By Sandeep Chaudhary

Liquidity Position of Nepal’s BFIs as of Baisakh End, 2082

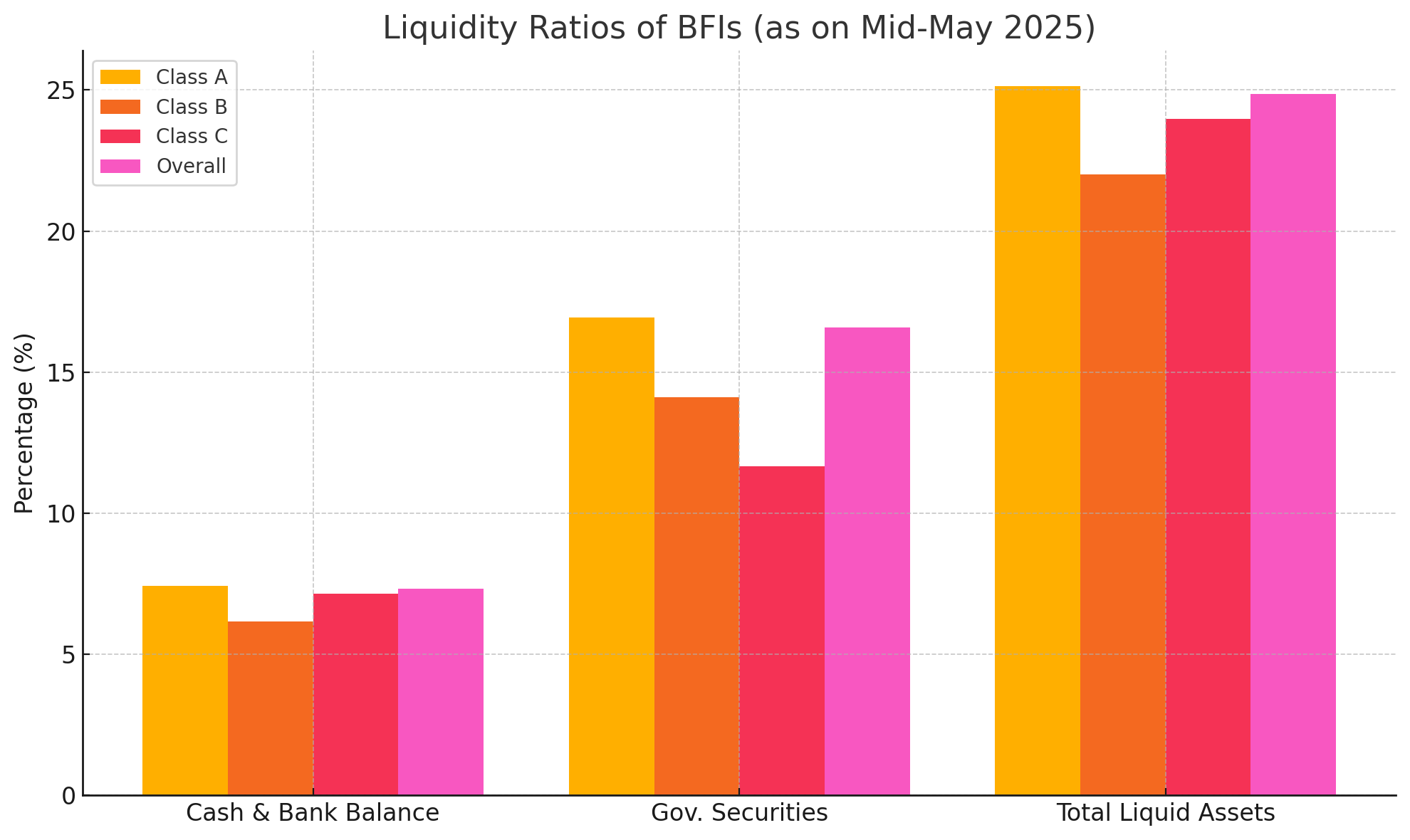

As of mid-May 2025, the overall liquidity position of Nepal’s banking and financial institutions (BFIs) shows a stable yet slightly cautious trend in terms of maintaining cash reserves and liquid assets. The latest liquidity ratio data reveals that the overall Cash and Bank Balance to Total Deposit ratio stood at 7.32%, indicating the immediate liquidity available across all classes of BFIs. Class “A” commercial banks maintained a slightly higher ratio at 7.43%, while Class “B” development banks lagged behind at 6.17%. Class “C” finance companies held 7.15% of their deposits in cash and bank balances.

When it comes to investments in government securities, the overall ratio was 16.59%, suggesting a strong reliance on safe, liquid investment instruments to manage liquidity. Class “A” banks led this category with a 16.93% investment ratio, showing a preference for secure government-backed instruments. Development banks (Class “B”) followed with 14.11%, and finance companies (Class “C”) had the lowest investment ratio at 11.66%.

The Total Liquid Assets to Total Deposit ratio, which gives a more comprehensive view of liquidity, stood at a healthy 24.85% overall. Commercial banks again topped the chart with 25.15%, followed by Class “C” finance companies at 23.97% and development banks at 22.00%.

These figures highlight that Nepal's Class “A” banks are maintaining relatively stronger liquidity buffers compared to smaller institutions, which is expected due to their larger scale and broader regulatory compliance mechanisms. Overall, the liquidity structure reflects a conservative and stable stance, essential for withstanding short-term financial shocks and maintaining depositor confidence.