By Dipesh Ghimire

Nepal’s Economy Shows Moderate Recovery Amid Slowing Capital Formation

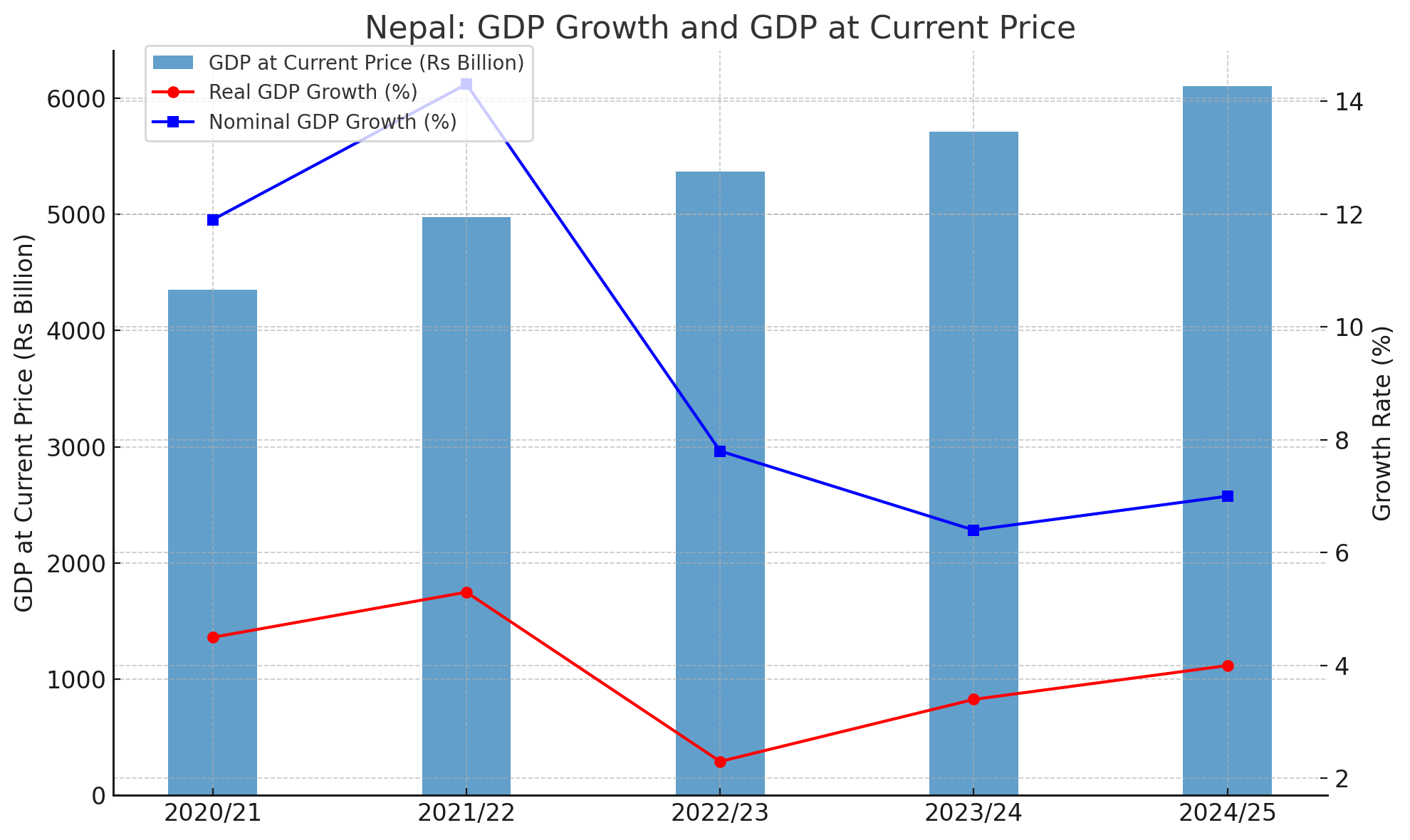

Nepal’s latest macroeconomic indicators highlight a fragile but improving economic outlook, with real GDP growth projected at 4.0 percent in FY 2024/25, up from 3.4 percent in the previous year. While growth momentum appears to be returning, structural challenges in investment and savings continue to pose risks to long-term stability.

GDP Trends: Recovery After a Slowdown

Real GDP growth at basic prices declined sharply in FY 2022/23 to 2.3 percent, reflecting subdued domestic demand, weak industrial activity, and external shocks. The economy regained some traction in FY 2023/24, reaching 3.4 percent, and is expected to expand by 4.0 percent in FY 2024/25.

At purchasers’ prices, growth is slightly higher at 4.6 percent, suggesting marginal improvement in consumption. However, the growth trajectory remains below pre-pandemic potential, indicating that Nepal’s economy has yet to return to a high-growth path.

Nominal GDP and National Income

Nominal GDP growth, which captures price effects, slowed drastically from 14.3 percent in FY 2021/22 to 7.8 percent in FY 2022/23, before stabilizing at 7.0 percent in FY 2024/25. This moderation reflects easing inflationary pressures but also signals limited expansion in economic activity.

Gross National Income (GNI) growth, closely linked with remittances, fell from a strong 14.4 percent in FY 2021/22 to 6.7 percent in FY 2024/25. Similarly, Gross National Disposable Income (GNDI), which includes remittance inflows, is expected to grow 7.4 percent, lower than the double-digit expansion seen in earlier years. This slowdown suggests that while remittances remain a vital support, their growth contribution is tapering.

Capital Formation Weakening

One of the most concerning trends is the decline in capital formation. Gross Capital Formation as a share of GDP fell from 37.6 percent in FY 2021/22 to just 28.1 percent in FY 2024/25. Likewise, Gross Fixed Capital Formation dropped from 29.3 percent in FY 2020/21 to 24.1 percent in FY 2024/25.

This indicates weaker investment in infrastructure, industries, and productive assets—critical engines of long-term growth. Analysts warn that without revitalizing capital formation, Nepal’s economic expansion could remain constrained around the 4–5 percent range.

Savings Dynamics: Mixed Picture

Domestic savings remain persistently low, hovering at just 6.6 percent of GDP in FY 2024/25. This reflects high consumption relative to income and limited household or institutional savings. In contrast, Gross National Savings, supported by remittance inflows, has improved steadily, rising from 29.6 percent of GDP in FY 2021/22 to 36.2 percent in FY 2024/25.

This divergence underscores Nepal’s reliance on external remittances to finance investment and reduce current account pressure. However, with remittance growth flattening, policymakers may need to focus on boosting domestic savings mobilization.

GDP Size Expands but Challenges Persist

In absolute terms, Nepal’s Gross Domestic Product at current prices is projected to reach Rs. 6.1 trillion in FY 2024/25, compared to Rs. 4.35 trillion in FY 2020/21. While this reflects steady expansion, the pace of increase has slowed in recent years.

Experts argue that sustaining higher growth will require revitalizing investment climate, accelerating infrastructure projects, and diversifying the economy beyond remittance-driven consumption.

Overall, the data paints a picture of gradual recovery in GDP growth, stabilization in income, and rising national savings—but also highlights declining capital formation and weak domestic savings. Unless these structural imbalances are addressed, Nepal’s economy may struggle to achieve the robust, inclusive growth necessary to meet employment and development goals.