By Sandeep Chaudhary

Nepal's Foreign Exchange Reserves Surge to Historic Highs in Mid-May FY 2024/25

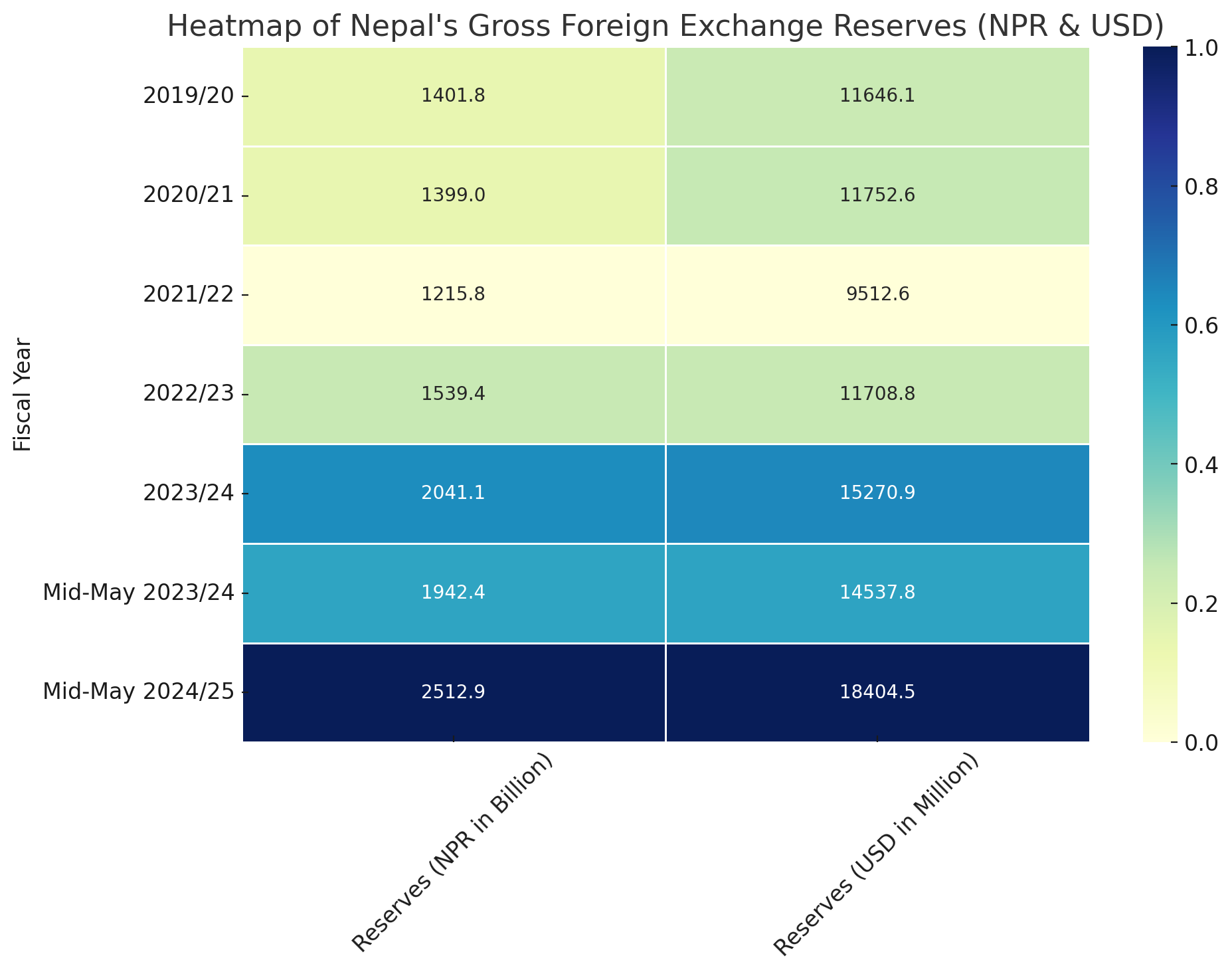

Nepal's gross foreign exchange reserves have witnessed a significant surge, reflecting strong external sector performance and improved remittance inflows. As of mid-May 2024/25, Nepal’s gross forex reserves reached an all-time high of Rs. 2,512.9 billion, a substantial rise from Rs. 1,942.4 billion in the same period of the previous fiscal year. This sharp rise marks a year-on-year increase of nearly 29.4%, highlighting robust balance of payments support and conservative spending on imports.

In terms of U.S. dollars, the reserves stood at USD 18.40 billion, up from USD 14.54 billion in mid-May 2023/24. This marks an impressive growth of 25% in dollar terms, showcasing the strength of the Nepalese rupee against external shocks and the central bank’s prudent reserve management strategies.

Looking at the annual trends, the country had faced a dip in reserves during FY 2021/22, with figures falling to Rs. 1,215.8 billion (USD 9.51 billion), primarily due to a high import bill and declining remittance during the post-COVID recovery phase. However, the recovery has been steady and strong since FY 2022/23, where reserves climbed to Rs. 1,539.4 billion (USD 11.7 billion), supported by a cautious monetary policy, rising remittance, and controlled imports.

In FY 2023/24, the gross reserves jumped further to Rs. 2,041.1 billion and USD 15.27 billion, indicating a consistent upward trend. This steady growth in reserves has provided a strong buffer for Nepal to handle potential external shocks and currency volatility.

The rising reserves also signify improved investor confidence and macroeconomic stability. Policymakers are expected to use this window to facilitate capital spending, encourage exports, and build resilience in Nepal’s external sector for sustainable economic growth.