By Sandeep Chaudhary

Nepal's Balance of Payments Shows Strong Recovery Despite Past Deficit

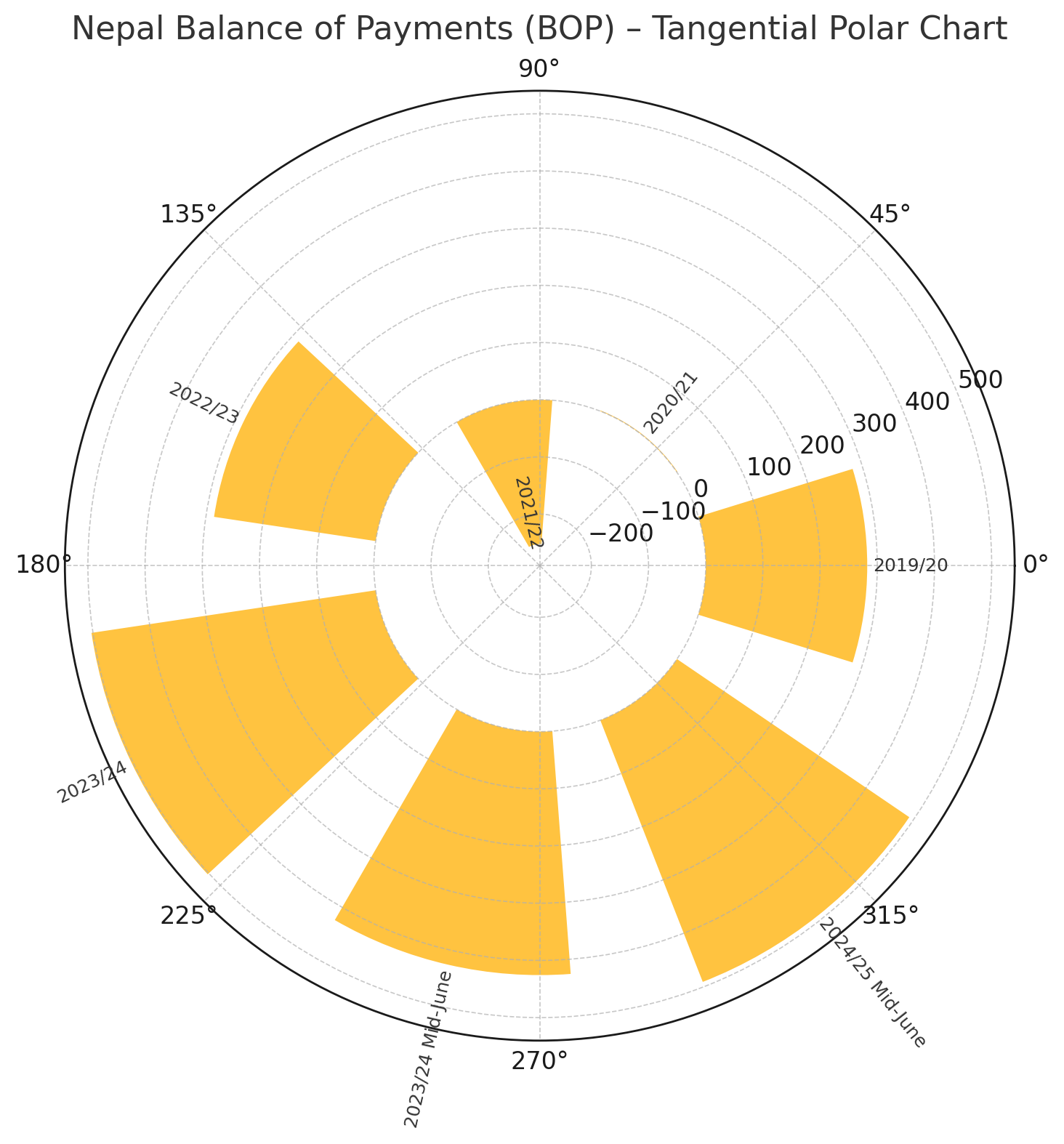

Nepal’s external sector has shown a remarkable turnaround over the past few fiscal years, particularly in the balance of payments (BOP) position, reflecting an improvement in the country's international economic transactions. According to the latest data from Nepal Rastra Bank, the BOP recorded a significant surplus of Rs. 491.4 billion by mid-June 2025, continuing the positive trend from the previous fiscal year.

Looking back, Nepal faced a sharp deficit of Rs. 252.4 billion in FY 2021/22, largely due to heightened imports, subdued remittances, and global economic shocks. However, this trend reversed dramatically in FY 2022/23, as the BOP swung to a surplus of Rs. 285.8 billion. The momentum strengthened in FY 2023/24, when the annual surplus peaked at Rs. 502.5 billion — the highest recorded in recent years — before slightly tapering to Rs. 425.7 billion by mid-June of the same year.

The sustained surplus into mid-June 2025, at Rs. 491.4 billion, suggests a stable inflow of foreign currency through remittances, tourism revival, and a controlled import regime. This improvement is a strong indicator of external sector resilience and reflects well on macroeconomic stability.

The transition from a marginal surplus of just Rs. 1.2 billion in 2020/21 to a major recovery post-2022 marks a critical phase in Nepal’s external sector reform. As the country continues to rebuild its foreign reserves and maintain a positive BOP, policymakers may find room to relax monetary constraints and focus on sustainable economic growth strategies.