By Trading view

Nepal Announces NPR 1,860.30 Billion Budget for FY 2081/82.

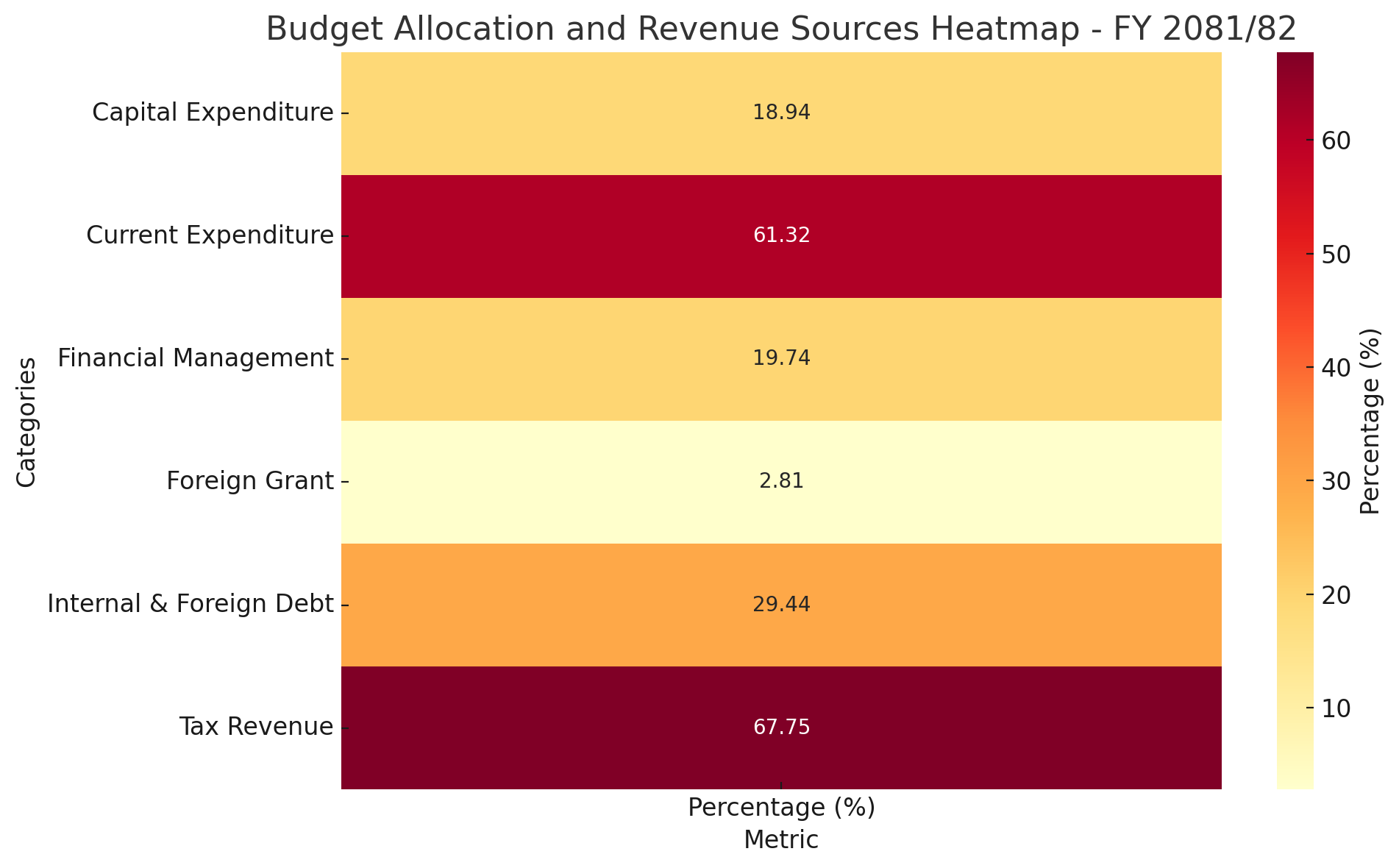

The Government of Nepal has officially unveiled the national budget for the fiscal year 2081/82, setting a total allocation of NPR 1,860.30 billion, reflecting both expansion and restructuring in financial planning amidst a slow but steady economic recovery. The budget exhibits a strong orientation towards domestic resource mobilization, disciplined public expenditure, and cautious borrowing, signaling a shift towards fiscal self-reliance and targeted development.

Budget Allocation: Major Priorities Revealed

The largest component of the budget, amounting to NPR 1,140.66 billion (61.32%), is designated for current expenditure. This covers salaries, administrative expenses, pensions, and routine government functions. While this percentage may seem high, it reflects the reality of maintaining the state machinery and supporting ongoing public services in the short term.

Capital expenditure has been allocated NPR 352.35 billion, which makes up 18.94% of the total budget. This portion is critical as it directly impacts infrastructure development, such as roads, bridges, irrigation systems, and other nation-building projects. The government appears to be cautiously balancing developmental ambitions with available resources.

Notably, financial management, which includes interest payments, debt servicing, and repayments, receives NPR 367.28 billion (19.74%). This reflects the growing burden of public debt, both domestic and foreign, and underlines the importance of managing liabilities without compromising development and service delivery.

Revenue Structure: Nepal Turns Inward

On the revenue side, tax revenue remains the backbone, expected to generate NPR 1,260.30 billion, which constitutes a commanding 67.75% of the funding. This strong dependency on tax collection indicates the government's push for internal revenue strengthening, especially through income tax, VAT, and excise duties. It also sends a clear message: Nepal aims to minimize reliance on uncertain foreign support.

Internal and external borrowing together are expected to contribute NPR 547.67 billion, or 29.44% of total revenue. While debt funding remains significant, the ratio reflects a conscious effort to keep borrowing within manageable levels.

Only NPR 52.33 billion (2.81%) is projected from foreign grants, a minimal portion that highlights the declining role of international aid in Nepal’s national financing—a trend consistent with the government’s narrative of moving towards economic sovereignty.

Historical Budget Trend: Moderate but Steady Growth

Reviewing the trend in total budget figures over the last eight fiscal years shows consistent expansion—from NPR 1,278.99 billion in 2074/75 to NPR 1,860.30 billion in 2081/82. Despite external shocks such as the pandemic and internal disruptions, the government has managed to increase fiscal space moderately. The increase of NPR 109 billionover the previous year marks cautious optimism and a proactive approach to economic planning.

Economic Growth & Inflation: Recovery with Caution

Economic performance indicators show volatile GDP growth in the past five years. After a deep contraction of -2.4% in 2077/78, Nepal's economy bounced back with 4.20% in 2078/79, further climbing to 5.50% in 2081/82. While still below pre-crisis levels of over 6%, this rebound reflects resilience supported by government spending, remittances, and private sector recovery.

Inflation trends, however, remain a concern. After peaking at 7.80% in 2080/81, inflation has slightly moderated to 6.00% in the current fiscal year. The persistent high inflation reflects rising commodity prices, energy costs, and supply chain bottlenecks. This suggests that while the economy is recovering, price stability remains an unresolved challenge.

Policy Interpretation: What This Budget Signals

This budget clearly signals the government's commitment to fiscal discipline, revenue generation, and economic rebuilding. The low reliance on foreign grants and relatively high allocation to financial management reflect a pragmatic understanding of Nepal’s fiscal constraints and a cautious approach to debt servicing. However, the high share of current expenditure might raise concerns about underinvestment in long-term infrastructure and innovation.

For sustainable development, future budgets will need to gradually shift more resources towards capital expenditure and productive sectors like agriculture, manufacturing, and digital infrastructure. At the same time, broadening the tax base, improving compliance, and reducing leakages will be crucial to meet revenue targets.