By Sandeep Chaudhary

Nepal's Balance of Payments Shows Strong Recovery Despite Past Volatility

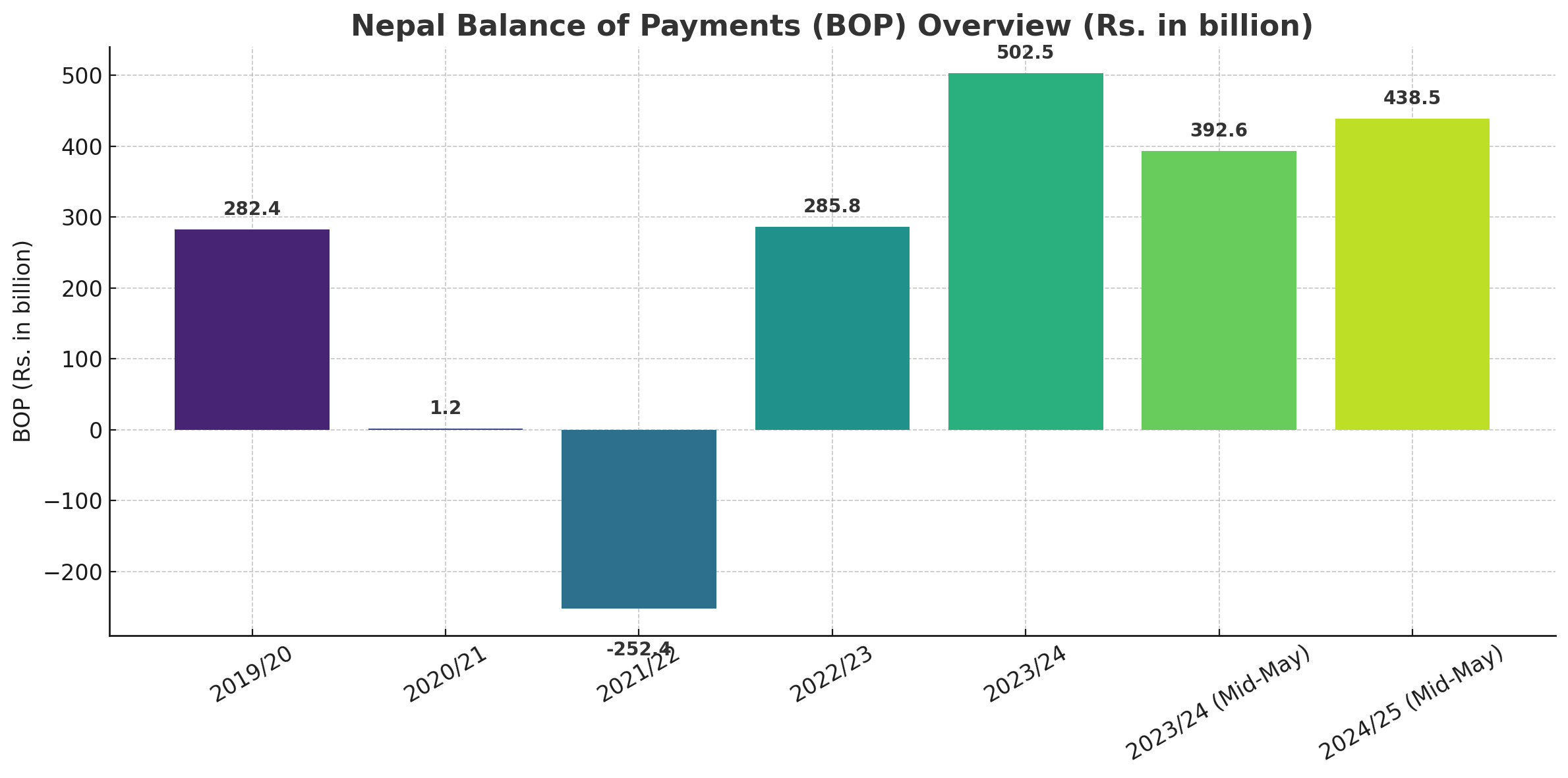

Nepal’s Balance of Payments (BoP) has shown a significant rebound in recent years, indicating an improving macroeconomic position after periods of instability. According to the latest mid-May data for FY 2024/25, Nepal has recorded a BoP surplus of Rs. 438.5 billion. This marks a notable increase from Rs. 392.6 billion recorded in mid-May of the previous fiscal year, FY 2023/24.

The BoP, which reflects the country’s transactions with the rest of the world, has seen considerable fluctuations over the years. In FY 2019/20, Nepal posted a surplus of Rs. 282.4 billion, which dropped drastically to a mere Rs. 1.2 billion in FY 2020/21. The situation deteriorated in FY 2021/22 when the country recorded a BoP deficit of Rs. 252.4 billion, primarily due to soaring imports, declining remittance inflows, and rising outflows of foreign exchange.

However, the scenario reversed sharply in FY 2022/23 and FY 2023/24, with BoP surpluses of Rs. 285.8 billion and Rs. 502.5 billion respectively. These improvements are attributed to tighter import controls, increased remittance inflows, and tourism recovery post-COVID-19. The mid-May update for 2024/25 further confirms the continuation of this positive trend, showcasing improved foreign reserve management and external sector resilience.

The recovery in BoP not only highlights effective policy interventions by Nepal Rastra Bank but also signals a stabilizing economy that could bolster investor confidence and support monetary stability in the upcoming fiscal periods.