By Dipesh Ghimire

Nepal’s Public Finance: Rising Debt, Fluctuating Revenues, and Fiscal Pressures

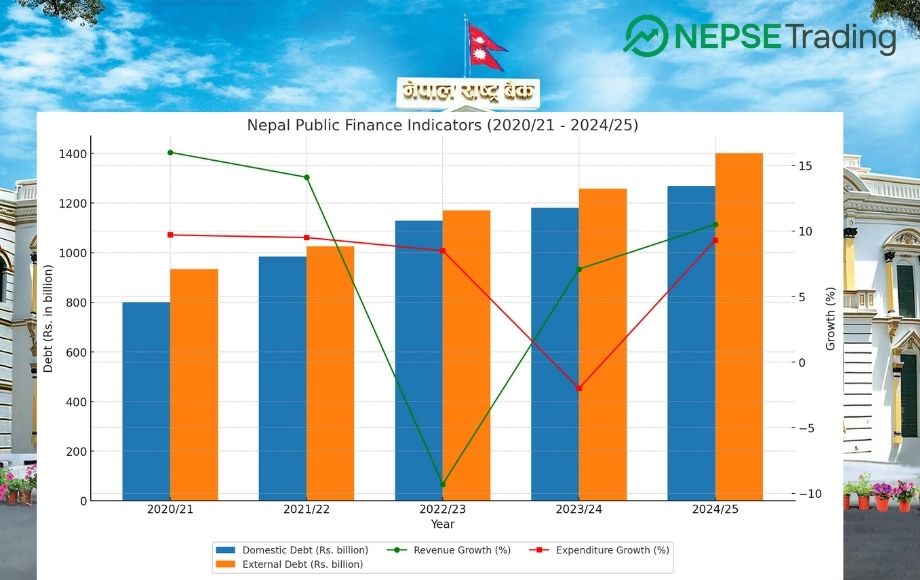

Nepal’s fiscal indicators from 2020/21 to 2024/25 reveal a challenging picture of inconsistent revenue growth, uneven expenditure patterns, and a steady rise in both domestic and external debt. While revenue performance has improved in the latest fiscal year, the growing reliance on borrowing underscores persistent structural weaknesses in public finance.

Revenue Growth: Volatile Recovery After a Sharp Decline

Revenue growth was relatively strong in the early years, with 16 percent in 2020/21 and 14.1 percent in 2021/22. However, the government’s revenue mobilization collapsed in 2022/23, shrinking by -9.3 percent, as imports fell and economic activity slowed. This was a major blow to fiscal stability, given Nepal’s heavy dependence on import-related taxes.

The following years brought some recovery. Revenue growth improved modestly to 7.1 percent in 2023/24 and further to 10.5 percent in 2024/25. Despite this rebound, revenue-to-GDP ratios show only a partial recovery, improving from a low of 18.8 percent in 2022/23 to 19.6 percent in 2024/25, still below earlier peaks of 22.4 percent. This points to structural weaknesses in domestic revenue generation and overdependence on customs duties.

Expenditure Growth: Uneven Trends and Capital Weakness

Expenditure growth has been uneven across the period. After maintaining growth rates around 9–10 percent in 2020/21 and 2021/22, spending rose by 8.5 percent in 2022/23 before contracting by -2 percent in 2023/24, indicating austerity and underutilization of budgets. It returned to growth at 9.3 percent in 2024/25.

When measured as a share of GDP, recurrent expenditure has declined steadily, from 19.4 percent in 2020/21 to 16.1 percent in 2024/25, suggesting some fiscal restraint. However, capital expenditure has remained consistently low, hovering around 3–5 percent of GDP, highlighting Nepal’s chronic challenge in implementing development projects. This weakness in capital spending raises concerns about long-term growth prospects and infrastructure bottlenecks.

Domestic and External Debt: Growing Burden

Both domestic and external debt have been on a steady upward trajectory. Domestic debt rose from Rs. 800.3 billion in 2020/21 to Rs. 1.26 trillion in 2024/25, while external debt increased from Rs. 934.1 billion to Rs. 1.40 trillion over the same period.

As a share of GDP, domestic debt has stabilized around 20–21 percent, while external debt has inched higher, rising from 21.5 percent in 2020/21 to 22.9 percent in 2024/25. Combined, this means Nepal’s public debt now exceeds 43 percent of GDP, raising concerns about sustainability, especially given weak revenue performance.

Fiscal Ratios: A Mixed Picture

Revenue/GDP improved slightly to 19.6 percent in 2024/25, but still lags behind earlier years.

Recurrent Expenditure/GDP declined to 16.1 percent, indicating some restraint on operational expenses.

Capital Expenditure/GDP remains weak at just 3.6 percent in 2024/25, underscoring persistent inefficiency in public investment.

Debt-to-GDP ratios show a rising trend, signaling increasing reliance on borrowing rather than sustainable revenue growth.

Interpretation: Stability at Risk Without Structural Reforms

The data paints a picture of a government balancing between fiscal discipline and financing needs. On one hand, lower recurrent spending as a share of GDP and a recovery in revenue collection are encouraging. On the other hand, weak capital expenditure and rising debt burdens highlight deeper fiscal vulnerabilities.

Economists caution that while Nepal’s debt-to-GDP ratio is still within a manageable range, the trend is worrying given the low productivity of expenditures and limited fiscal space. Unless the government can expand the tax base, improve project execution, and reduce over-reliance on imports for revenue, fiscal sustainability will remain under strain.