By Sandeep Chaudhary

Imports from India Show Mixed Trends, Highlighting Economic Shifts

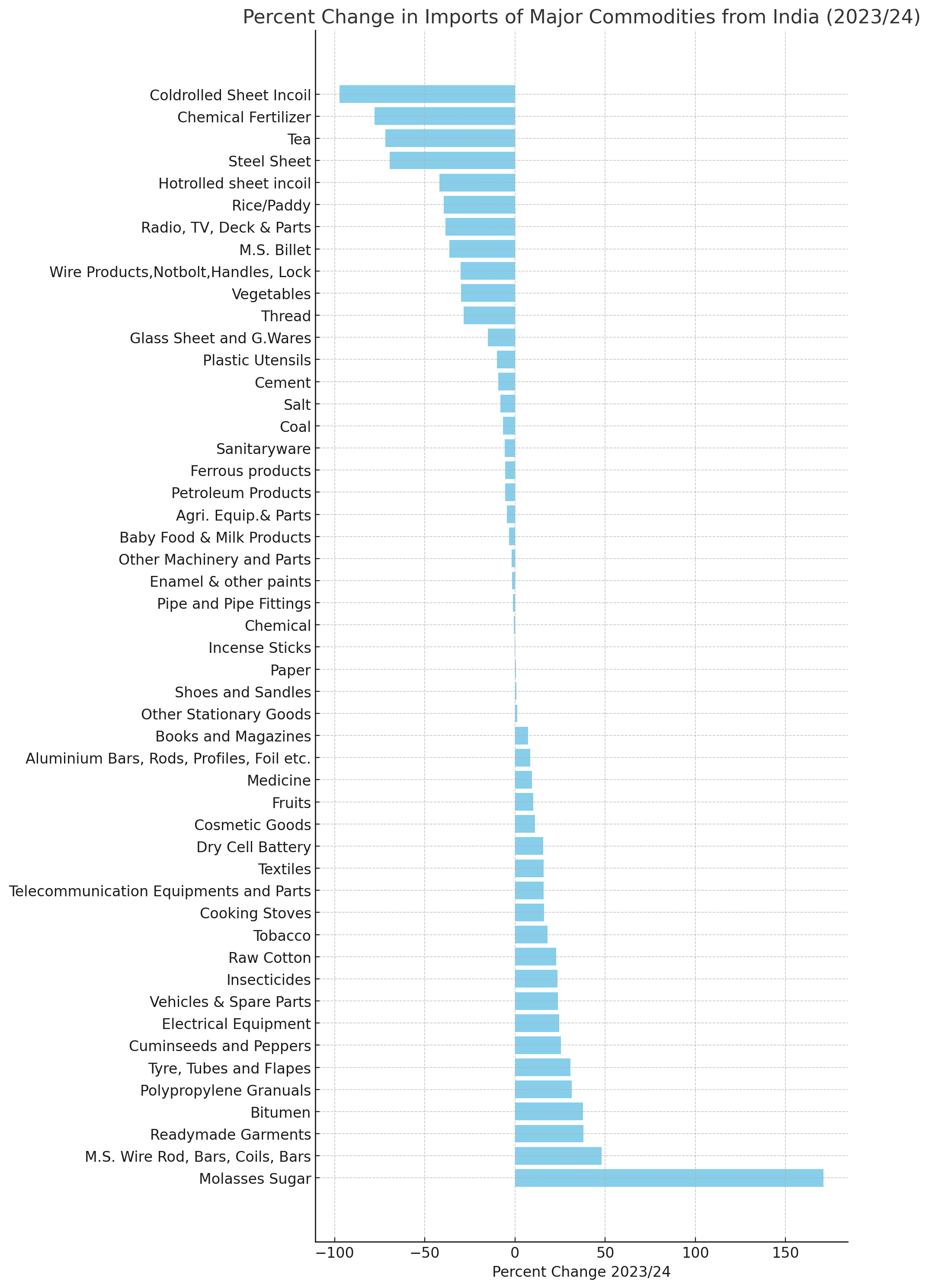

In the latest report detailing imports of major commodities from India, significant fluctuations are observed across various sectors, reflecting both opportunities and challenges in the trade relationship. The total imports for the period have decreased, with a noticeable shift in the composition and volume of specific goods.

Decline in Major Commodities

The overall import value of major commodities from India has seen a decline, with the total imports dropping from Rs. 901,702.5 million in the first nine months of 2022/23 to Rs. 729,658.5 million in the same period of 2023/24, marking a 19.1% decrease. This reduction is attributed to several key categories experiencing sharp declines.

Chemical Fertilizer and Petroleum Products Hit Hard

Chemical fertilizers, a critical import for the agricultural sector, have seen a dramatic 77.8% decrease. Similarly, petroleum products, which make up a significant portion of the import bill, have decreased by 5.4%. The reduced demand for these essentials suggests a shift in agricultural practices or possibly an increased domestic production.

Fluctuations in Industrial Inputs

There have been mixed trends in the import of industrial inputs. Aluminium products and insecticides have shown a modest increase, indicating sustained demand in construction and agriculture. In contrast, imports of cold-rolled sheet in coils and hot-rolled sheets have plummeted, suggesting a slowdown in the manufacturing sector.

Consumer Goods and Machinery

The import of consumer goods presents a varied picture. While cosmetic goods and baby food have experienced minor declines, other categories such as cooking stoves and sanitaryware show significant drops. Notably, the machinery and parts sector, essential for industrial activities, has also faced a reduction, reflecting cautious investment in capital goods.

Bright Spots in Trade

Despite the general downward trend, there are categories that have bucked the decline. Imports of bitumen have surged by 37.8%, potentially driven by infrastructure projects. The paper industry has also seen a slight increase, hinting at steady demand in publishing and packaging sectors. Additionally, the import of telecommunication equipment has rebounded, suggesting a renewed investment in communication infrastructure.

Conclusion

The data underscores a complex narrative of trade with India, marked by significant contractions in some sectors and resilience in others. These trends not only reflect changes in domestic economic activities but also highlight the broader shifts in supply chain dynamics and market demands. As the economy continues to navigate these changes, strategic adjustments in trade policies and domestic production capabilities will be crucial to maintaining a balanced and sustainable import portfolio.