By NEPSE TRADING

Nepal’s Import Dependence Deepens: Petroleum, Oils, and Machinery Dominate Trade

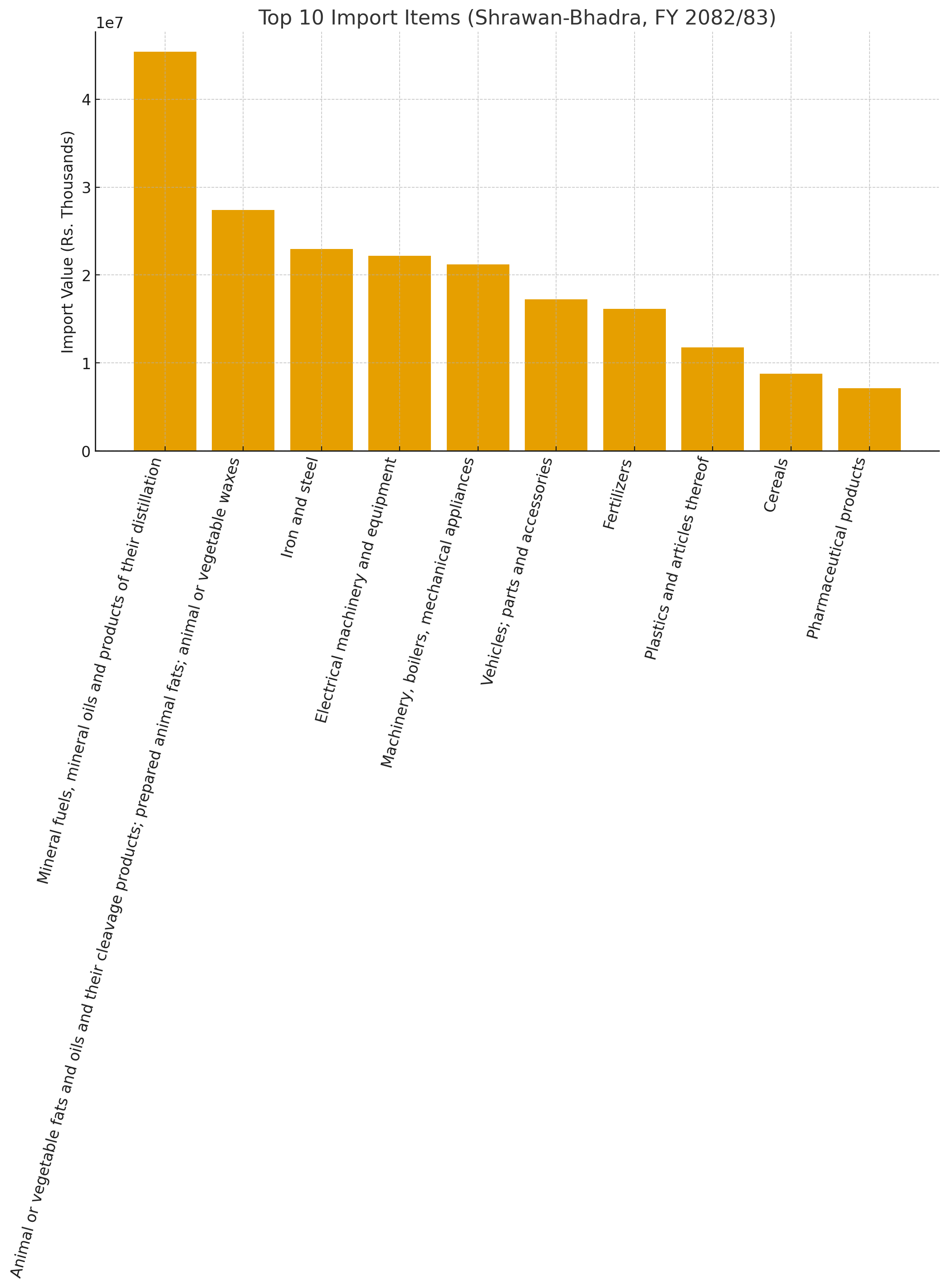

Kathmandu – Nepal’s trade data for the first two months of fiscal year 2082/83 (July–September 2025) reveals an import-heavy economy increasingly dependent on petroleum, edible oils, machinery, and vehicles. According to the Department of Customs, total imports stood at Rs. 305.15 billion, while exports were just Rs. 47.31 billion, leaving a massive trade deficit of Rs. 257.83 billion in only two months.

Petroleum Products: The Largest Burden

At the top of the list, mineral fuels and petroleum products accounted for imports worth Rs. 45.39 billion. This single category dwarfs almost all others combined, showing how fuel dependency has become Nepal’s greatest economic vulnerability. With rising global oil prices and limited domestic alternatives, petroleum continues to drain foreign reserves and destabilize the balance of payments.

Edible Oils: Growth Fueled by Exports, Yet Import-Dependent

The second-largest import category, animal and vegetable oils and fats, reached Rs. 27.41 billion. Interestingly, refined soybean oil is also Nepal’s biggest export, worth Rs. 20.42 billion, but industries remain reliant on imported crude oil for processing. This reflects a structural paradox: while Nepal exports processed oil, the raw material dependence keeps imports high, locking the country into a cycle of value-added re-exports rather than genuine self-sufficiency.

Iron, Steel, and Machinery: Infrastructure-Led Demand

Imports of iron and steel stood at Rs. 22.97 billion, underscoring strong demand from construction and infrastructure projects. Meanwhile, electrical machinery and equipment (Rs. 22.16 billion) and mechanical appliances (Rs. 21.18 billion) occupied the fourth and fifth spots. These are essential for industrial modernization but also highlight the weakness of domestic manufacturing capacity.

Vehicles and Fertilizers: Consumption vs. Necessity

At sixth position, imports of vehicles and parts amounted to Rs. 17.22 billion. This reflects urban consumption trends and Nepal’s growing appetite for foreign automobiles, yet it worsens the current account deficit.

In contrast, fertilizers at Rs. 16.17 billion are an absolute necessity, given Nepal’s agrarian economy. However, this dependence exposes farmers to price shocks in global fertilizer markets, limiting agricultural productivity and food security.

Plastics, Pharmaceuticals, and Cereals

The remaining top imports were plastics (Rs. 11.78 billion), cereals (Rs. 8.79 billion), and pharmaceutical products (Rs. 7.1 billion). Each of these sectors reflects different forms of dependency: plastics for industrial and consumer use, cereals due to insufficient domestic production, and pharmaceuticals because of Nepal’s underdeveloped healthcare manufacturing capacity.

Trade Imbalance: A Widening Crisis

The overall picture is troubling. Imports grew by 16.23%, while exports rose by an impressive 88.57%, yet the trade deficit still expanded by 8.59%. The surge in exports, largely driven by soybean oil, cannot mask the structural imbalance. The fact that a single commodity makes up more than half of total exports leaves Nepal dangerously exposed to market volatility and tariff risks in importing countries.

Expert Interpretation

Economists warn that Nepal’s economy faces a triple vulnerability:

Energy dependence on imported petroleum products.

Industrial weakness, reflected in heavy machinery and raw material imports.

Agricultural reliance on imported fertilizers and cereals.

Unless Nepal aggressively diversifies its energy sources, boosts domestic agro-industrial production, and expands export capacity beyond a few commodities, the trade deficit will keep straining the economy.

The data shows that Nepal’s top 10 imports are not luxury goods but essential items like fuel, machinery, fertilizers, and cereals—highlighting the structural dependency of the economy. However, without addressing these dependencies through industrial policy, renewable energy expansion, and food self-sufficiency, Nepal risks falling into a deeper cycle of import-led growth and unsustainable trade deficits.