By Sandeep Chaudhary

Monetary Indicators Reflect Mixed Trends in Nepal's Economy as of Mid-May FY 2024/25

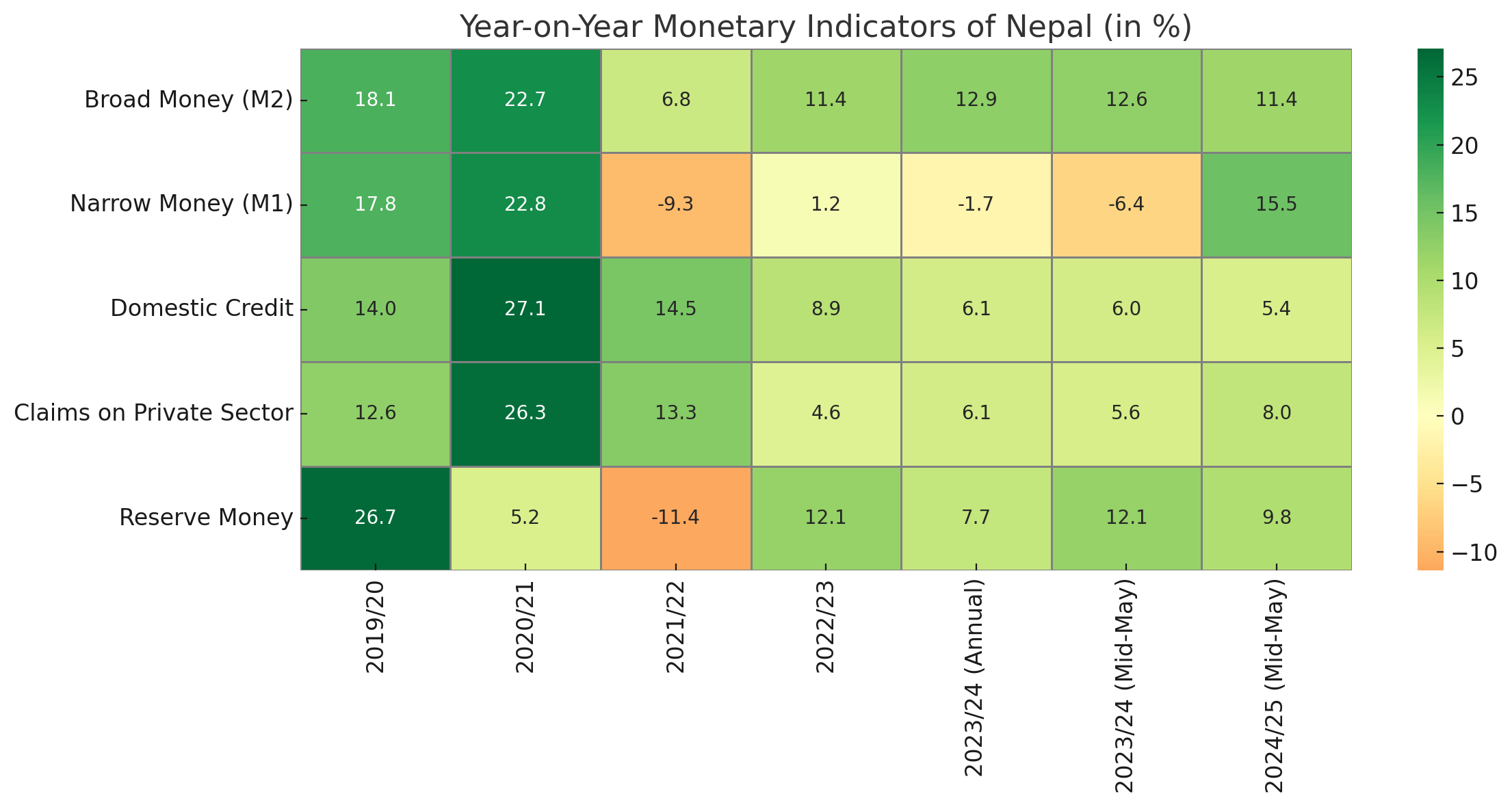

Nepal's latest monetary data reveals a complex picture of economic momentum, showcasing both signs of stability and areas of concern. As of mid-May 2024/25, the Broad Money (M2) supply grew by 11.4% year-on-year, slightly down from 12.6% in the same period of the previous fiscal year. This moderate expansion suggests a steady increase in liquidity in the economy, likely supported by improved foreign reserves and banking sector activities.

A notable shift is observed in Narrow Money (M1), which rebounded sharply to 15.5% growth in mid-May 2024/25 from a contraction of -6.4% in the previous year. This dramatic turnaround indicates increased transactional demand for money, possibly reflecting rising consumption or improved confidence in the economy.

On the credit front, Domestic Credit growth has continued to slow, registering 5.4% in mid-May 2024/25, compared to 6.0% in the same period of 2023/24 and down significantly from previous years like 27.1% in 2020/21. The declining trend reflects cautious lending practices and subdued investment demand amid tighter liquidity or risk management measures.

Claims on the Private Sector, a key indicator of private sector borrowing, rose to 8.0% in mid-May 2024/25—higher than 5.6% during the same time last fiscal year. This indicates a mild revival in credit appetite by businesses and individuals, potentially signaling a positive shift in economic activities and business sentiment.

Reserve Money, which reflects the central bank’s base money, grew by 9.8% as of mid-May 2024/25. Though lower than the 12.1% growth seen in the same period last year, it is still a healthy expansion, reflecting Nepal Rastra Bank's (NRB) ongoing efforts to manage liquidity without overheating the economy.

Overall, the monetary indicators suggest a cautiously optimistic outlook. While liquidity conditions appear stable and transactional money demand has strengthened, credit growth remains restrained, indicating the need for further stimulus or reforms to catalyze stronger private sector participation in the economic recovery.