By Sandeep Chaudhary

Nepal’s Fiscal Indicators Show Mixed Trends in FY 2023/24

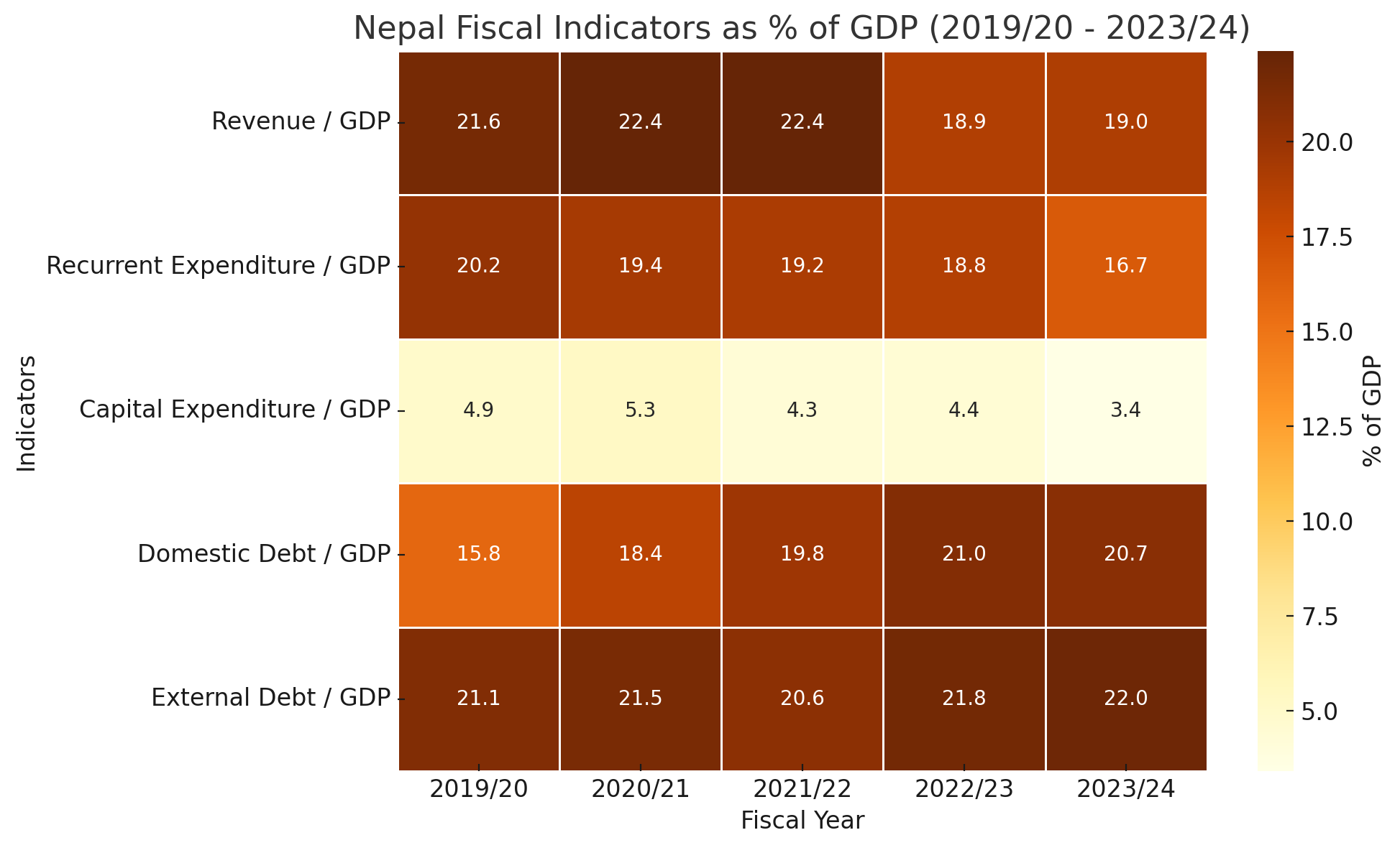

Nepal’s fiscal health indicators for the fiscal year 2023/24 present a mixed picture, reflecting both progress and areas of concern in economic management. The latest data highlights key changes in revenue collection, government expenditures, and public debt ratios relative to GDP.

Revenue to GDP Stability Amid Declining Expenditures

The Revenue to GDP ratio slightly increased from 18.9% in 2022/23 to 19.0% in 2023/24. While this marks a marginal improvement, it is still significantly lower than the 22.4% recorded in both 2020/21 and 2021/22. The decline from earlier years suggests continued challenges in tax collection and economic activity post-pandemic, though the slight rebound may indicate the beginning of stabilization.

Recurrent Expenditure Sharply Falls

One of the most notable shifts is the steep decline in the Recurrent Expenditure to GDP ratio, which dropped to 16.7% in 2023/24 from 18.8% the previous year. This is the lowest in the five-year span and could be attributed to austerity measures, reduced administrative spending, or delayed payments. It also shows a marked downward trend from the 20.2% recorded in 2019/20.

Capital Expenditure Continues to Deteriorate

More alarming is the continued drop in Capital Expenditure to GDP, which fell to just 3.4% in 2023/24—its lowest in the last five years. This decline from 5.3% in 2020/21 and 4.3% in 2021/22 signals weakening public investment in infrastructure and development projects, potentially impacting long-term growth prospects.

Debt Levels Remain High but Stable

Public debt as a share of GDP remains elevated. Domestic Debt to GDP slightly declined to 20.7% from 21.0% in 2022/23, reflecting minor debt repayment or slower domestic borrowing. Meanwhile, External Debt to GDP rose marginally to 22.0%, the highest in the five-year period. This suggests continued reliance on foreign borrowing, which could increase exposure to currency and interest rate risks.

In summary, while Nepal has made minor gains in revenue collection and curbed recurrent spending, the persistent decline in capital investment and rising debt levels warrant close attention. Policy focus should now shift towards reviving development expenditure and managing debt sustainably to foster long-term economic stability.