By Dipesh Ghimire

Nepal’s Financial Sector Shows Signs of Stability Amid Lower Interest Rates and Stronger Deposits

Nepal’s financial sector indicators from 2020/21 to 2024/25 reflect a cycle of volatility followed by relative stabilization. While broad money growth has settled into moderate levels, interest rates have softened significantly, credit expansion has slowed, and stock market indicators suggest renewed investor confidence. The picture is one of easing financial pressures, but also of limited private sector lending growth that could weigh on long-term economic expansion.

Broad and Narrow Money: Moderation With Recent Uptick

Broad money (M2) growth, which had surged to 22.7 percent in 2020/21, slowed sharply to 6.8 percent in 2021/22, before stabilizing in the range of 11–13 percent in subsequent years. In 2024/25, M2 recorded a healthy 12.5 percent growth, signaling sufficient liquidity in the system.

Narrow money (M1), however, tells a more volatile story. It fell into negative territory in 2021/22 (-9.3 percent) and again in 2023/24 (-1.7 percent), reflecting tighter monetary conditions and weaker demand for highly liquid assets. But in 2024/25, M1 bounced back sharply by 22 percent, pointing to stronger transaction demand and improved circulation of money in the economy.

Credit Expansion Slows, Private Sector Lending Remains Weak

Domestic credit growth has steadily declined, from 27.1 percent in 2020/21 to just 6.2 percent in 2024/25. A similar trend is seen in claims on the private sector, which dropped from 26.3 percent in 2020/21 to 8.1 percent in 2024/25.

This reflects both tighter lending conditions in recent years and subdued borrowing appetite among businesses. Analysts note that sluggish private sector lending could slow investment and limit job creation. However, policymakers may see this as necessary for keeping inflation under control.

Reserve Money and Monetary Policy

Reserve money, a key indicator of monetary base, swung sharply across the review period. After contracting by -11.4 percent in 2021/22, it rose consistently, hitting 16.1 percent growth in 2024/25. This expansion suggests more liquidity injections into the banking system, either through foreign reserve accumulation or central bank operations.

While this provides relief to banks struggling with liquidity in earlier years, it also risks fueling inflationary pressures if not matched with productive investment.

Interest Rates: Sharp Decline Reflects Liquidity Easing

Short-term money market rates have softened dramatically. The 91-day Treasury bill rate, which spiked to 10.66 percent in 2021/22, has since fallen to just 2.95 percent in 2024/25. Similarly, the 364-day Treasury bill rate slid from 10.19 percent to 2.98 percent over the same period.

Interbank rates followed a similar pattern, easing from 6.99 percent in 2021/22 to 2.92 percent in 2024/25, reflecting abundant liquidity in the banking system. Deposit and lending rates have also come down:

Weighted average deposit rate fell from 7.41 percent in 2021/22 to 4.19 percent in 2024/25.

Weighted average lending rate declined from 11.62 percent to 7.85 percent.

The base rate of commercial banks, a critical benchmark for loan pricing, dropped from 9.54 percent to 6.02 percent over the same period.

These lower rates indicate improved liquidity conditions and easier access to credit, but they also reflect subdued credit demand and cautious lending by banks.

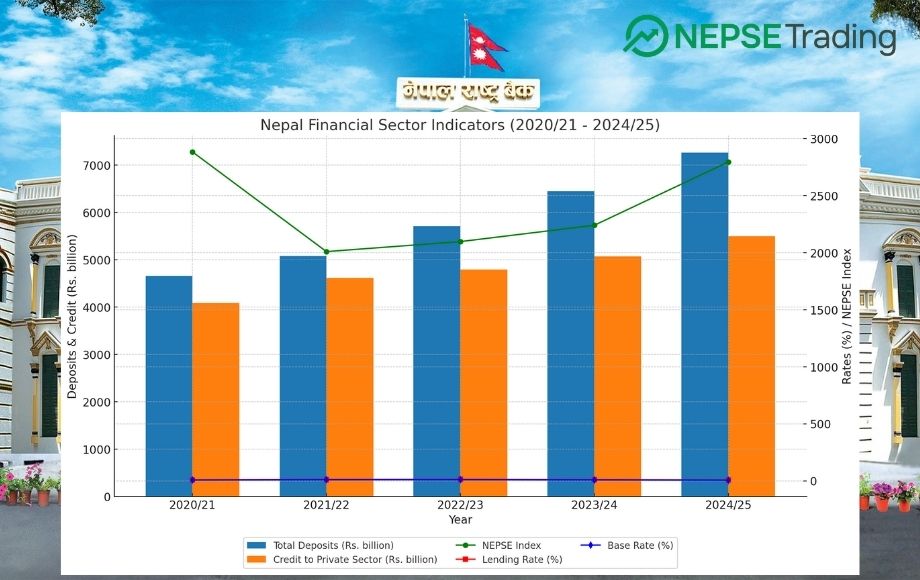

Deposits Strengthen, Credit Growth Lags

Total deposits in the banking system have grown steadily, rising from Rs. 4.66 trillion in 2020/21 to Rs. 7.26 trillion in 2024/25. This shows continued confidence of savers in the financial system.

However, credit to the private sector expanded at a much slower pace, growing from Rs. 4.08 trillion to Rs. 5.49 trillion in the same period. The deposit-credit gap has widened, suggesting that while banks are flush with deposits, they are unable—or unwilling—to translate these into higher lending volumes. This could constrain private sector-led growth.

Stock Market Regains Momentum

The NEPSE index, which had reached a high of 2883.4 in 2020/21, slumped to 2009.5 in 2021/22, reflecting the impact of rising interest rates and liquidity shortages at the time. Since then, it has gradually recovered, hitting 2794.8 in 2024/25.

Similarly, the market capitalization-to-GDP ratio has improved from a low of 57.4 percent in 2022/23 to 76.3 percent in 2024/25, reflecting renewed investor interest. Analysts believe that the stock market is responding positively to lower interest rates and excess liquidity in the banking system.

Interpretation: Stability, But Risk of Sluggish Investment

The financial sector’s recent trends highlight improved stability—ample liquidity, declining interest rates, and a recovering stock market. However, the slowdown in private sector credit growth raises concerns about whether banks are channeling funds into productive investments.