion

GBBL’s ROE of 10.8% for Q3 2080/2081 highlights significant financial challenges that need to be addressed. The bank must undertake effective strategic measures to improve its profitability and financial performance. Stakeholders will be closely monitoring the bank’s efforts to enhance its ROE in the coming quarters.

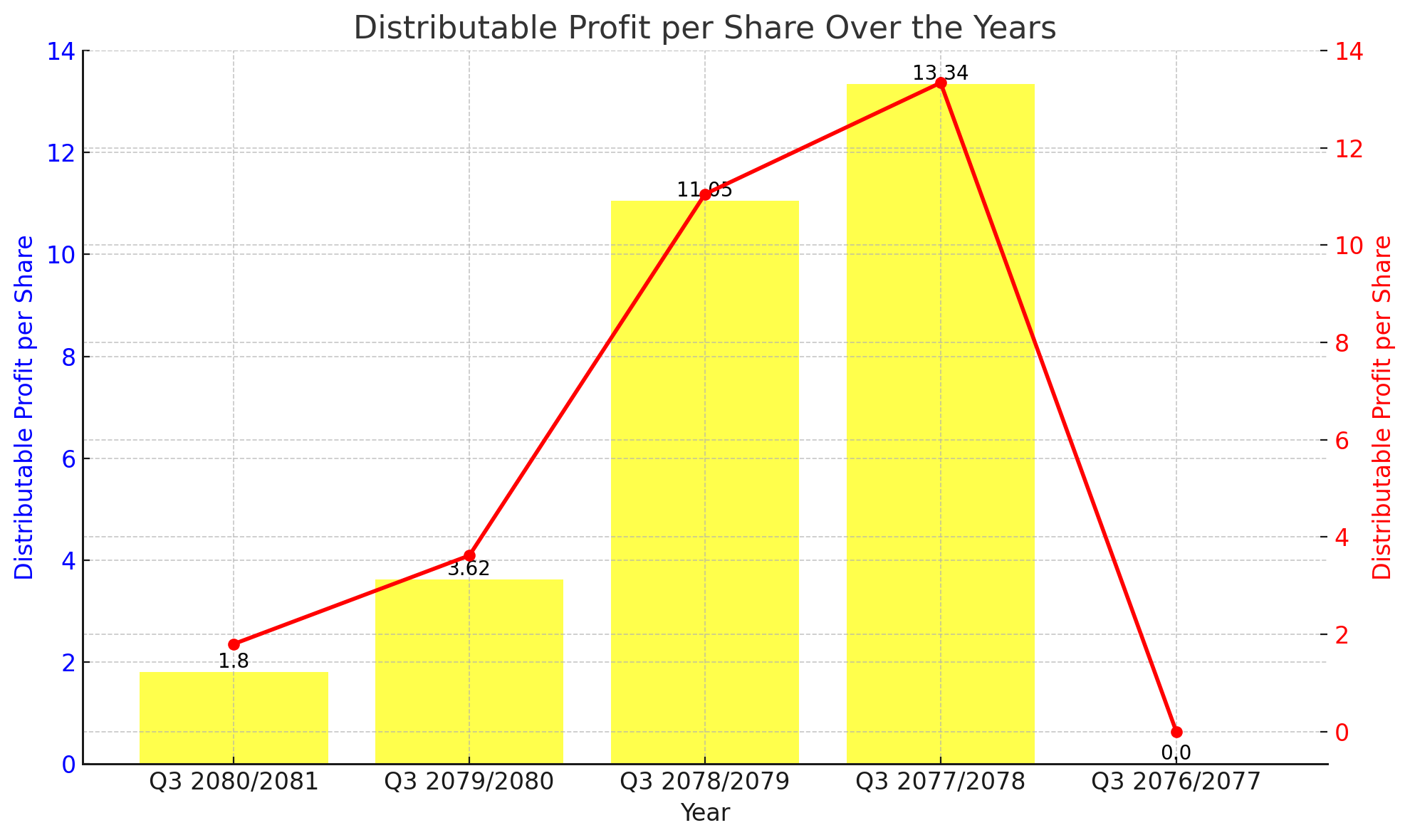

GBBL Reports Significant Decline in Distributable Profit per Share

Garima Bikas Bank Limited (GBBL) has reported its Distributable Profit per Share for the third quarter of the fiscal year 2080/2081. The latest figures show a distributable profit per share of Rs. 1.8, reflecting a significant decline from the previous year's Rs. 3.62. This downward trend indicates ongoing challenges in maintaining profitability.

Historical Performance and Trends

Analyzing the past five years, GBBL's distributable profit per share has shown a declining trend:

Q3 2080/2081: Rs. 1.8, a decrease from Rs. 3.62 in Q3 2079/2080.

Q3 2079/2080: Rs. 3.62, showing a significant decline from Rs. 11.05 in Q3 2078/2079.

Q3 2078/2079: Rs. 11.05, a decrease from Rs. 13.34 in Q3 2077/2078.

Q3 2077/2078: The highest distributable profit per share in this period at Rs. 13.34.

Q3 2076/2077: No distributable profit recorded.

Interpretation of Trends

The observed decline in GBBL’s distributable profit per share suggests several underlying issues:

Profitability Challenges: The consistent decline in distributable profit indicates challenges in maintaining profitability.

Economic Impact: Broader economic conditions may have adversely affected the bank’s profitability, leading to lower distributable profits.

Operational Efficiency: Potential inefficiencies in operations and financial management could have contributed to the declining distributable profit.

Future Outlook

To address these challenges and improve distributable profit, GBBL must focus on strategic initiatives:

Enhancing Profitability: Implementing measures to boost profitability, such as expanding revenue streams and reducing costs.

Operational Improvements: Streamlining operations to improve efficiency and financial performance.

Strategic Investments: Making strategic investments to drive growth and enhance shareholder value.

Conclusion

GBBL’s distributable profit per share of Rs. 1.8 for Q3 2080/2081 highlights significant financial challenges that need to be addressed. The bank must undertake effective strategic measures to improve its profitability and financial performance. Stakeholders will be closely monitoring the bank’s efforts to enhance its distributable profit in the coming quarters.