By Sandeep Chaudhary

Nepal T-Bills Rates Show Continued Decline in 2024 Amid Easing Liquidity Pressure

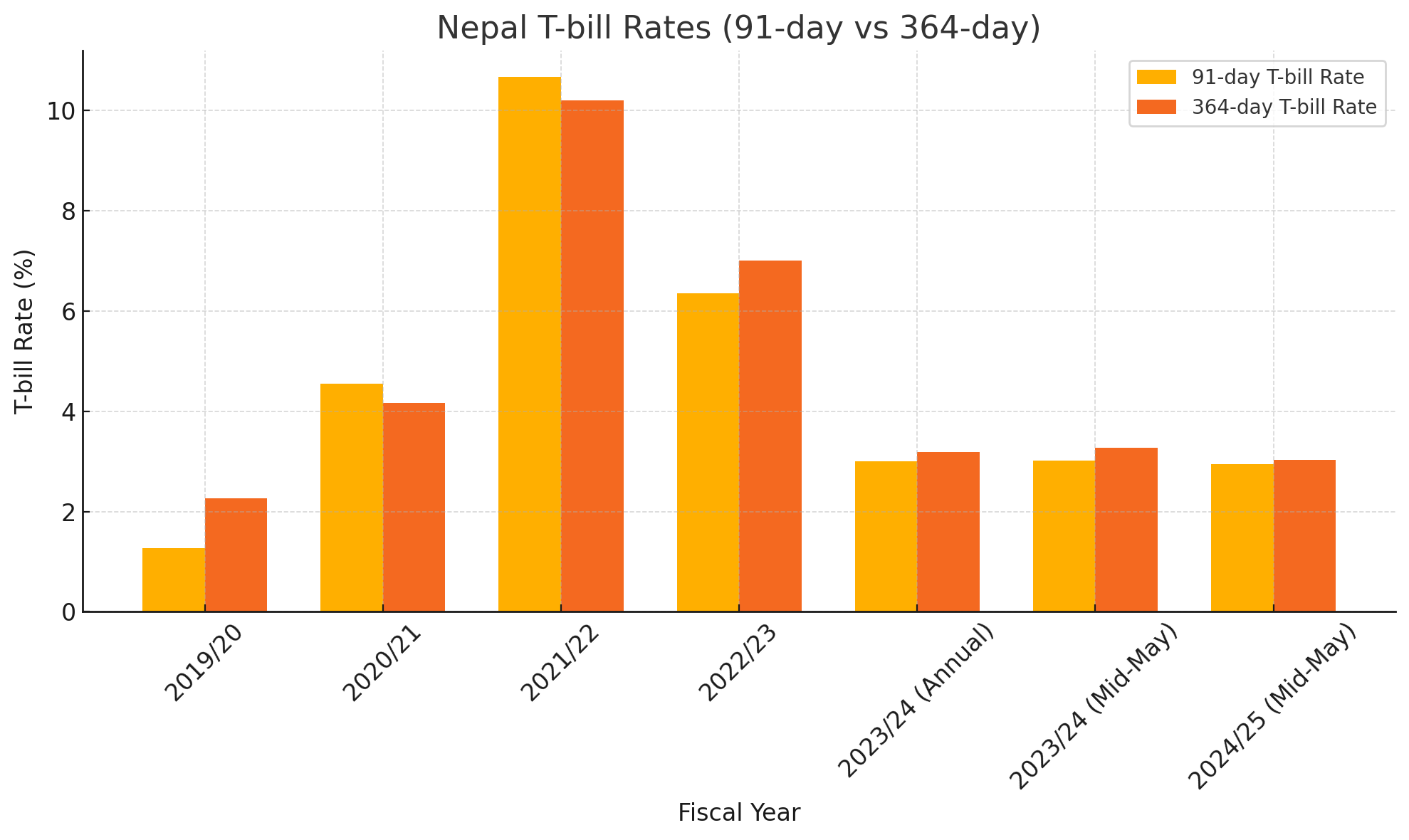

Nepal’s Treasury bill (T-bill) rates have shown a consistent downward trend in the fiscal year 2024/25, reflecting easing liquidity constraints and a cautious monetary stance by the Nepal Rastra Bank (NRB). As of mid-May 2025, the 91-day T-bill rate stands at 2.95%, down slightly from 3.02% in mid-May 2024. Similarly, the 364-day T-bill rate has also declined to 3.03% from 3.27% during the same period last year.

Historically, T-bill rates had spiked during FY 2021/22 due to tight liquidity and heightened inflationary expectations, with the 91-day rate peaking at 10.66% and the 364-day rate hitting 10.19%. However, since FY 2022/23, both rates have seen a steep decline. The 91-day T-bill dropped from 6.35% in FY 2022/23 to just 3.00% in FY 2023/24, while the 364-day T-bill followed a similar trajectory, falling from 7.00% to 3.19%.

This decreasing trend indicates a reversal in monetary tightening and suggests improved banking sector liquidity. It also signals investors' reduced expectations of inflation or monetary shocks in the near term. The marginal drop from mid-May 2024 to mid-May 2025 also implies a relatively stable interest rate environment.

The moderation in T-bill rates could potentially lower government borrowing costs and encourage investment by reducing returns on risk-free assets. However, it may also pressure savings rates, prompting banks to rebalance their deposit and lending strategies.

Overall, the sustained easing in T-bill rates reflects a more balanced and stable macro-financial outlook for Nepal, supported by moderated inflation, improved external sector performance, and proactive monetary management by the central bank.