By Dipesh Ghimire

Nepal’s External Sector Gains Strength, But Trade Imbalance Persists

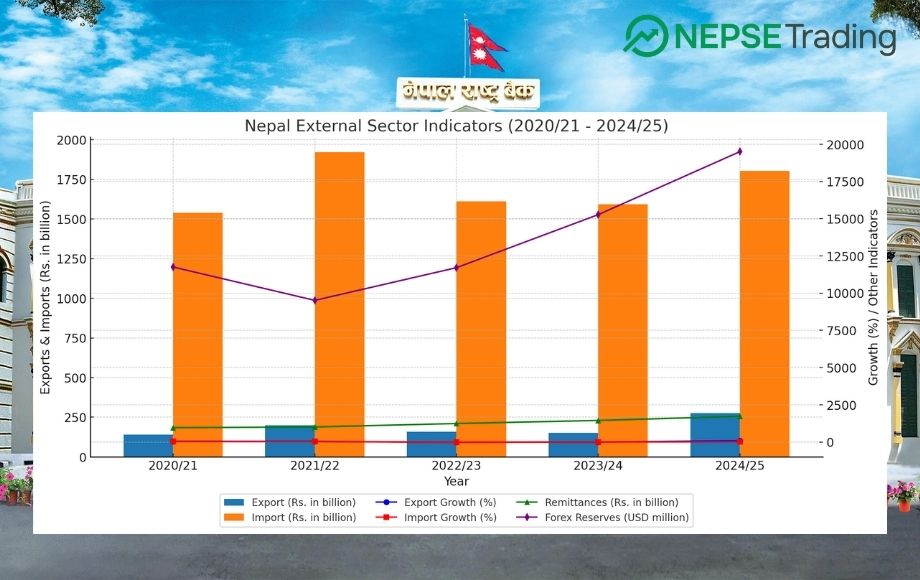

Nepal’s external sector performance over the past five fiscal years reflects both resilience and vulnerability. While remittances and foreign reserves have soared to record highs, and exports have staged a surprising rebound, the structural trade imbalance remains a pressing challenge. The data highlights a positive turnaround from past deficits, but also underlines risks tied to over-dependence on imports and migrant earnings.

Exports: A Sharp Recovery After Years of Weakness

Nepali exports went through a volatile cycle. From Rs. 141.1 billion in 2020/21, exports expanded to Rs. 200 billion in 2021/22, supported by growing demand for traditional goods such as carpets, garments, and handicrafts. However, the following two years brought contraction. In 2022/23, exports fell to Rs. 157.1 billion, and again to Rs. 152.4 billion in 2023/24, reflecting supply chain bottlenecks, higher transport costs, and weaker global demand.

The most recent fiscal year, 2024/25, brought a remarkable turnaround. Exports surged to Rs. 277 billion, marking an 81.8 percent growth rate—the strongest in the review period. Analysts suggest that targeted export promotion policies, improved regional demand, and favorable exchange rate adjustments contributed to this recovery. Despite the rebound, exports remain a small fraction of overall trade, raising concerns about sustainability.

Imports: Still Dominant, But Growth Slows

Imports continue to overshadow Nepal’s trade profile. From Rs. 1.54 trillion in 2020/21, imports ballooned to Rs. 1.92 trillion in 2021/22, straining the balance of payments. However, subsequent years witnessed a moderation, with imports contracting to Rs. 1.61 trillion in 2022/23 and Rs. 1.59 trillion in 2023/24. By 2024/25, imports rose slightly to Rs. 1.80 trillion, with a modest 13.3 percent growth rate.

This slowdown is partly attributed to tighter monetary policies, reduced domestic consumption, and import restrictions on luxury items. While easing import growth helps narrow deficits, the structure of Nepal’s imports—dominated by fuel, machinery, vehicles, and consumer goods—underscores continued reliance on foreign supply for basic consumption and industrial inputs. Economists warn that without significant import substitution, Nepal’s external vulnerability will remain high.

Balance of Payments and Current Account: From Deficit to Surplus

Perhaps the most dramatic change lies in the Balance of Payments (BOP). After posting a deficit of Rs. 252.4 billion in 2021/22, Nepal reversed its position, recording surpluses of Rs. 285.8 billion in 2022/23, Rs. 502.5 billion in 2023/24, and Rs. 594.5 billion in 2024/25.

The Current Account Balance followed a similar trajectory. From deep deficits of Rs. -333.7 billion in 2020/21 and Rs. -623.4 billion in 2021/22, the balance shifted to a surplus of Rs. 409.2 billion in 2024/25. This positive turnaround indicates stronger external sustainability, largely fueled by rising remittances and restrained imports. Yet, experts caution that this surplus may not reflect productive strength, but rather subdued domestic demand and reliance on overseas inflows.

Remittances: The Lifeline of the Economy

Workers’ remittances continue to underpin Nepal’s external stability. Inflows grew steadily from Rs. 961.1 billion in 2020/21 to Rs. 1,723.3 billion in 2024/25, nearly doubling within five years. Remittances now account for over a quarter of Nepal’s GDP, making the country one of the most remittance-dependent economies in the world.

This surge provides multiple benefits: sustaining foreign reserves, financing imports, and supporting household consumption. However, policymakers face a dilemma—while remittances ease external pressures, they also discourage domestic job creation and industrial expansion. The economy risks remaining stuck in a cycle where labor export is prioritized over local production.

Foreign Exchange Reserves: Record Highs

Foreign exchange reserves offer another bright spot. After dipping to USD 9.5 billion in 2021/22, reserves climbed steadily to USD 19.5 billion in 2024/25 (equivalent to Rs. 2.67 trillion). This level provides over a year’s worth of import cover, significantly above international benchmarks, and shields the country against currency volatility.

Nonetheless, experts highlight that these reserves are not driven by export competitiveness but are sustained mainly by remittance inflows. Without structural improvements in trade, the reserves could face pressure if global labor markets weaken or remittance flows decline.

Interpretation: Progress With Structural Risks

Taken together, the data portrays an external sector that has stabilized, but not fundamentally transformed. Exports have rebounded, imports are growing at a slower pace, and both the BOP and current account are in surplus. At the same time, Nepal’s heavy dependence on imports and remittances continues to expose the economy to external shocks.

For long-term resilience, economists emphasize three policy imperatives:

Export diversification into higher-value goods and services.

Selective import substitution, especially in agriculture and light manufacturing.

Productive investment of remittances, channeling household savings into enterprises rather than consumption alone.

Nepal’s external sector has entered a phase of relative strength, underpinned by remittances and record foreign reserves. Yet, the persistent trade imbalance and reliance on migrant earnings reveal deep-rooted structural weaknesses. The challenge for policymakers lies in converting temporary external stability into sustainable economic transformation.