By Sandeep Chaudhary

Interest Rate Trends of Nepal’s Commercial Banks Show Mixed Movements in 2024/25

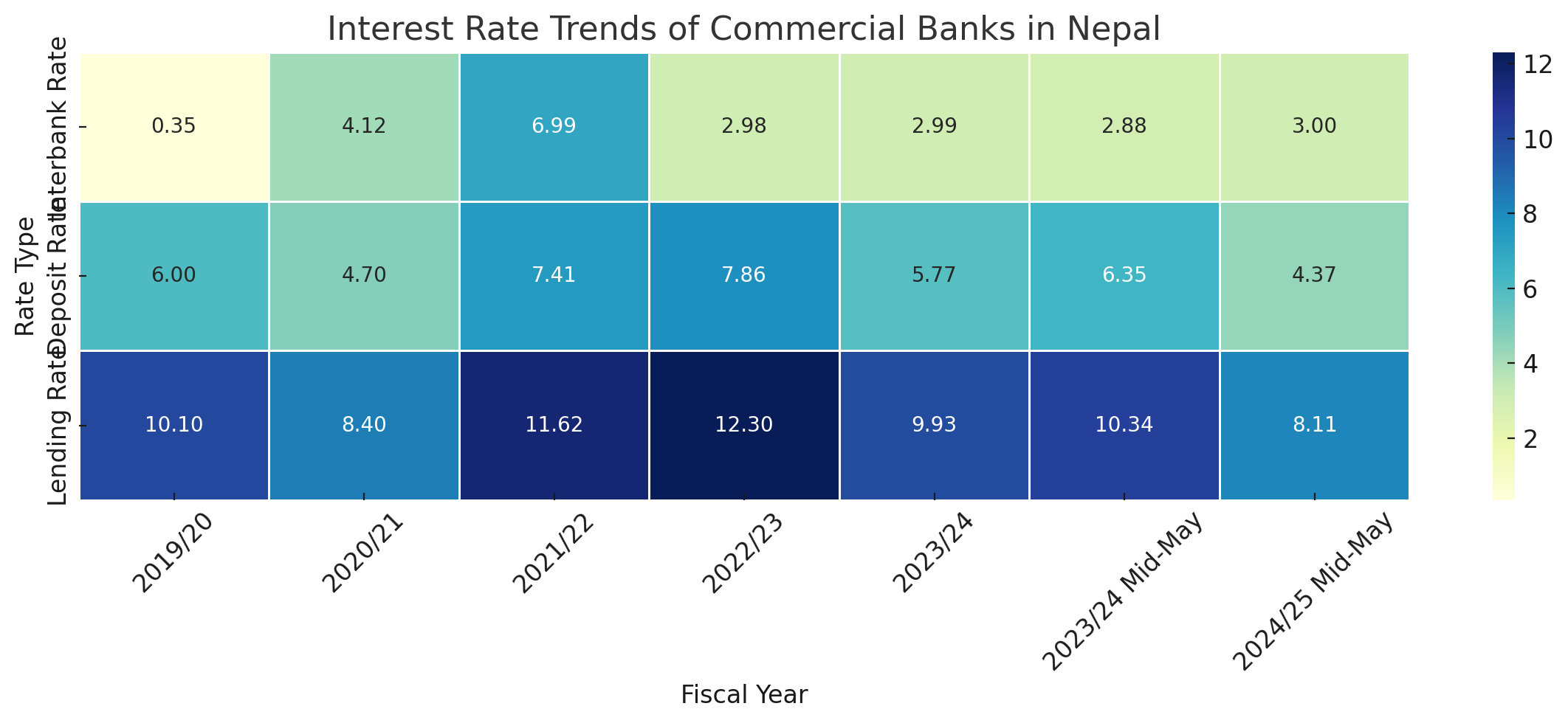

The latest mid-May data for fiscal year 2024/25 indicates nuanced shifts in Nepal’s banking interest rates, reflecting broader economic and liquidity dynamics in the financial sector.

The Weighted Average Interbank Rate—a key indicator of short-term liquidity among commercial banks—has seen a slight increase to 3.00%, up from 2.88% in mid-May 2023/24. Though still modest compared to the peak of 6.99% in 2021/22, this uptick suggests a marginal tightening of interbank liquidity, possibly due to reduced excess reserves or cautious interbank lending activity.

Meanwhile, the Weighted Average Deposit Rate has declined significantly to 4.37% in mid-May 2024/25 from 6.35% a year earlier. This sharp drop, despite earlier rising trends during 2021/22 and 2022/23, signals easing pressure on banks to attract deposits—often a sign of sufficient liquidity or limited credit demand.

The Weighted Average Lending Rate, a measure of how expensive it is for borrowers to access loans, also dropped to 8.11%, a marked fall from 10.34% in the same period last year. This could imply either a strategic reduction by banks to stimulate credit uptake or a reflection of lower-cost funding sources, aligning with the downward trend in deposit rates.

Looking at the broader annual data, the peak lending and deposit rates occurred in 2022/23, at 12.30% and 7.86%respectively, before beginning to taper in 2023/24 and continuing into the current fiscal year. This consistent decline suggests a softening monetary environment and a potential shift in Nepal Rastra Bank’s policy stance toward economic stimulation.

In summary, the decreasing trend in both deposit and lending rates, alongside a stable but low interbank rate, points to a less aggressive monetary environment in Nepal. If maintained, this could encourage private sector borrowing and investment—key components for accelerating economic growth in the coming quarters.